David Blanchflower: How much worse do things have to get before we get action?

Economic Outlook: Why not start temporary tax cuts and shovel ready projects right now?

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.For us data watchers, last week was a big one and pretty exciting. Oil and commodity prices continued their downward slide. In the euro area, the PMI flash estimates showed weakening in both services and manufacturing. Perhaps more important still was the flash estimate for Germany, which also implied slowing. To this point, Germany has been an island of growth but as John Donne warned in For Whom the Bell Tolls : "No man is an island, Entire of itself. Each is a piece of the continent, A part of the main. If a clod be washed away by the sea, Europe is the less." The less indeed. These data appear to strengthen French President François Hollande's argument that it is time for the Euro area to get a growth plan. Austerity is failing everywhere – not just the UK.

Data at home were also not great. Inflation dropped more sharply than most economists expected to 3 per cent, so there was no need for another missive to the Chancellor from the Bank of England Governor explaining why they had missed the inflation target again. But retail sales for April 2012 decreased by 2.8 per cent on the month. The CBI's Industrial Trends Survey found that UK manufacturers reported weaker order books in May, and the pace of expected output growth over the next three months has slowed.

This is consistent with the finding of the Bank of England's agents survey of employers that consumer demand, manufacturing demand and private sector investment intentions were all broadly flat. Private sector employment was also expected to be broadly unchanged over the next six months. The agents reported a marked contraction in construction output "in large part due to declining work for the public sector".

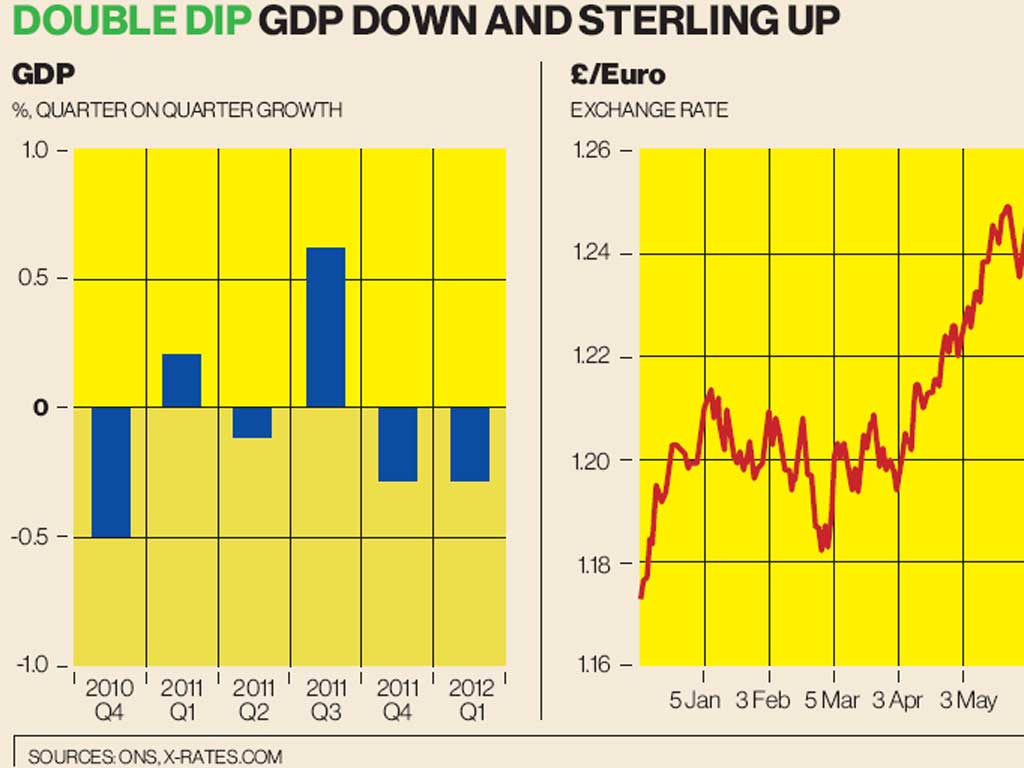

Then there was the revision to GDP growth for Q1 2012, down from - 0.2 per cent to -0.3 per cent (see above), which I had anticipated. This confirms that the UK economy is in double-dip recession. As a result the recession deniers went rather quiet. The best the former Monetary Policy Committee (MPC) member Andrew Sentance could do was to tweet "Latest GDP doesn't tell us anything new about double-dip. Significant revisions occur after 1-2 yrs +."" My question for those who say we aren't in recession and don't need to do anything is this: what if they are wrong and we do nothing?

These revisions now make it clear that the 25 votes by MPC members for interest rate increases in 2010 and 2011 by Sentance (12), Spencer Dale (6) and Martin Weale (7) were mistaken. The worry now is deflation once again, with nominal wage growth of only 0.6 per cent and falling oil prices, especially if the euro area implodes. The strengthening pound, which has seen an appreciation against the euro of over 10 per cent in a year (see chart), will also lower inflation.

The final twist was the IMF report and the press conference in the Treasury building with Christine Lagarde standing next to George Osborne, who had backed her for the job against Gordon Brown and who had just contributed £10 billion to the IMF's coffers. Ms Lagarde pulled her punches to say the least. Interestingly the published report didn't even contain the word recession in it. When our economics editor Ben Chu asked Ms Lagarde about it at the press conference, Lagarde said that the IMF's forecast was for positive growth in 2012. That may well be wishful thinking – and the IMF has engaged in a lot of that recently.

But on the monetary front the IMF did pile up the political pressure on the MPC to do more, going so far as to say "further monetary easing is required" because "anemic nominal wage growth and broadly stable inflation expectations suggest underlying inflationary pressure is weak, providing space for greater monetary easing...Monetary stimulus can be provided via further Quantitative Easing and possibly cutting the policy rate".

The pressure on the MPC to act at its June meeting is probably too strong to resist, so I fully expect they will move again and do another £50bn. Of particular note is their call for the MPC once again to purchase private-sector bonds, but in this case to support mortgage lending and financing for business. This is eminently sensible but opposed by the Governor, Sir Mervyn King, who thinks this is the job of the Treasury. There is obvious and mounting tension between Downing Street and Threadneedle Street.

Interestingly, in a June 2011 report on the UK, the IMF had argued that "if the economy experiences a prolonged period of weak growth and high unemployment... it will be important to ensure that the slowdown does not become entrenched due to capital scrapping and cyclical unemployment becoming structural. This is not the central scenario, but if this appears to be in prospect, then some combination of the following would need to be considered: (i) expanded asset purchases by the Bank of England and (ii) temporary tax cuts".

Over the last four quarters, growth has declined by 0.1 per cent but this time around the IMF concluded "if growth does not build momentum and is significantly below forecasts even after substantial additional monetary stimulus and further credit easing measures, planned fiscal adjustment would need to be reconsidered... Fiscal easing measures in such a scenario should focus on temporary tax cuts and greater infrastructure spending, as these may be more credibly temporary than increases in current spending".

Oh, OK, but how much less growth would there have to be for the IMF to recommend that the fiscal stimulus trigger is actually pulled? Even Nick Clegg seems to think it's time, and he now admits that his talking down the economy was a bad idea. Well that is at least a start. But why not begin temporary tax cuts and shovel-ready projects right now?

The CBI says that every £1 spent on construction buys £2.84 in economic return. Slasher Osborne is going to have to do this – and soon. This was all so predictable.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments