Budget has been overshadowed by Brexit – but don’t ignore its importance

Economic View

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.You may have missed it, given the noise that has been generated by the EU referendum, but we are only two weeks from the Budget. Somehow the charge and counter-charge about the impact Brexit would have on the economy makes the tweaks that might be made to our national finances seem rather petty. Will it pass the “so what?” test?

Actually there will be three things to look for, and it is worth pondering about them now. The first will be the extent to which the Office for Budget Responsibility is taking the threat of a sharp global downturn seriously. The second is whether there really will need to be further cuts to spending to meet the borrowing targets. And the third is what on earth is to be done about savings and pensions.

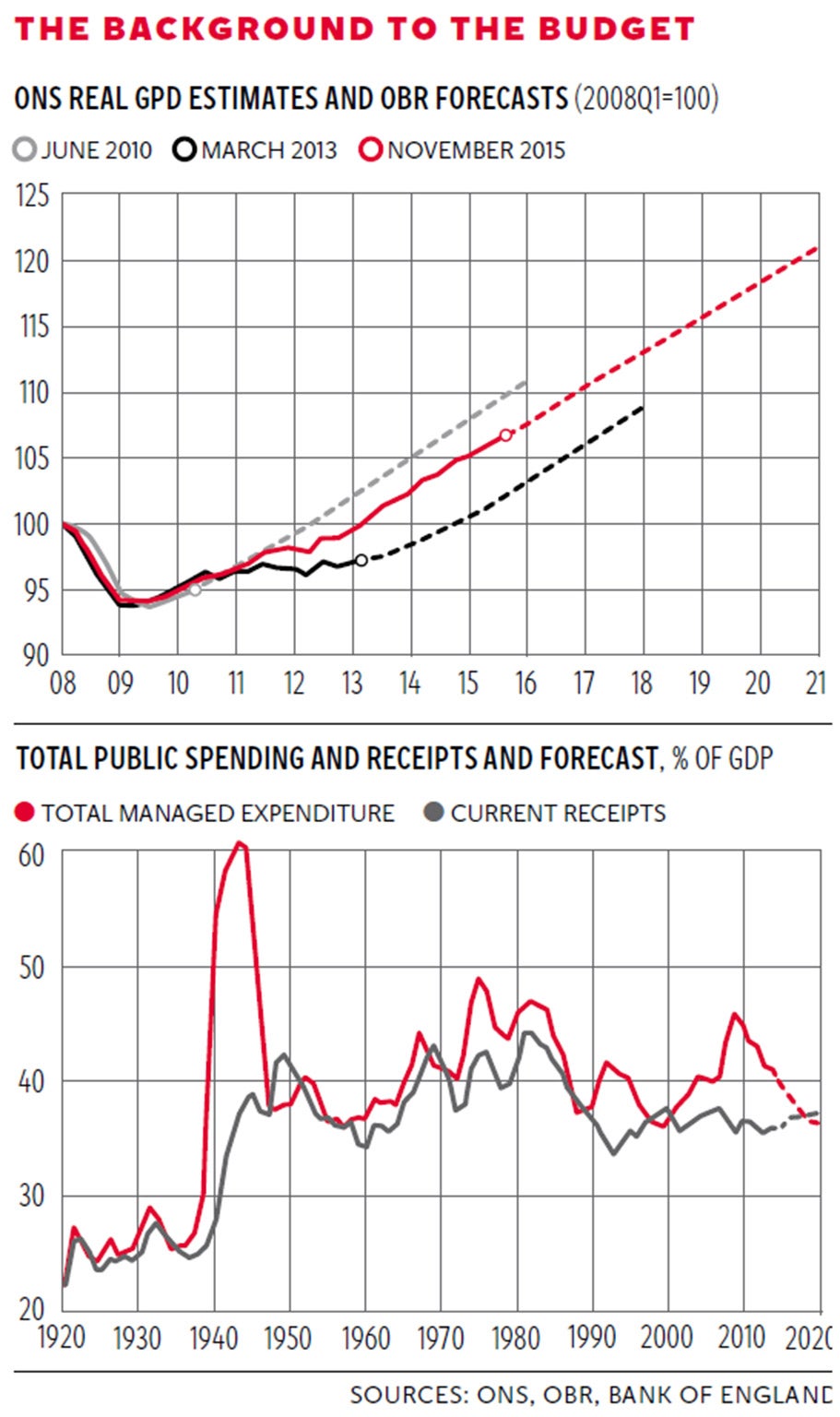

The point about the global outlook can be put very simply. If the world economy continues to grow decently the UK budget sums will turn out more or less all right. If on the other hand it tanks – and this expansion is now quite mature by historical standards – then things become very difficult indeed. The best way into this whole subject is the OBR’s November report, now to be updated, and the two charts here come from it.

The top chart shows how there have been different projections for the growth of the economy at different times. The first, made after the Coalition came into office in 2010, was the most optimistic. That’s the grey line. The black line, showing estimates in March 2013, starts from a point that we now know (because all the data have been revised upwards) was far too pessimistic. The most recent line, the red one, is reasonably close to the original estimates, showing the economy running about a year behind where 2010 projections. There may be some downward revisions this month, so let’s wait and see.

But now look at the left hand side of the graph, the big dipper. Growth since 2009 has been pretty much a straight line, with only a slight shading down in 2012. But it is not reasonable to expect that straight line to continue through to 2021. The OBR has to make the assumption of straight-line growth, but the reality is that there is a global economic cycle. So the thing to look for will not so much be the new version of this particular graph, but any other information or judgement about the risks of growth undershooting. My own guess is that there will be a significant global slowdown in the life of this Parliament, but not a serious recession.

The next thing will be to try to think through the impact of this on public finances. Public opinion has been massaged to expect further cuts in spending, but implementing this will be tricky. The bottom graph shows why. As you can see, the aim is to get total spending as a percentage of GDP down to the level it was in the late 1950s and late 90s, the bottom of the post-war range. The composition is somewhat different, with defence taking less (much less than in the 50s) and health care and pensions more. Revenue is planned to be roughly the same, again as a proportion of GDP, as in the late 50s and 90s. It was higher in the 70s but we had the Thatcher revolution as a result, and it was higher in the 80s, but we had North Sea oil revenues. (Did you know that even during the Second World War, taxation as a share of GDP was only around 38 per cent, close to where it is now? And that our public spending peaked at about 60 per cent of GDP, not much higher than the 57 per cent of GDP the French government spent in 2014?) So give or take the odd percentage point, while the plans to cut spending further are not beyond the limits of post-war experience, they are at the limits of it.

So if there are to be further cuts beyond present plans, then things do look tight. That is not to say they would be unrealistic or unattainable; the unprotected parts of the public sector have done a remarkable job in maintaining and often improving their quality of service on smaller resources. But this will be difficult – hence the drive to squeeze more out of the tax system.

That leads to the third issue: the detail of the taxation changes. Our lack of savings and poor private pension provision have become really troubling. The Labour Party’s two-year review on pensions, the Independent Review of Retirement Income, suggests the target for savings should be 15 per cent of salary, which compares with an average of 8 to 9 per cent at the moment. This must be right and a tax system that encourages, nudges or compels people to do that should surely be a prime objective of fiscal policy.

Yet both parties have chopped and changed tax rules almost by the year, which is actually rather disgraceful. I fear there will be further chopping and changing in this Budget. In an ideal world, pension rules should be taken out of politics, and public and private pension provision aligned to bring broadly similar results – but we are far from an ideal world. This is not just a government/private sector employer issue. More than 15 per cent of the UK workforce is self-employed, and arrangements here need to be brought into line with that of employees.

So three issues; which matters most? Outstandingly the most important thing will be the global outlook. If growth continues at something over 2 per cent, we scramble through. If there is a year of growth between 1 and 2 per cent, the Chancellor’s ambitious deficit-cutting programme is in trouble.

And if growth were to dip much below 1 per cent and stay there, then there is trouble indeed.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments