David Blanchflower: The MPC didn't have a clue and still doesn't

They expected the depth of the recession to be revised upwards

Economic Outlook: What a contrast between the upbeat and exciting news on the Olympics and the downbeat news on the economy. Great Britain ranks third in the medal table. But that good news is tempered by the fact that, in terms of economic performance, the UK is doing disastrously in the economic medal rankings. If we just add up GDP growth in the last eight quarters for which we have data, the UK ranks 31st out of 34 OECD countries, below Ireland (29th) and Spain (30th). The only countries with a worse performance are Italy (32nd), Portugal (33rd) and Greece (34th).

The bad news on the economy keeps rolling in. Retail sales numbers were weak. The trade figures for June were pretty bad, with the trade deficit the largest since comparable records began in 1997. The UK's deficit on trade in goods and services increased to £4.3bn in June, up £1.6bn from £2.7bn in May, driven mostly by a big decline in exports to non-EU countries. The worsening trade picture is not primarily due to a slowing eurozone as ministers have tried to claim.

Data releases from Germany last week showed declines in manufacturing orders, industrial output, imports and exports. Chinese exports in July rose just 1 per cent from a year earlier, undershooting forecasts by a big margin. All this means that net trade is likely to continue to make a negative contribution to UK growth as the world economy slows. The Chancellor's Office for Budget Responsibility has forecast that it will make a small positive contribution.

Industrial production numbers were also bad, although they were slightly better than the consensus forecast and will result in a small upward revision of around 0.1 per cent to the minus 0.7 per cent first estimate of GDP growth for Q22012. Construction output fell by 3.9 per cent in the second quarter, revised up slightly from the first estimate of 5.2 per cent, but there were also downward revisions for Q32011, Q42011 and for Q12012, whereas Q22011 was revised up. So the latest figures do not compensate for the previous three quarters' falls, which is why overall for the year construction activity has shrunk by nearly 10 per cent.

Of interest also is the fact that nearly every sector of construction activity, from private to public and from housing to infrastructure, has shrunk considerably over the last year, and that overall, construction activity across GB has contracted by 9.5 per cent in a year. Commenting on these figures, Simon Storer of the Construction Products Association said: "What is most concerning is that private sector activity has fallen sharply, implying that not just activity but also confidence is sadly lacking. This situation is rapidly becoming a crisis, and at this rate I wouldn't be surprised if manufacturers begin to shut down their operations and lay people off."

Unsurprisingly there was all sorts of gloom and doom and handwringing from the beleaguered Governor of the Bank of England at the Inflation Report press conference last week, where the MPC downgraded its growth forecast once again, to 0 per cent for 2012 and around 1.7 per cent in 2013. In what amounts to a complete abdication of responsibility, the Governor essentially claimed: "We got it wrong. Things are bad. And they're not getting much better anytime soon. But monetary policy is fine. And fiscal policy was right, is right and should not change." That is a total admission of macro policy failure so we should do nothing! It's absurd. People running macro policy need be accountable; the buck stops at the top.

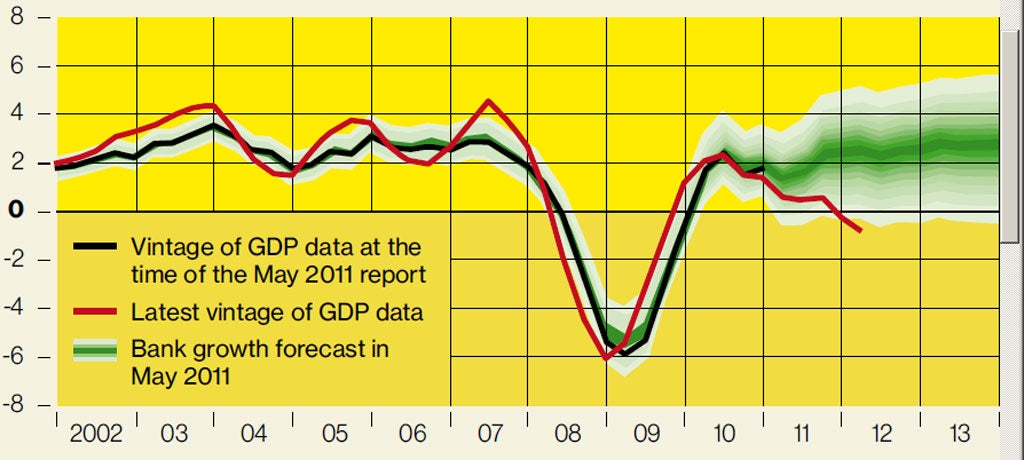

The above chart, which is taken from the August Inflation report, illustrates how hopeless the MPC have been not only in their forecasts but also in their predictions of subsequent data revisions. It shows the May 2011 growth fan chart, which contains both a forecast and a backcast over the preceding seven years because data can be revised. The green fan to the left of 2011 shows the MPC's expectation for data revisions in comparison to the ONS official data, plotted as the black line. It is clear that they expected the depth of the recession to be revised upwards, which hasn't happened. In general revisions have been up when the economy was on the up phase of the cycle in 2007 and down when it was declining in 2006. And then the MPC forecast that by Q2 2012 growth would be around 2.3 per cent with some prospect of 5 per cent and smaller prospects of zero or negative growth. Zero or negative growth was outside the 90 per cent confidence interval. But that is exactly what we now have, as the red line shows!

The MPC's new growth forecast looks broadly similar in shape to the one from May 2011 and looks equally unlikely to be correct, with a central projection of growth of 2 per cent by 2013 and beyond with only a slim prospect of zero or negative growth. The MPC didn't know where the economy had been, didn't know where it was when they made the forecast, and had no clue where it was going and still doesn't.

It is blindingly apparent that the MPC should have done much more monetary stimulus a while ago, including unconventional asset purchases, as suggested by my old friend Adam Posen. On that subject, I was particularly impressed by the recent speech by Adair Turner, who unlike Sir Mervyn King seems prepared to think out of the box in terms of activist fiscal-monetary co-ordination, purchasing a wider range of assets and debt restructuring. Adair has suddenly jumped to the top of my list of candidates for the Governor's job. The King is dead, long live the king.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks