Fossil fuels fire up an impassioned debate over the Church of England's investments

Some campaigners think the Church should get out, but is the better approach to engage and reform?

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.God certainly smiled on the Church of England’s investments last year. The Church Commissioners announced a total return of 17.1 per cent for 2016.

That sort of performance in the current climate looks like clear evidence of the divine.

It compares to a still very respectable 8.2 per cent the previous year. Over the past 30 years, the Church's funds have achieved a return of 9.6 per cent per annum. Mammon and God in alliance? Heaven forbid.

Joking aside, the fund had some help last year. The Brexit driven fall in the pound pushed the value of the UK stockmarket higher, chiefly because lots of the companies in it earn their money in dollars.

Which is where it gets interesting. Many of the dollar companies in the FTSE 100 are fossil fuel businesses. Should the Church really be investing in companies that produce material that could yet contribute to the destruction of life on a planet God gave to man in trust (if you follow the teachings of the Bible)?

The Church has sought to reconcile the inevitable tension between God and Mammon by, in many ways, acting as a model for the way big institutional shareholders should behave.

During 2016, for example, the Church Commissioners voted against the majority of company remuneration reports, and publicly called upon company remuneration committees to better exercise their judgement on the vexed subject of executive pay.

They also voted against the chairs of nomination committees in instances where female representation was below 25 per cent of the board.

That's called putting principles into practice, and it is laudable. If more big asset managers followed the Church's lead, some of the festering problems in corporate Britain, and indeed in the wider corporate world, might have been addressed by now.

So far so good. But leave it to The Tablet, a Catholic weekly, to highlight the contradictions posed by the Anglican Church's investments in fossil fuels.

It reports that campaigners want the Church to get rid of them (current shareholdings includr ExxonMobil, Shell, and BP) given the damage that they do.

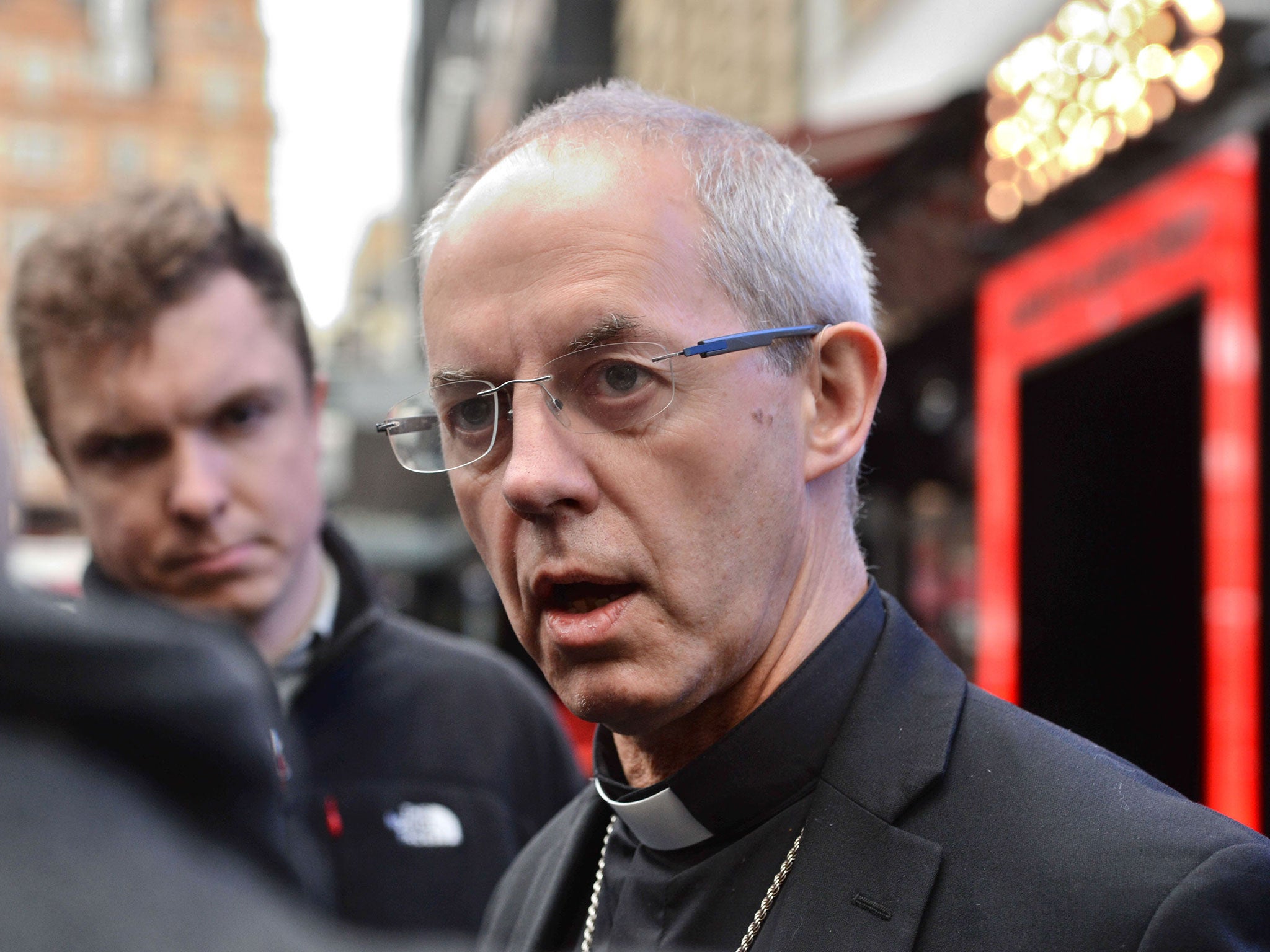

Further, it notes that the Archbishop of Canterbury Justin Welby, played a crucial role, as president of BMO Global Asset Management’s responsible investment council, in a tightening of its policy towards the fossil fuel industry which resulted in the outfit’s ethical funds dumping £20m of their fossil fuel shares.

The Church Commissioners take a rather different view. Instead of divesting their holdings, they have focussed on engagement, recognising that they will play an important role in meeting the world’s energy needs over the coming decades.

That being the case, why not press producers to work harder at minimising the damage they do, thus using the influence the Church has as an investor to constructive ends?

The Commissioners point out that they were instrumental in filing climate disclosure resolutions at Anglo American, Glencore and RioTinto.

A shareholder resolution was also jointly filed with the New York State Common Retirement Fund at ExxonMobil, seeking further disclosure on climate change.

Ultimately, you can make the case for both sides. When it comes to this issue, there are no easy answers, and there may be no right answers. It is something the world beyond the church is currently grappling with too.

The Church has enjoyed a bravura year when it comes to the markets, and its ten year record is on a par with the best in class when it comes to endowments.

But nobody ever said reconciling moral issues with money was easy.

Given the damage they are causing, fossil fuels surely present one of the thornier dilemmas for the church’s moralists to consider.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments