Budget 2016: IFS says rich gain most as Osborne's plans extend austerity into the next decade

The IFS response was peppered with attacks on Osborne’s 'odd' tax policies and his 'bizarre' asides

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Austerity is to be extended into the next decade in the Chancellor George Osborne’s 2016 Budget, according to analysis by the Institute for Fiscal Studies.

In a response peppered with attacks on Osborne’s“odd” tax policies and the “rhetorical nonsense”, of his “bizarre” asides, the leading watchdog on the Government’s spending plans dismantled the Budget delivered on Wednesday.

Paul Johnson, director of the IFS, said that Osborne will have to make further spending cuts of £3.5 billion to reach his target of clearing the gap between tax income and Government spending before 2019/20 – but he hasn’t yet said where that money will come from.

“Yet another year of austerity pencilled in,” Mr Johnson said, picking out Osborne’s decision not to mention that the Office of Budget Responsibility has “lost £56 billion down the back of the sofa”.

The losses stem from changes in expectations for the UK’s economic growth, Mr Johnson said.

“If the [Office for Budget Responsibility] is right about that we should all be worried. This will lead to lower wages and living standards, not just lower tax revenues for the Treasury,” he said.

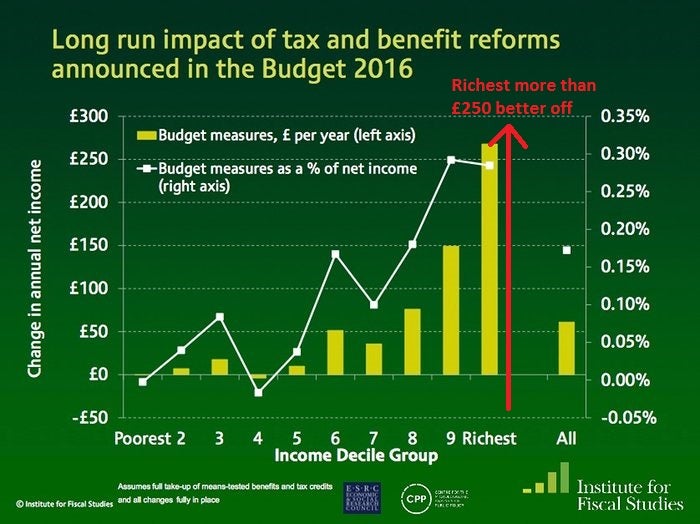

Meanwhile IFS analysis showed that the richest 20 per cent will do best out of the plans announced yesterday, both in cash terms and as a proportion of their income.

"The biggest gainers were those towards the top of the income distribution, with most towards the bottom broadly unaffected," Mr Johnson said.

Mr Johnson said that if the outlook for the UK economy becomes any gloomier, Osborne will have to turn to “real policy change”, or tax rises and spending cuts.

“If the objective is to get the surplus by 2019, that would be the right response – whether it’s the right response economically or not,” he said.

It was “disingenuous” of Mr Osborne to say that he had raised 1.3 million low paid workers out of tax when they were still hit by their national insurance bill, Mr Johnson said.

The IFS put the number of disabled people affected by changes to disability benefit at 370,000, who will lose an average of £3,500 each.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments