David Blanchflower: Sorry, the economic picture is not going to look any better

Economic Outlook: Some commentators have argued that the poor GDP data shouldn't be believed

It has been a dreadful couple of weeks for the Tories who are increasingly looking out of touch with ordinary folk. Horsegate, Grannygate, Cash for Cameron, Pastygate and Fuelgate all suggest the thin veneer of competence has been peeled away. It was only skin deep. These debacles are already costing the Tories dear in the opinion polls.

The trend actually seems to have started well before the Budget. In the 21 polls taken between 1 and 21 March, the Labour lead over the Tories averaged 3.5 per cent. In the eight polls since the Budget on 22 March the Labour lead averages 7.5 per cent and is growing. In the latest YouGov/Sun poll taken on 27 March Labour leads by 10 points.

In my view, the steady drip of poor economic data over the last month has been the major cause of the sense of panic in the Coalition, which survives, or not, on the success of austerity.

I have warned from the beginning that this was a loser's bet and so it is turning out. The data on consumer confidence, house prices, mortgage approvals and lending over the last few days have all been bad. The retail sales data for February fell by a much greater than expected 0.8 per cent, the biggest drop in nine months. Spending was down 1.5 per cent in non-food stores on the month. In addition, January's increase was revised down from 0.9 per cent to 0.3 per cent.

But then there were the killer GDP data revisions released on Wednesday. Embarrassingly for George Osborne, GDP growth data for three quarters of 2011 were revised down by the Office for National Statistics (ONS). In each case they were revised down by 0.1 per cent, from 0.3 per cent to 0.2 per cent in Q1, from zero to -0.1 per cent in Q2 and from -0.2 per cent to -0.3 per cent in the fourth quarter. The fourth quarter was revised up from 0.5 per cent to 0.6 per cent, but growth over the four quarters was revised down from 0.6 per cent to 0.4 per cent.

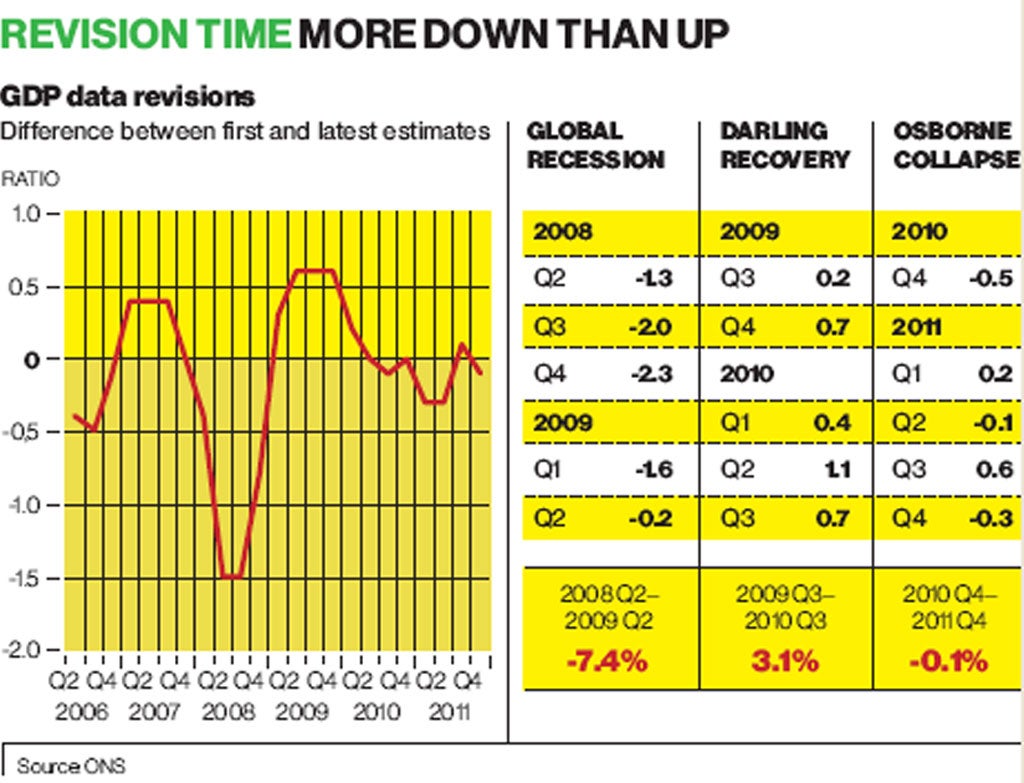

The graph above plots the revisions since Q2 2006, and shows that, during the period of growth before the global recession, the initial estimates have subsequently been revised upwards. Initial estimates of the recovery under Alistair Darling have also been revised upwards.

In contrast, the depth of the recession has been revised sharply downwards. Under Mr Osborne the revisions have mostly been down too. The economy is in worse shape than the Office for Budget Responsibility thought a week ago.

The table splits the latest revised GDP data up into three different groups of five quarters. The first five quarters, from Q2 2008 to Q2 2009, covers the period of global recession when output fell by 7.2 per cent. Then the next, five-quarter period from Q3 2009 to Q3 2010, that I call the Darling recovery, shows output rose 3.1 per cent. Finally, the subsequent, five-quarter period to the present, that I dub the Osborne collapse, shows that output fell by 0.1 per cent over that period.

Mr Osborne turned polices that were delivering growth under the previous Labour Government into reverse and destroyed growth. This now means that the Great Recession is comparable in depth to the Great Depression but much longer lasting. The drop in output in the Great Depression in the UK was restored in 48 months, whereas the current downturn has lasted 45 months and not even half the drop in output has been restored.

There is another issue that warrants our attention, which is whether the weak GDP data really are as bad as they appear.

Several commentators have argued that the poor GDP data shouldn't be believed as they will be revised upwards. This seems to be to justify their view that the economy has been going along swimmingly when it hasn't. Of course, if it was that simple then the ONS would simply make the statistical adjustment.

The definitive source on revisions to GDP growth data is a paper published by Gary Brown and co-authors from the ONS in 2009. This concluded that "revisions are not sufficiently large, regular or predictable to be able to support any procedure of incorporating bias adjustments into early estimates".

A 2007 Bank of England study by Cunningham and Jeffrey found that historically there is some evidence of bias in early estimates of GDP – certainly in the 1980s and early 1990s – but it is far from clear "that this has persisted into more recent periods".

The authors looked at revisions between 1999 and 2005 and concluded that compared to initial growth estimates, revisions were "not significantly different from zero".

Since 1992 the average revision has been +0.1 per cent but -0.1 per cent since 2006. There is little reason to expect that future revisions will be any different; whichever direction they are in they will on average be small beer and not significantly different from zero. Sorry chaps.

But it gets worse. On Thursday, the the Organisation for Economic Co-operation and Development (OECD), which Osborne has long held out as one of his biggest fans, forecast that output in the UK for Q1 2012 would be -0.1 per cent. Set alongside the newly revised -0.3 per cent for Q4 2011, it would fit the definition of a recession, which if the OECD is right, would be a double-dip.

A big day on the economic calendar will be 25 April when the first estimate of GDP growth for Q1 2012 is released. I also expect the number to be negative.

Then what George? He might not have a plan B, but the markets might force him to get one in a hurry.

Brown, Buccellato, Chamberlin, Dey-Chowdhury and Youll (2009), "Understanding the quality of early estimates of Gross Domestic Product", ONS.

Cunningham and Jeffery (2007), "Extracting a better signal from uncertain data", Bank of England Quarterly Bulletin, autumn.

David Blanchflower is professor of economics at Dartmouth College, New Hampshire, and a former member of the Bank of England's Monetary Policy Committee

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks