Chancellor Philip Hammond might claim asset strippers aren't welcome but there's not much he can do to stop them

The Government doesn't have the power to stop asset strippers from taking over British comapnies as things stand and any change to the law might have to wait for Brexit to be completed

Asset strippers go home. You’re not welcome to waltz over here with the aim of gobbling up and gutting the country’s best companies.

So said Chancellor Philip Hammond, the man with arguably the toughest job in the post-Brexit Tory government.

He was speaking in a Q&A session with MPs after the takeover of one of those companies that occurred as a direct result of the EU Referendum and the precipitous fall in the value of Sterling that followed.

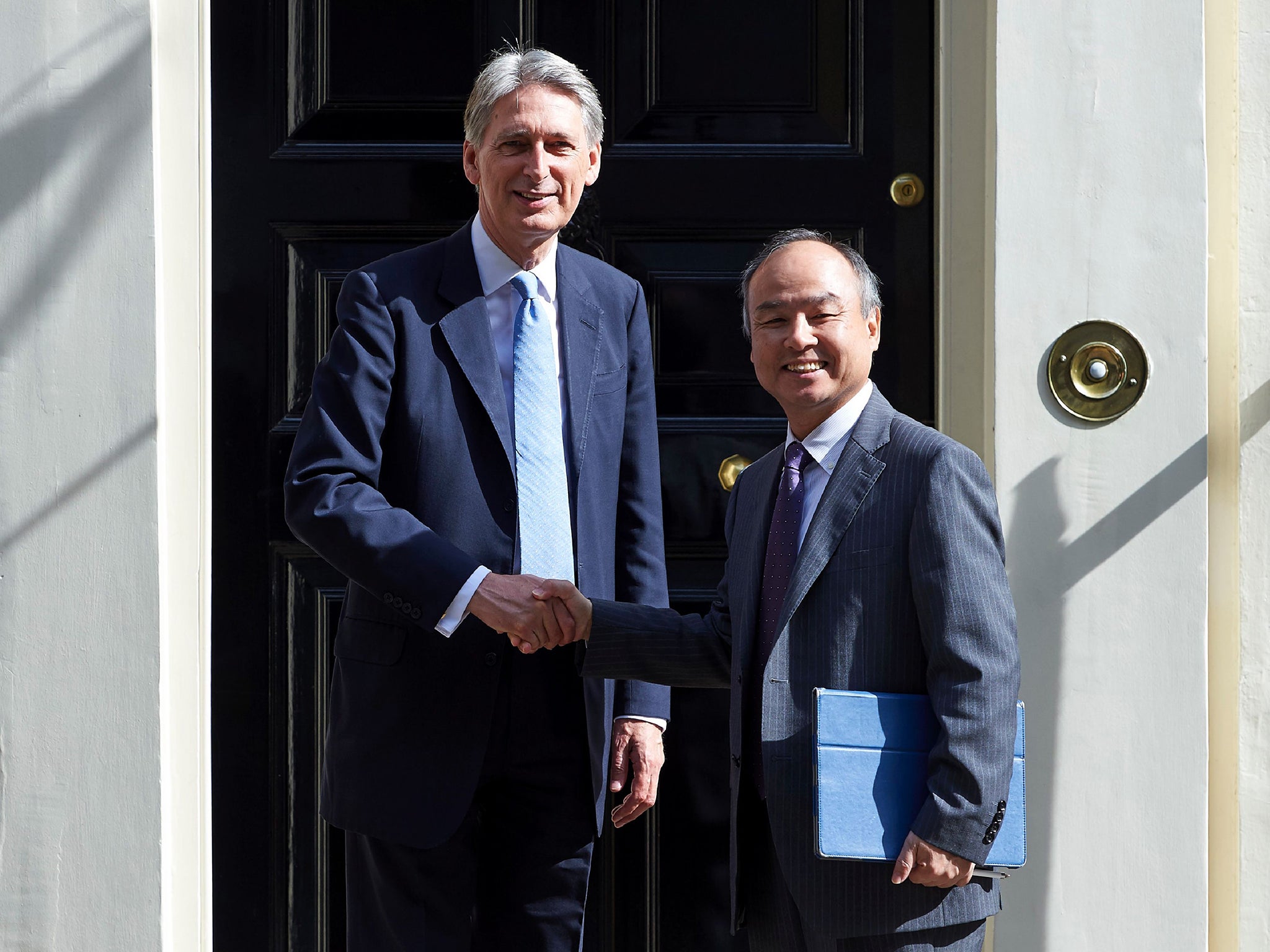

Mr Hammond, however, did not criticise the takeover of ARM Holdings by Japan’s SoftBank and with good reason. While it is in many ways regrettable, as I wrote yesterday SoftBank could turn out to be a good partner for ARM, and a good investor in the British tech sector. An asset stripper it is not.

Unfortunately the weak pound means those that are asset strippers will still be tempted to launch raids on British companies. The weakness of Sterling makes them cheap to buy. Opportunity knocks to Evil Asset Stripper (EAS) Inc and its fellows.

Having Mr Hammond in Number 11 doesn’t offer much protection against this because there’s not a lot he can do to stop them. As things stand, there is a for sale sign above every publicly listed British company. The only way for deals to be frustrated is if regulators intervene on competition grounds.

The British Government has never been overly keen on the sort of ruses used by the French, who drafted the so called “Danone Law” in response to the mooted interest of Pepsi in the food company. Yoghurt being a key strategic industry.

New PM Theresa May has talked about industrial policies and key strategic industries. She and Mr Hammond have good reason to be concerned. The only reason Pfizer’s cynical bid for fellow drugs giant AstraZeneca failed a while back was that it didn’t come up with a bid high enough to satisfy Astra’s chief executive Pascal Soirot.

Unfortunately, any new legislation the Government might propose will have to be in line with EU rules, at least until Brexit is complete, which won’t be for at least until two years after the now famous Article 50 has been triggered. That doesn’t look likely to happen until next year at the earliest. In the meantime, do you think the EU will be willing to give the Brits the same sort of leeway as the French have traditionally enjoyed? I don’t.

In the meantime Mr Hammond has been talking a good game. But it’s just talk. As things stand there isn’t all that much he can do to prevent any asset stripper from taking the family silver from the table and flogging it off down the local metal smelters.

Perhaps talking tough will be enough. But I rather doubt it.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks