David Blanchflower: Sir Mervyn King missed the big one despite plenty of wake-up calls

Economic Outlook: King didn't need divine intervention, he should have looked at the data

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Stop the excuses. Sir Mervyn King argued in his BBC Today lecture last week that "there seemed no reason to expect the worst recession since the 1930s" and nobody saw it coming because "no one believed it would happen". The problem is that King did not believe it would happen even though many other people did. Just because he didn't believe what these people said at the time does not exonerate him; he should have.

King also claimed that "with hindsight we should have shouted from the rooftops that a system had been built in which banks were too important to fail". Hindsight isn't good enough. We pay the Governor a large salary to have some foresight. No mea culpa here. Is nobody going to take responsibility for the biggest macroeconomic mistake for a century?

Many people warned what was coming and King would have none of it as he was too focused on inflation and missed the big picture. Blaming Gordon Brown, the Financial Services Authority and the banks simply doesn't wash.

There is quite a lot of evidence in support of my contention that King personally missed what was going on. I recall sitting at the same table in front of the Treasury Select Committee in March 2008 when these issues were raised. I went back to the transcripts and this is what I found. The Labour MP Andy Love asked him if we needed more regulation, to which King replied: "A brief answer would be, do not have knee-jerk reactions but think very, very deeply about the causes of this crisis and whether levels of bank capital and the sort of financial system that generated this crisis does not require some action."

What a weird answer. King says he was calling for more capital from early 2008. So why did he warn against a knee-jerk reaction? Surely he should have made an unambiguous call for banks to raise more capital.

Love also asked King whether he was concerned that as the US was in recession it might spread to the UK. "For us, far more important than the United States in terms of the impact on demand in the UK is the impact on the euro area because they have a weight three times larger than the United States in our trade-weighted index, so what happens in the euro area is much more important to us directly than the US economy." I heard him claim the UK had decoupled from the US many times. It had not, of course.

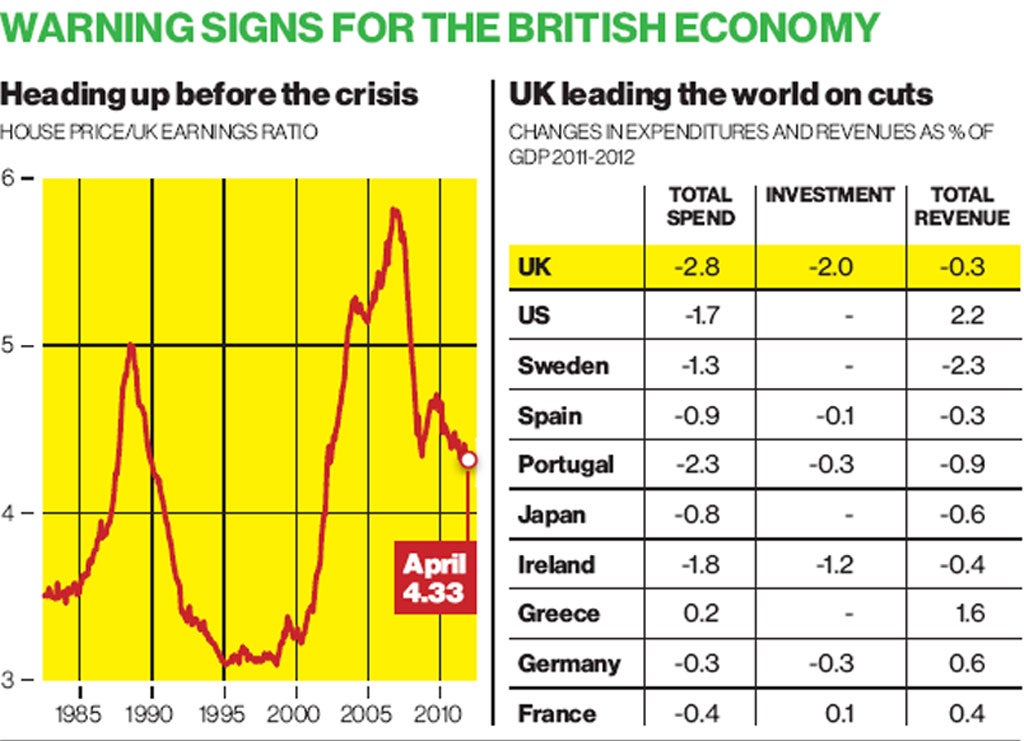

The chart above provides some evidence that is hard to ignore. It plots the Halifax house price to earnings ratios, which took a big drop last week from 4.42 to 4.33 as house prices fell 2.4 per cent on the month. The US housing market had started to collapse in 2006, which should have set alarm bells ringing, given that the 1929 Great Crash started in the Florida housing market. UK average house price to earnings ratios had risen to unsustainably high levels. From 1983-2004 it averaged 3.4, but by July 2007 had reached 5.81. When King was interviewed in March 2008 the ratio had fallen to 5.44 and house prices were5 per cent below their peak nine months earlier. Consumer confidence had started to collapse. That should have been a wake-up call, but not for King, who even by the beginning of September 2008, a week before the collapse of Lehmans, had not spotted the big one. He didn't start voting for rate cuts until October 2008. Note in the minutes of the September 2008 MPC meeting there is even a large section that argues for a rise in Bank rate. I ask you.

House price to earnings ratios are only held up at these historically high levels by the very low interest rates, and if they were to rise this would have a downward and likely large impact on prices. To get back to long-run averages would imply drops of at least 15 per cent, and probably more given likely overshooting, which would add to the Coalition's electoral worries and hit its support in the opinion polls still further.

I also recall Governor King being questioned in September 2008 at another TSC session after the August 2008 Inflation Report that failed to spot recession coming. Love again asked: "On unemployment there have been some suggestions ... that it may go up faster than the projections in the Inflation Report. Is that a worry to you? King's response: " I do not think we really know what will happen to unemployment. At least, the Almighty has not vouchsafed to me the path of unemployment data over the next year." He didn't need divine intervention, he should have looked at the data. Unemployment had started rising in March of that year and would continue to do so for many months ahead, and by that time the Bank of England's agents scores on the labour market had fallen off a cliff. King simply didn't get it and he should have.

One other issue that warrants attention this week is the extent of the cuts that the Government has undertaken. These, of course, were supported by King. Data from the International Labor Organisation sheds light on the scale of the deficit reduction that has gone on in the UK. This is reported in the table above and makes it clear that the Coalition has cut deeper than many other countries. The main driver is public investment cuts. No wonder growth has tanked. So the claims that cuts haven't taken place are wide of the mark. Plus the vast majority haven't happened yet. I dread to think what the effect on the economy will be if they are.

The big worry is what to do next. The MPC this week will clearly be concerned about the inflation risk and the slowing economy, but the downside risk to activity looms large. Looks like it's time to push the trigger again. Doing too much in these circumstances is better than doing too little. We would have been in much better shape today if Mervyn King had realised that in 2007 and 2008.

David Blanchflower is professor of economics at Dartmouth College, New Hampshire, and a former member of the Bank of England's Monetary Policy Committee

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments