Hamish McRae: As Europe's protests continue, expect countries to turn on one another

Economic Life: Tensions within the eurozone will grow as it is perceived that the core countries benefit from membership while the fringe ones suffer

It has been a week of high drama for European finance. There have, of course, been the new estimates of the funds needed to cover the losses of Irish banks. There have also been new budgets from France and Portugal; the Italian government has got through a confidence vote; and the European Commission has announced plans to impose fiscal discipline on member states and automatically fine transgressors. Spain's debt was downgraded, though perhaps not by as much as many expected. And there were huge demonstrations across Europe, protesting at the squeeze on living standards resulting from the downturn, and at the forthcoming cuts in public spending.

On the more positive side, but less noticed, was the news of a continued fall in unemployment inGermany, reminding all of us of the divergence taking place within Europe between the fringe and the core. Another thing that received little notice was a fall in the support that the European Central Bank has been giving commercial banks, suggesting the latter are more confident about their funding.

So a lot of stuff. And, as always when the economic newsflow is running strongly, there is a danger that the important is neglected amid the immediate. The Irish situation is discussed at length elsewhere in this paper, so just some quick thoughts here. Ireland is very different from almost all the other fringe European societies in that it remains an inherently competitive economy. There is a huge debt hangover and there is no getting away from that. But if it were not for the property excesses and the related indebtedness, Ireland would be in pretty good shape. Of course, you cannot just waft away the debts with a few words; these will take a decade to clear, during which time living standards will rise more slowly than they would have done otherwise. Meanwhile Ireland will have to pay an interest rate penalty. But when the country started its bull run in the early 1990s it had a debt to GDP ratio of close to 100 per cent, so growth is possible against a background of heavy debts.

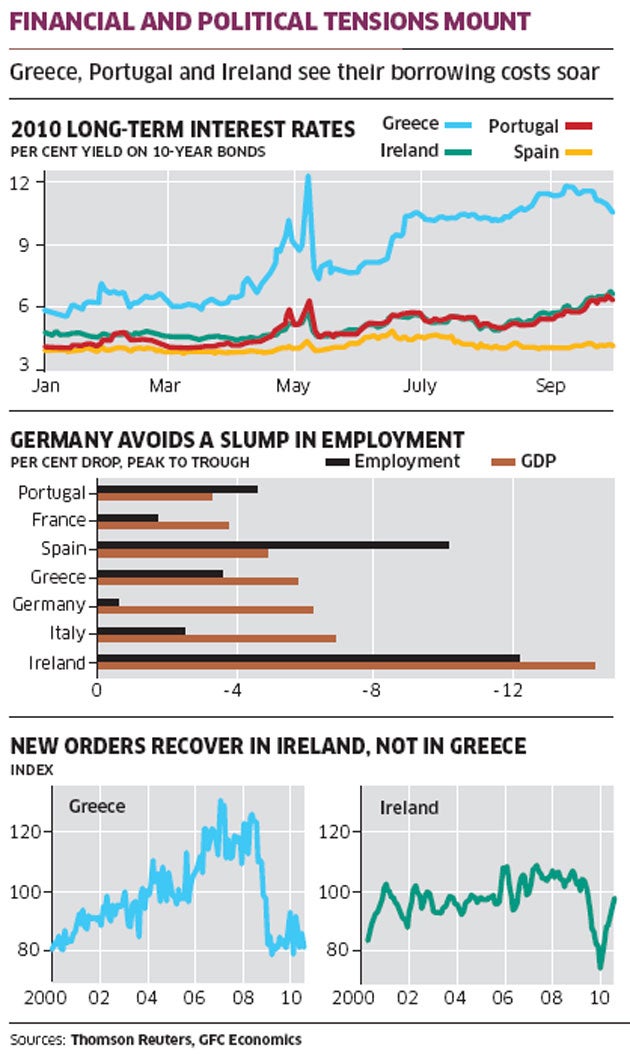

There is, however, this matter of interest rates. Ireland, as part of the eurozone, enjoys the low short-term rates set by the European Central Bank. It is the market, however, that sets longer-term rates and the yield on 10-year Irish debt has risen steadily through the past few months. The gap between what Ireland has to pay for 10-year loans is roughly five percentage points higher than the highest-rated European nation, Germany. You don't need a calculator to realise that over 10 years, a lot of extra interest has to be paid.

The position of Greece is much worse, as you can see. You could say that this suggests the markets are convinced Greece will sooner or later default on its debt, whereas they think Ireland has a fighting chance of being able to repay the full amount. Portugal is, in market perceptions, in much the same boat as Ireland, while Spain is in much better shape.

The different perceptions of Ireland and Greece arereflected in their economic performance. Output has bounced back in Ireland, whereas in Greece it remainsdepressed. Car sales in Greece are back to the levels of the early 1990s. When people see theirliving standards hit in this way it is perfectly natural for them to be upset, though I think it is important to distinguish between general anger and the anger shown in the street protests. Public sector workers, who have been prominent in the protests, have in many European countries been the ones who have up to now enjoyed better protected jobs than their counterparts in the private sector.

So there is increasing tension between private and public sectors within countries; there is also increasing tension between countries. The most remarkable performance has come from Germany. It suffered as severe a fall in output as any of the large economies anywhere in the world: around 6 per cent peak-to-trough. But there has been hardly any fall in employment, and now employment is rising strongly. This is in contrast with France, where output declined less but job losses were greater, and Italy, which also lost a lot of jobs.

For Spain and Ireland, the loss of jobs has been even more serious and I think the main reason was that both countries had large property booms; when these collapsed, construction jobs were especially hard hit. It is interesting, too, that neither Portugal nor Greece have experienced nearly as sharp a fall in employment as Spain. Yet Spain is managing so far to retain the support of the markets, whereas the others are not.

So what will happen next? There seem to me to be three important things going on. First, it's the financial markets that are imposing budgetary discipline, not the European Commission. You don't need fines by the EC to make countries cut their deficits; the bond markets are already fining them. But this is not at all satisfactory, for market discipline is uneven and capricious. The markets that are hammering Ireland and have, in effect, shut Greece off are the same markets that were happy to lend to both countries at much lower rates three years ago. If the European establishment's discipline was weak and ineffective, that of the markets was non-existent. It is not easy to have much faith in the Commission's new plans, but the present situation is untenable.

Second, there will be some sort of turning point in the bond markets, and spreads between the weak countries and the strong ones will narrow. You might say that at present the markets are charging Germany too little for its money and Ireland and Portugal too much. The problem is that until Greece reschedules its debts (and Greece is the one country that really cannot repay at face value), the debt of other countries will remain under suspicion. My instinct is that there will be several more months of nervous trading and the scope for an accident is uncomfortably big.

And third, the tensions within the eurozone will grow as it is perceived, rightly or wrongly, that the core countries benefit from membership while the fringe ones suffer. The ECB is still some months from its first increase in interest rates but at some stage the interest rate cycle will turn, and when that happens the weaker countries are bound to argue that monetary policy is being set to suit Germany, not them.

The "one size fits all" interest rate caused huge problems during the boom years, for had Ireland and Spain been in control of their own interest rates they might have slowed the expansion of their property bubbles. In the slump years a single interest rate has been less of an issue, for everyone needed near-zero rates and the ECB has been able to support the weaker countries. But as growth picks up in some parts of Europe and not in others, the single interest rate will cause problems again. The protests will continue a while yet.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks