Brexit: JPMorgan may one day move all European business out of London, says bank boss

Leaving the EU ‘cannot possibly be good for the United Kingdom’s GDP’, says investment bank boss

JPMorgan may one day move all of its EU-focused business out of London and into Europe, the investment bank's boss has said.

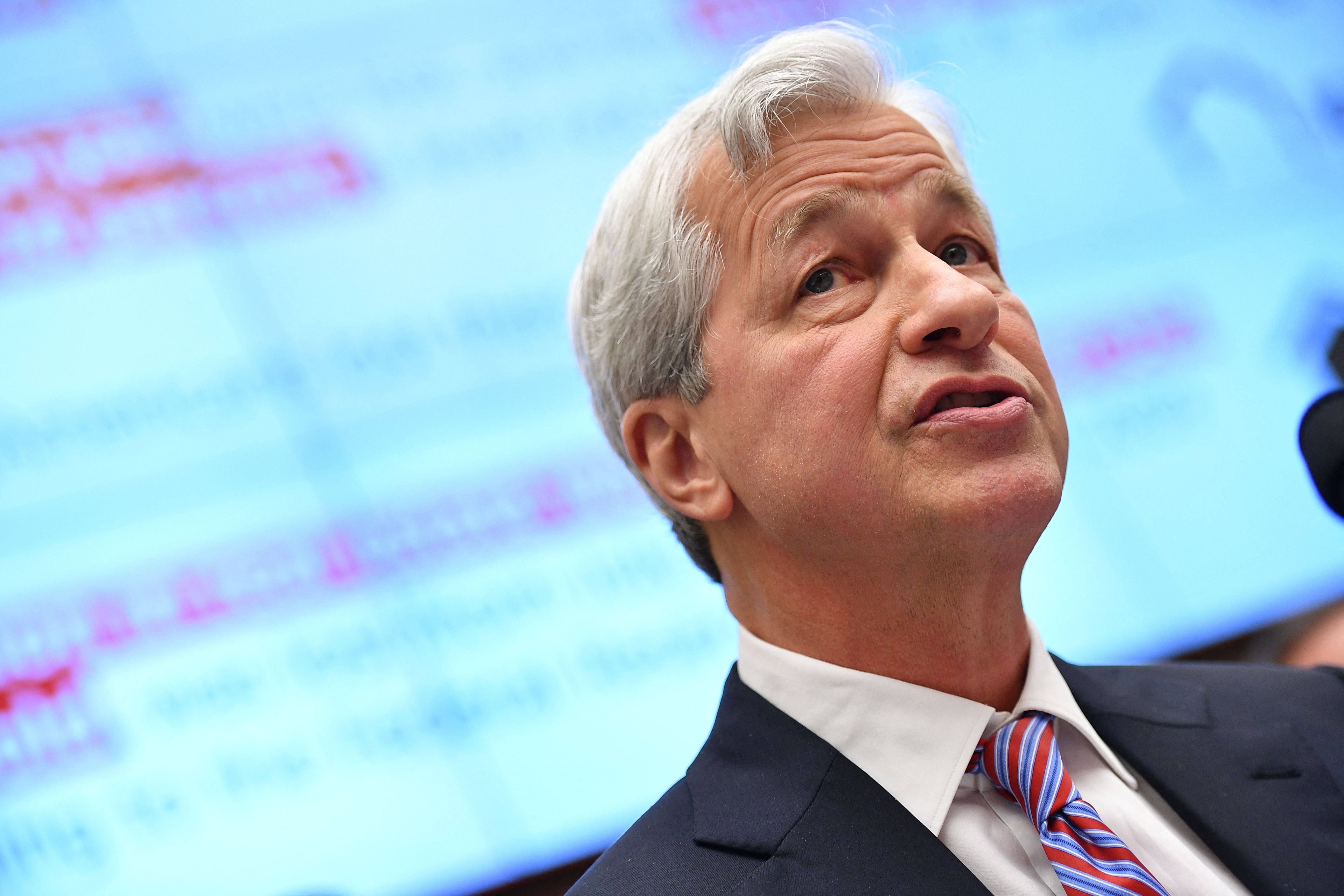

Jamie Dimon said any such move would be "many years out" but warned that London will need to “adapt and reinvent itself” after Brexit.

JPMorgan's chairman and chief executive opined that “few winners are likely to emerge” from the UK's decision to leave the EU which will make financial services fragment across multiple cities including Amsterdam, Frankfurt, Paris and Dublin.

In his annual letter to shareholders, Mr Dimon wrote: "In the short run (ie, the next few years), this cannot possibly be a positive for the United Kingdom’s GDP – the effect after that will be completely based upon whether the United Kingdom has a comprehensive and well executed strategic plan that is acceptable to Europe."

He added: “Brexit was accomplished, but many issues still need to be negotiated. And in those negotiations, Europe has had, and will continue to have, the upper hand."

The UK and EU have agreed to reach a deal on financial services which are one of the UK's most lucrative exports. However, EU officials have signalled that they are in no rush to conclude an arrangement. In the meantime, European financial hubs have been hoovering up business that had London dominated until now.

JPMorgan employs around 19,000 people in the UK including 12,000 in London. Many of those may have to move at some point, Mr Dimon wrote.

"We may reach a tipping point many years out when it may make sense to move all functions that service Europe out of the United Kingdom and into continental Europe," he wrote. Paris, Frankfurt, Dublin and Amsterdam were likely to "grow in importance."

He said London was "a magnificent place to do business" and had the "opportunity to adapt and reinvent itself" but officials have to act quickly.

"Innovation is key to preparing for doing the business of tomorrow versus relying on the shifting ways of the past," he wrote.

Mr Dimon was among the senior bankers to warn that Brexit would be bad for the UK's financial services industry. Before the 2016 referendum he forecast that around 4,000 jobs may have to move if the UK voted to leave the EU.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks