David Blanchflower: The European Central Bank is a crawling tortoise – six years behind the curve on stimulus

More austerity in France when fiscal and monetary policy are both too tight is a plan for disaster

This was supposed to be the time when Britain was “carried aloft by the march of the makers”, the claim made by George Osborne in his Budget speech in March 2011. In the three years since then the number of workforce jobs in manufacturing is up 20,000 (+0.7 per cent) out of a total rise of 1.56 million (+4.9 per cent). Manufacturing as a proportion of all jobs in the UK has actually fallen from 8.2 per cent to 7.8 per cent. The Coalition has given up entirely on its claim that it will rebalance the economy so that in future the UK would be less susceptible to a financial market shock. It has also given up any hope that exports will rise.

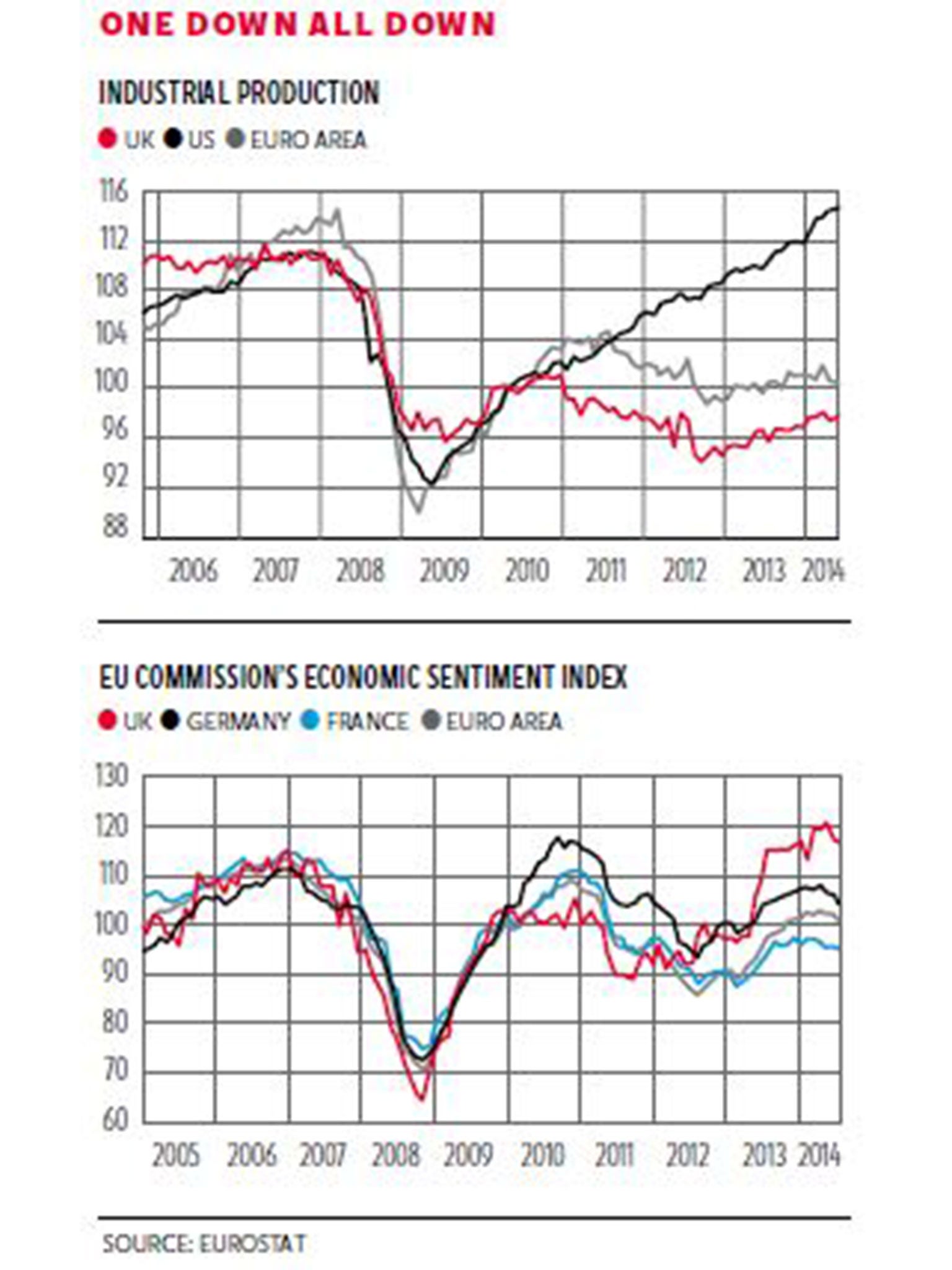

The first chart below plots industrial production (2010=100) since 2005. It shows how remarkably closely the eurozone and the United States’ paths were before and during the Great Recession and for a while afterwards. The two lines separate sharply in 2011 when the ECB raised rates twice. US makers continued to march ever upwards while in the eurozone the march of the makers did an about-turn. As Scott Sumner from Bentley University has noted: “The ECB tightened monetary policy sharply in 2011. This caused growth to plunge and the eurozone fell into a double-dip recession … The ECB caused the double dip recession.”

The UK data also tracks the US and the eurozone closely through 2007 and 2008 but has less of a fall in the down phase of the Great Recession. Euro area output dropped from a high of 115 in April 2008 to a low of 93 in August 2009, compared with a fall in the US from a high of 111 in November 2007 to a low of 92 in June 2009, and compared with a smaller fall from 111 in February 2008 to 96 in September 2009 in the UK. From these low points the three lines track each other closely from the middle of 2009 through the end of 2010.

The euro area continues to have growth through 2011 until the ECB rate rises; the US rises steadily from the spring of 2009. In contrast UK industrial production collapses just after the Coalition took office, not recovering until the end of 2012. The level in the UK (97.8) remains well below that of both the euro area (100.5) and the United States (114.7). Industrial production fell in the eurozone in the latest month’s data release and in 10 of the 18 countries: Austria, Belgium, Cyprus, Estonia, Greece, Ireland, Luxembourg, Netherlands, Portugal and Spain.

The blame for the crumpling of industrial production in the UK from the end of 2010 has little to do with the MPC, who were not raising rates. Far from it, in October 2011 they voted to increase asset purchases (QE) by £75bn to £275bn and again in February 2012 by a further £50bn. It also has nothing to do with the eurozone, which continued growing for another year. George Osborne’s economic policies caused the collapse of UK industrial production.

In France last week the government was reshuffled over the need to do further austerity in a country where the inflation rate is 0.6 per cent; industrial production is flat; GDP has grown 0.1 per cent over the last four quarters; and where the unemployment rate is currently 10.3 per cent and rising. So more austerity when fiscal and monetary policy are both too tight is a plan for disaster. When I was on the MPC we cut rates sharply at the end of 2008 and it took us three months to work out how to do QE. Six years in and the ECB is still working on it. They have been taken by surprise by the high levels of unemployment, low output and falling inflation. Only now with GDP in Germany contracting 0.2 per cent in Q2 2014 and Italy contracting in the last two quarters has the ECB tortoise woken up. Maybe the markets will force them, kicking and screaming, to start doing QE. They should have started doing it six years ago.

The second chart plots a series on consumer and business confidence published by the European Commission each month for the euro area as well as for each country. The chart plots data for the euro area, France, Germany and the UK. The Economic Sentiment Index (ESI) that is plotted is the sum of four business surveys from industry, services, retail and construction, along with a consumer confidence survey. As was the case for industrial production, the surveys track one another closely before and during the Great Recession. It is notable that all four surveys started plummeting from the spring of 2007 but few central bankers noticed.

As with the industrial production data, the upward trend in the UK series established under Labour breaks in the spring of 2010 when the Coalition takes office and claims that the UK is bankrupt like Greece and implements austerity. The German series rises steadily through the beginning of 2011 but, as in France, when the ECB raises rates, falls sharply again.

Of interest is the common pick-up since the autumn of 2012, which, admittedly, is sharpest in the UK, but occurred in almost every EU country. It most likely derives from Mario Draghi’s declaration in July 2012 that the ECB would do “whatever it takes” to protect the euro. Mr Draghi’s statement is likely more responsible for the lift in sentiment in the UK than anything the Coalition did.

Of concern, though, is the decline in all five surveys over the last three months, in the euro area, Germany, France and the UK. The UK survey fell from 120.7 in June to 116.3 in August, while Germany fell from 106.5 to 104.1. The French ESI has fallen every month since April, from 97.1 to 95.1. Supporting evidence last week for slowing was also provided by the IFO business sentiment index in Germany, which has now fallen for the last four months in a row. The expectations component has been especially weak, turning lower for much of 2014, reaching an 11-month low in July. Last week’s flash update for the German composite PMI also dipped slightly, all of this probably in part down to a Putin effect from the ongoing difficulties in Ukraine.

One down all down, and there’s an election coming!

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks