Hamish McRae: A double dip is likely but it will not slip into a depression

Economic Life: European banks hold large amounts of sovereign debt of the 'Club Med' countries. Those securities are trading well below the price they paid

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.The dreaded double-dip is upon us – no, not the double dip in the economy, at least not yet, but a double dip in share prices. The major markets are now below their dips earlier this year and though they are still far above the troughs of March 2009, this past quarter has been a bit of a disaster. The "sell in May and go away" invocation does not always work, but this year it certainly has.

But the economy is not the same as the markets. From the perspective of the latter, the risks to the recovery have increased substantially and for a number of reasons. These include a faltering of the US house market, fears about the stability of the continental banking system post-Greece, worries about the speed at which governments everywhere, including here, are cutting their deficits, and concerns about willingness and ability of the central banks to maintain their ultra-loose monetary stance.

All these fears are legitimate. As I have argued in these columns for some months there has long been a strong probability that there will some sort of double dip before the recovery is assured. But the fears that we are facing some sort of prolonged depression seem to me to be as unfounded as the confidence three years ago that the boom would continue for ever. Take each of the concerns noted above in turn.

First, a US consumer slump associated with a further fall in property prices. Well, there is no doubt that as the exceptional measures designed to boost housing have been withdrawn, the housing market has faltered. The very latest figures, for April, were stable, but that followed two months of declines, leaving prices just 4 per cent above the trough of last year. Market expectations vary and in any case in such a vast country it is misleading to write as though it were a single market. But for what it is worth most people seem to expect another modest fall in prices through the rest of the year. So there could well be a double dip there.

Whether this translates into a double dip in consumption is another matter. Paul Dales, at Capital Economics, thinks not, noting that though consumer confidence fell sharply last month it is hard to see the economy actually going back into recession. Rising employment and income growth should stop that happening: so slower growth yes, recession no.

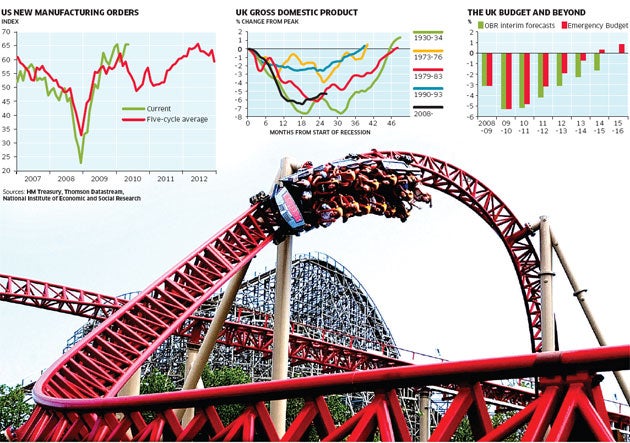

In any case, as you can see from the first graph, it is normal for there to be a fall back in economic activity after an initial bounce. This graph shows new orders for US manufactured goods in this cycle, compared with what happened in five previous recessions. We have, as you can see, had a sharper dip than usual, but also a sharp bounce-back. But look what typically happens next: a bit of fallback followed by a recovery.

What about Europe? I don't want to minimise the pressure that the indebted "Club Med" countries are placing on the European banking system. These banks hold large amounts of sovereign debt of Greece, Portugal and Spain. Those securities are trading well below the price they paid. So if they had to mark that debt to the market price quite a lot of European banks would be bust. They cannot borrow from the market and are being kept alive by funding from the European Central Bank, which is becoming increasingly uneasy about this policy. This was not what was supposed to happen when the euro project was launched, but there we are. Meanwhile these countries, like the rest of Europe, are cutting their deficits as swiftly as they dare.

But can you go on from here and say that a combination of banking weakness and fiscal restrictions will push the whole of Europe back into recession? Surely not. One of the weakest members of the eurozone, Ireland, is growing again. Northern Europe is largely unaffected. German unemployment is still falling and retail sales there rose in May. Much of Eastern Europe is staging a solid recovery. Sweden has just has its growth forecast for this year revised up to 3.8 per cent, and the central bank there is confident enough about the recovery to start raising interest rates. There will be a two-speed Europe, but the top half will be fine.

And here? Have a look at the next graph. It is the usual National Institute one, plotting this economic cycle against that of the recessions of the 1930s, 1970s, 1980s and 1990s. As you can see this cycle is pretty similar to that of the 1980s, going down a little faster and dipping a little deeper, but now almost exactly where you would expect it to be. But looking at those lines, while some sort of pause would be perfectly normal, the chance of dipping back as low as before is surely most unlikely. You have to be profoundly gloomy not to believe that we will be back to the past peak in output by the end of 2012 – the profile of the 1980s and 1930s cycles.

So yes, there may be a dip in UK house prices, for credit remains tight. But the industrial sector is still reporting a solid recovery and there has been some encouraging data from PricewaterhouseCoopers showing a sharp fall in insolvencies.

But what, you might reasonably ask, about the impact of our Budget? Surely that will knock things back. What about this stuff about 11 per cent of civil servants losing their jobs?

There are two answers to that. One is to ask what would have happened had the Budget not set out on this deficit-cutting journey. We do still have a larger deficit, relative to GDP, than Greece, and while we have been cut some slack by the markets, that was based on the expectation that the country would get its finances back under control.

The other is to note that – in the early years at least – the present government programme is not so different from that of the previous lot. The final graph compares this government's plan with the Office for Budgetary Responsibility's estimate of the previous government's projection. As you can see the deficit is being cut more swiftly, but the big differences are not this year or next but in years three, four and five. So from the point of view of the impact on the recovery, you could argue that the main drag on growth will be from 2013 and onwards, by which stage, if the economy is not making decent progress, we had better all head for the hills.

Besides, and I know this point is being made all the time, there is a world outside Europe and North America. China, India, Latin America, the Middle East – that is where all the demand over the past three years has come from, and while there are some signs of a slowing in China I have not seen a single suggestion that the emerging world might slide into recession. While the emerging world grows, that will eventually pull up the old developed world too. So a double dip, probably yes; some sort of depression, absolutely no.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments