US firm CME makes £3.9bn bid for London-listed NEX Group

The combined group will be based in Chicago but maintain a European base in London, if the deal goes ahead

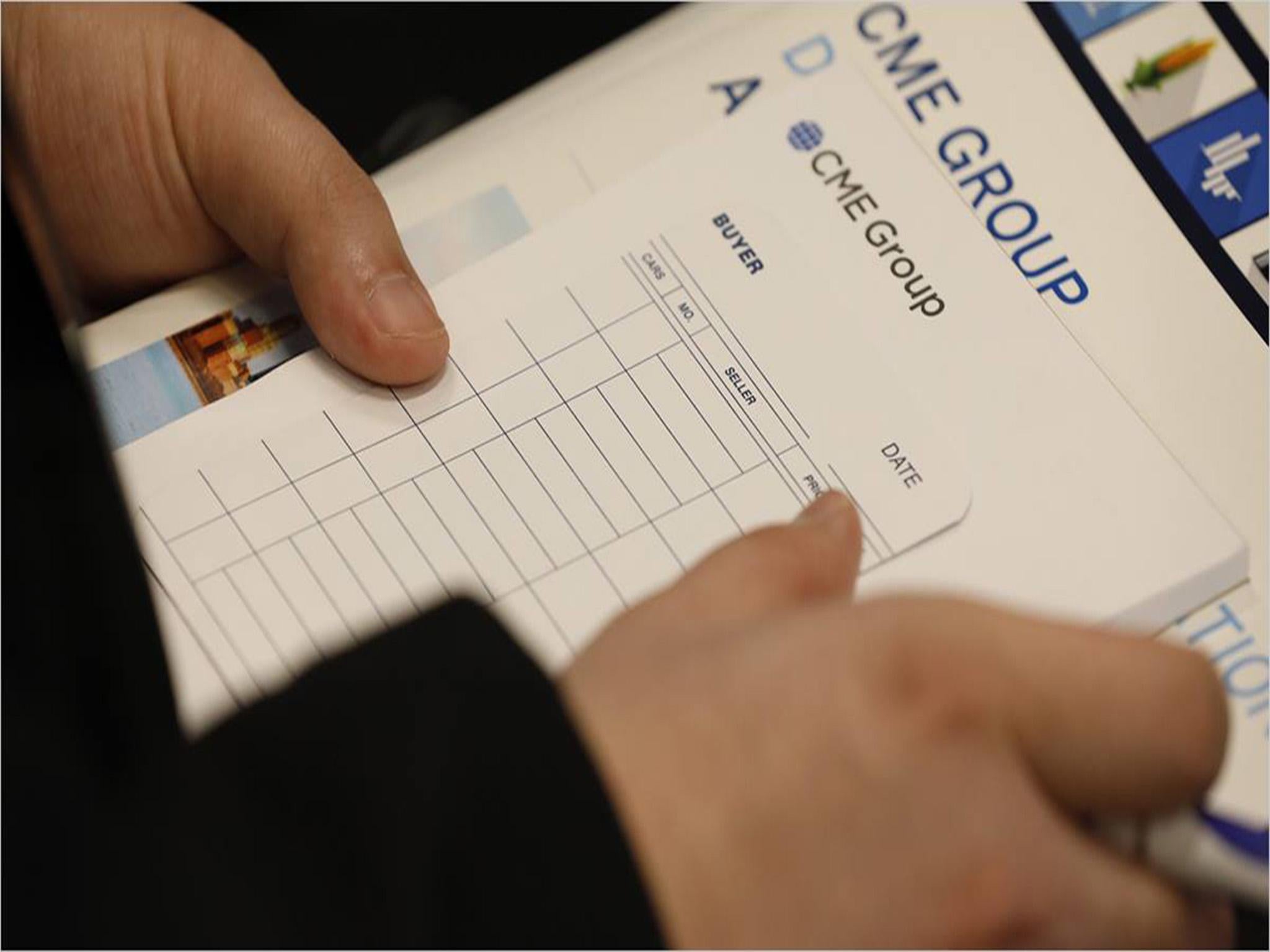

US exchange CME has agreed a £3.9bn deal to buy Michael Spencer’s NEX Group following weeks of talks.

Under the terms of the acquisition, CME will pay £10 for each NEX share, in the form of £5 in cash and 0.0444 new CME shares. NEX, formerly known as Icap, has recommended the offer to shareholders.

If the deal goes ahead, Mr Spencer will join the CME board to remain with the combined group as a special adviser. NEX’s headquarters will be joined with CME’s head office in Chicago, with the new firm also maintaining European HQ in London.

CME boss Terry Duffy said the deal would “allow us to create significant value and efficiencies for our clients globally”.

“Michael Spencer and his senior leadership team have built a world-class organisation that is at the center of capital markets. We are committed to maintaining the longstanding relationships NEX has with its clients and exchange and clearing house partners,” Mr Duffy said.

“Building on NEX's deep roots in Europe and Asia and CME's strong technology platform, we will transform our international profile and broaden our distribution network."

Mr Spencer added: “The combination of NEX and CME will be an industry-changing transaction. Bringing together cash and futures products and over the counter services will be unique, offering clients improved access to trading, greater financial efficiencies and highly valuable data sets. The technology and innovation opportunities will be diverse and extraordinary. Clients will be better served.

“CME's decision to choose London as its European headquarters is also a signal of tremendous support for Britain's financial services sector.”

Shares in NEX edged up at the open.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks