Our research shows austerity is hitting ethnic minorities and the disabled harder - ministers cannot claim they were not warned

For a Prime Minister who wants to remedy injustice in society, this should be a wake-up call

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.“If disparities cannot be explained, they must be changed.”

When the Prime Minister published the Government’s race disparity audit, she set out a challenge to our public services and our society as a whole: why do people from different backgrounds see such different outcomes, across a whole range of indicators, and what can we do about it?

In research published today by the Equality and Human Rights Commission, we shed some light on one aspect of the problem.

Over the last seven years, the Government has made numerous changes to the tax and benefit system: big and small. Some of these have increased incomes overall, such as increases to the personal allowance and to the national minimum wage; others, like changes to disability and housing benefits, have reduced them.

Some, like universal credit, have been and continue to be hugely controversial; others, such as the freeze to working-age benefits, have received much less attention.

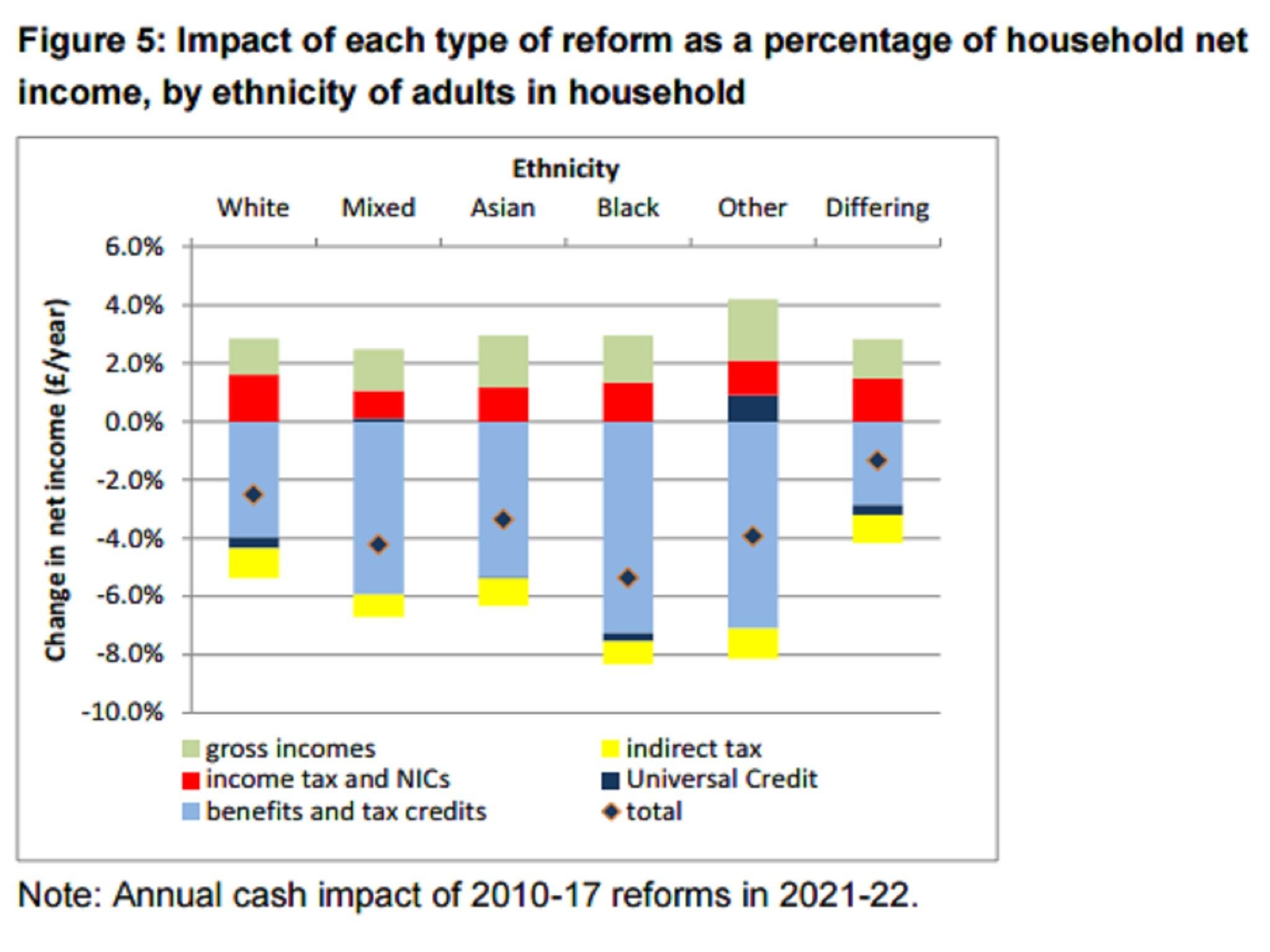

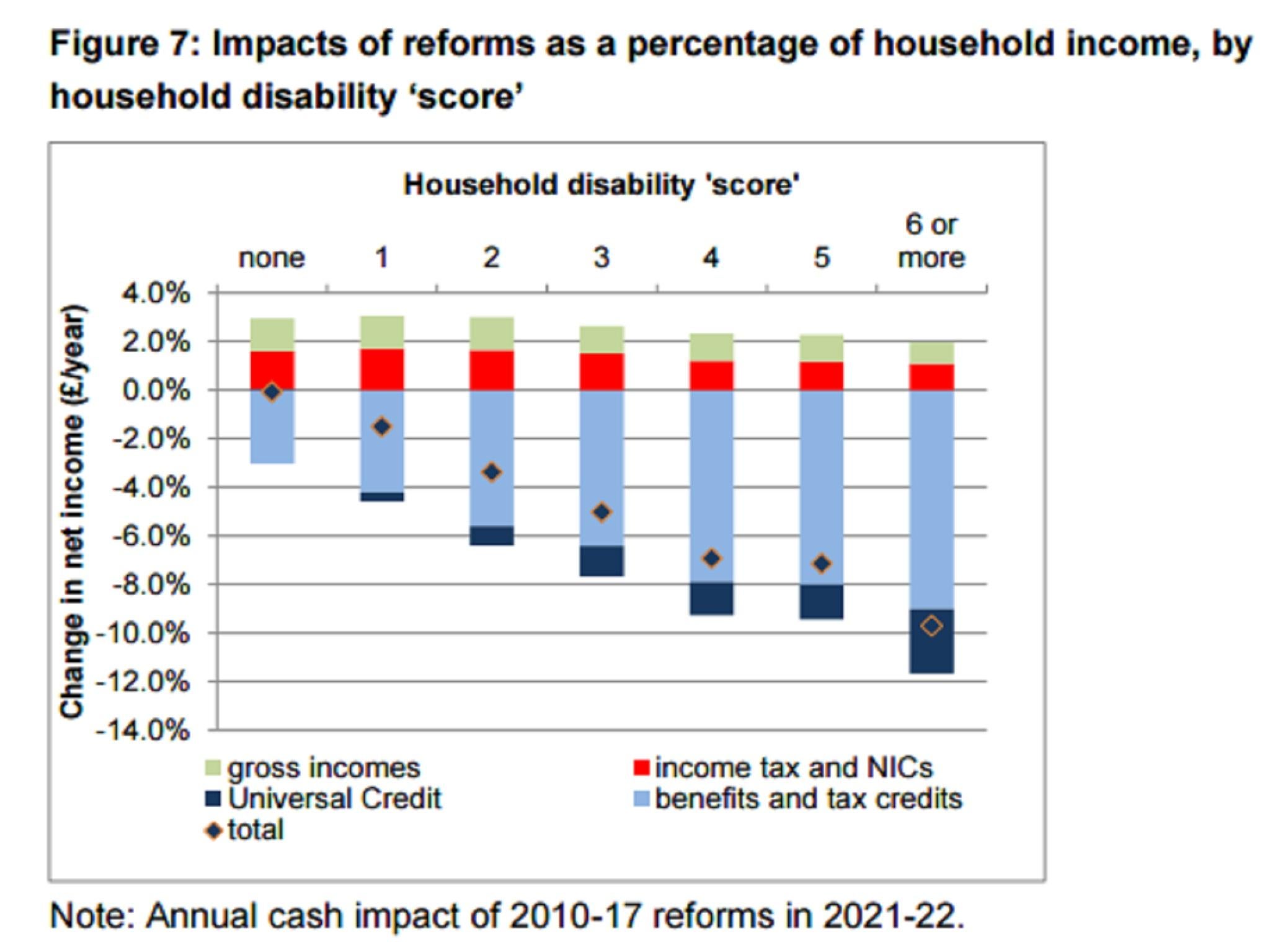

But what has been the impact on different groups within society – disabled people, the young and the old, women and men, and ethnic minorities? Although the Government has a legal obligation to take into account the differential effect of policy changes on these groups, it has never looked across the board at the overall impacts.

Our research looks at all the major changes introduced between 2010 and 2017 – some already implemented, and some still to come – and estimates the impact on incomes in 2021, when they will all, on current plans, be fully in place.

Some of our results are stark, particularly for the disabled; on average, the impact of tax and benefit changes on families with a disabled adult will be to reduce their income by about £2,500 per year. If the family also includes a disabled child, the impact will be over £5,500 per year: more than five times the impact on families where no one is disabled.

Women lose more than men – on average almost £1,000 a year, while men lose only half as much. The impact on black households is double that for white ones. And lone parent households will lose, on average, 15 per cent – almost a pound of every six – of their incomes.

None of this, of course, is necessarily the result of deliberate policy choice, still less direct discrimination. The very large cuts to working-age benefits, both for those in and out of work, and the introduction of universal credit at much less generous rates than originally planned, inevitably hits those on low incomes, especially those with children, particularly hard.

Because the disabled, lone parents and some ethnic minority groups are disproportionately represented amongst benefit recipients, it is hardly surprising they fare badly, while increases to the personal allowance provide little compensation for most.

And we do not claim that this is the whole story by any means. Increases to employment rates, particularly for lone parents and older workers, have mitigated the impacts on living standards so far – although this is less likely to be the case going forward.

And the results we are publishing today do not take into account changes to the funding of public services – in our final report, to be published early next year, we will be extending our work to look at those as well.

Nevertheless, for a Prime Minister and Government that want to remedy injustice in society, this should be a wake-up call. Ministers cannot claim that they were not warned.

Measures the Government has already announced and plans to implement over the next few years will, overall, widen gaps in society between different groups, and aggravate already-existing injustices. Next week’s Budget provides an opportunity to remedy that.

Jonathan Portes and Howard Reed are the authors of a new report for the Equality and Human Rights Commission on the impact of tax and welfare reforms between 2010 and 2017

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments