David Blanchflower: Can the UK jobs market really be freer than in the land of the free?

These are puzzling days for labour economists and central bankers. Watch out for more shocks

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.This has been a long drawn out, cold and snowy winter in New England, especially in Boston, which is close to a record snowfall of 107.6 inches, compared with an average of 42 inches. In New Hampshire we haven’t had a single day much above freezing this year so far and it has been really cold. Last week it was minus 26F (minus 32C) at my house. So I fully expect Q1 2015 output in the US will be impacted by the bad weather, just as it was last year in the first quarter (the only quarter in 2014 that the US did not grow faster than the UK).

There is some debate in the US on when the Fed will raise rates, not least because of commentaries by Fed officials, especially the vice-chair Stan Fischer, suggesting that the first rise will come in June or perhaps September. The Fed chair, Janet Yellen, did make clear in her congressional testimony that such a move will be data dependent. So negative shocks like bad weather might disrupt that move, even as the US has now entered deflation. But no worries, they say, all is well, this is just down to oil; the economy is on the move and the labour market is tightening (despite the fact that this month, even though the US unemployment rate fell from 5.7 per cent to 5.5 per cent and non-farm payrolls rose by 295,000, average hourly earnings growth remained flat at 2 per cent). Plus the Conference Board’s consumer confidence index has fallen sharply. In addition, the dollar continues to strengthen, which represents monetary tightening, and so negatively impacting exporters. The fear is that the move after that will be to cut rates again as activity plummets.

The Bank of England’s Monetary Policy Committee meeting this week was inevitably a non-event, with no change and every prospect that the decision was a unanimous one. There is no chance that the MPC will raise rates before the Fed does, not least because of the adverse impact on variable rate mortgage holders in the UK. Given that, when the time comes to tighten, which isn’t now, it would be seriously worth considering reducing the stock of assets bought in QE rather than raising rates as the first move. Or at least not reinvesting assets once they mature.

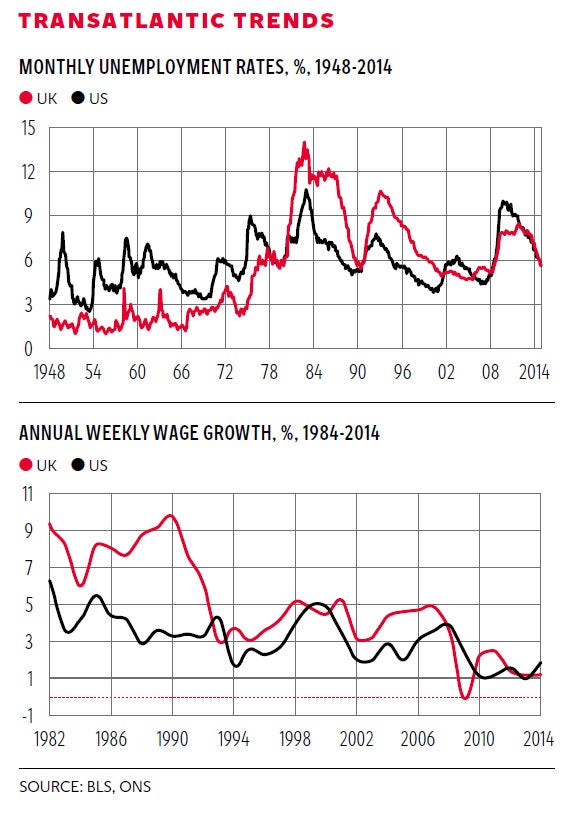

The big issue in the UK and the US will be what happens to the labour market, which in both countries continues to tighten but with little or no sign of rising wage pressure. The Bank of England’s latest release of data allows us to do a comparison between the US, using data from the Bureau of Labor Statistics (BLS), and the UK on two dimensions: unemployment and wages. The first chart plots the monthly unemployment rate since 1948. Currently both the US and the UK have broadly similar unemployment rates (5.5 per cent and 5.7 per cent) and as is clear from the chart the rates in the two countries have tracked each other through both up and down phases of the great recession.

They followed each other closely in the up phase from January 2009 to June 2009 and in the three years since September 2011. It is notable that US unemployment rates reached a higher peak of 10 per cent in October 2009 compared with a high in the UK of 8.5 per cent in November 2011.

Similarity between the two countries’ unemployment rates is rather unusual prior to the Great Recession, as the graph makes clear. For the 30-year period 1948-1978 the UK rate was below the US rate, and then they crossed. The only credible explanation for the crossing appears to be the rise in home ownership rates in the UK, which were well below those in the US. As Andrew Oswald and I have shown in a recent paper* rising home ownership tends to reduce mobility and raises unemployment.

The problem is that there are no other obvious contenders with the right timing to explain the crossover; the literature hasn’t explained the switch. From 1978 through 2001 UK rates were everywhere higher than in the US. US rates were higher from 2001-2004 while UK rates were higher from 2005-2007. We are also in search of explanations for these other crossing points. Over the 804-month, 67-year period from January 1948 to December 2014, US unemployment rates averaged 5.8 per cent, compared with 5.4 per cent in the UK. Since 1978 they averaged 6.4 per cent and 7.8 per cent respectively. We don’t have great explanations for these differences. All suggestions gratefully received.

The second chart, also using data from the Bank of England and the BLS, presents a possible explanation: wage flexibility. It plots 12-month growth rates in weekly wages since 1984 using annual data for the UK from the Average Earnings Index (AEI) up to 2000 and Average Weekly Earnings (AWE) since then. In the US it plots growth rates of median usual weekly earnings of full-time wage and salary workers. For almost the entire period 1984-2008 wage growth was higher in the UK than in the US. Average wage growth was 3.5 per cent in the US compared with 5.6 per cent in the UK over this 35-year period.

It is hard to believe that was sustainable and driven by markedly higher productivity growth in the UK than in the US. When the unemployment rate was last at 5.7 per cent and falling, in 1999, wage growth in the UK was 4.8 per cent but with a CPI of 1.3 per cent rather than 0.3 per cent.

What is notable is that wage growth slowed more sharply in the UK than in the US from 2007. There was little or nothing in the academic literature that suggested that wages in the UK were more responsive to macroeconomic shocks than they were in the US. In 2008 if you had tried to argue at academic conferences that wages were more flexible in the UK than the US you would have been given a hard time. It’s hard to see wages suddenly reverting to those unsustainable, pre-recession, heady days for workers, as the MPC keeps predicting.

These are puzzling days for labour economists and central bankers. Watch out for more shocks. I am headed to Florida.

* “Does high home-ownership impair the labor market?”, NBER Working Paper, David Blanchflower and Andrew Oswald (2013)

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments