‘Wolf in cashmere’ Bernard Arnault calls off the hunt for shares in rivals

The man behind LVMH has agreed to stop buying into luxury goods group Hermès - for now

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.What could bring a chief executive to compare an attempted takeover to rape?

Hermès’s then-chief executive, Patrick Thomas, did just that back in 2010 when it emerged rival French luxury group LVMH had secretly built a stake in the handbag and silk scarf maker.

Mr Thomas was so angry he declared: “If you want to seduce a beautiful woman, you don’t start by raping her from behind.”

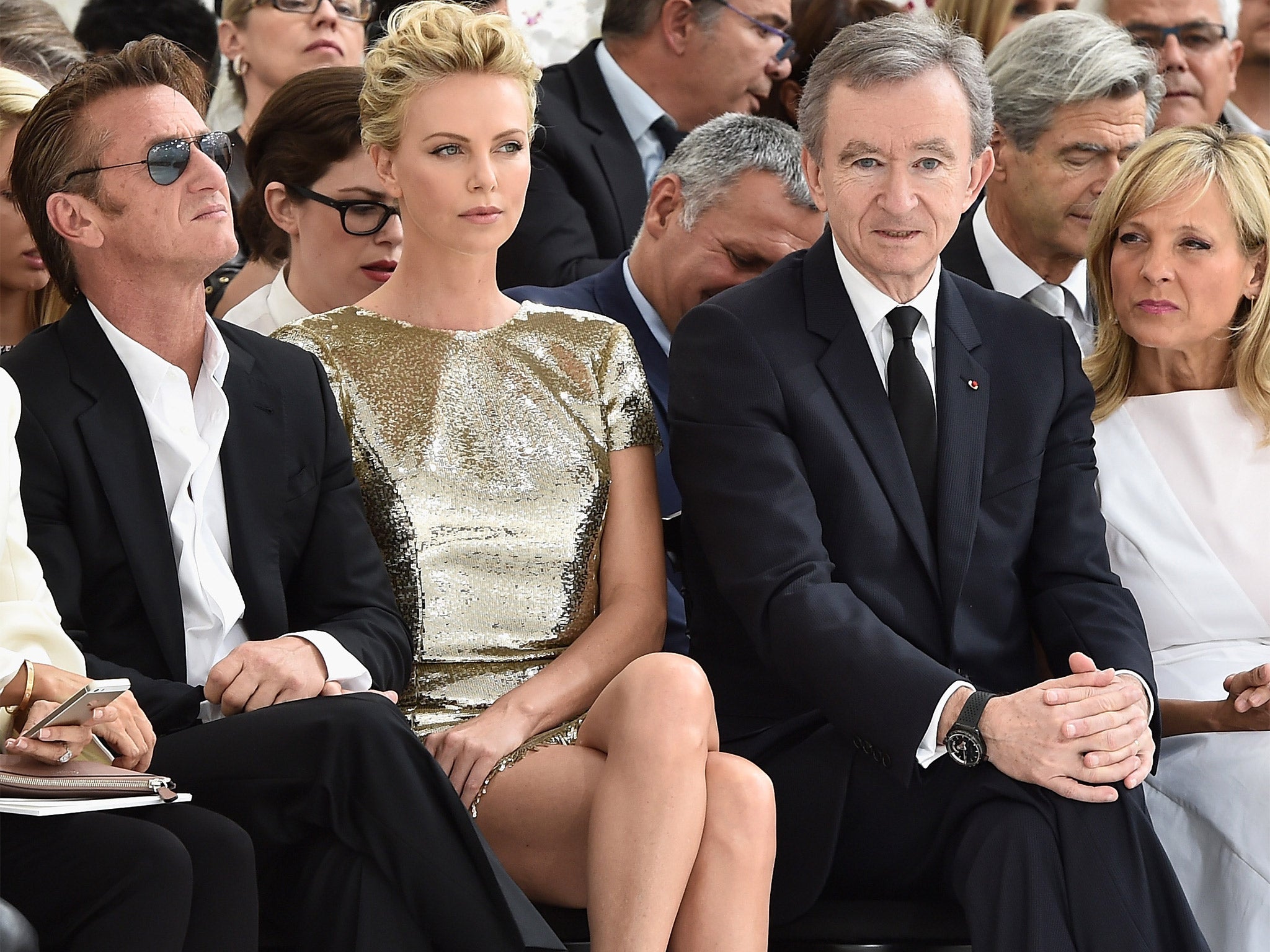

The man behind Louis Vuitton and Moët & Chandon owner LVMH is France’s richest man, Bernard Arnault.

He is known as the “wolf in the cashmere coat” for his shrewd business dealings and when it came to light that through contracts for difference and other complex share dealings, that his business had amassed a huge stake in Hermès, Paris was shocked.

Yesterday the luxury-goods groups finally agreed a truce.

After conciliation talks, brokered by the Commercial Court of Paris, the 23.2 per cent stake in Hermès will be distributed to shareholders in LVMH, Christian Dior and the Arnault family investment firm, Groupe Arnault. Mr Arnault also agreed not to buy any shares in Hermès for the next five years.

The deal dashes his plan to take Hermès over, for now, and puts an end to a saga that has rumbled on for nearly four years – as well as enriching Mr Arnault who is a significant shareholder of the beneficiary companies.

When news of the secret stakebuilding first broke in October 2010, Mr Thomas was reported to have heard about LVMH buying a 17 per cent stake when he was on a cycling holiday in rural France. LVMH continued to enter into other deals and eventually acquired 23.2 per cent.

It has been reported that the reason Mr Arnault was able to amass his stake was due to a sell off by one of the Hermès family – Nicolas Puech, although he denies this.

A war of words followed and an investigation ensued. Commentators said Mr Arnault’s deal was clearly the start of an attempted takeover and if other family members could eventually be persuaded to sell he could make his move..

But Hermès’s 52 key family shareholders were not going out without a fight. They created a new ownership structure to stop any future hostile takeover. The 177-year old company has a myriad of family members who are all related to the founder, Thierry Hermès. The new structure gave the families – the Dumases, the Puechs and the Guerrands – control of 50.2 per cent of the shares and voting rights.

When current chief executive Axel Dumas took over from Mr Thomas he continued to swap fighting talk with Mr Arnault, and was quoted as saying the fight would be “the battle of our generation”.

It wasn’t just the Hermès family that was cross. The manner in which LVMH quietly bought the shares also came under the scrutiny of France’s markets watchdog, AMF, and last year it fined the group €8m (£6.3m) for its behaviour.

All the while Mr Arnault continued to say the stake building was merely a straight-forward financial investment and not a secret takeover plan. Now that the shares are being distributed and shareholders are in line for a €3bn capital gain his argument is plausible.

Mr Arnault also realised that to continue owning the controversial stake would be bad publicity for his group. He has already recently courted controversy when he applied for Belgian citizenship in 2012. There was an outcry as people assumed it was for tax reasons and last year he withdrew his application.

The decision to back down on Hermès shows Mr Arnault is a pragmatic businessman.

This isn’t the first time he has known when to call it quits – and made a killing in the process.

Mr Arnault went head to head with France’s other luxury-goods family in the 1990s over a battle for Gucci.

Mr Arnault’s LVMH tried to buy the Italian brand but François Pinault’s PPR (now called Kering) took a stake to prevent a takeover. In 2001, after a three year bitter battle, Mr Pinault eventually won. But Mr Arnault profited around €760m from the bidding war.

He has always spotted ways to take advantage of weaknesses in a company. After beginning his business career in the 1970s at his father’s construction company, and turning it into a property developer, he bought a struggling textile company. The story of how he asset-stripped it to leave him with the star designer brand Christian Dior and department store Le Bon Marché is the stuff of legend in France. In the late 1980s, he exploited a feud between the bosses at Louis Vuitton and Moët & Chandon to build a stake in LVMH and eventually took control. He then set to work creating the sprawling mass of luxury-goods brands and drinks labels that it is today – from New York clothing label Donna Karan to Italy’s jeweller Bulgari.

He is usually happy to play the long game to get what he wants. The recent acquisition of Italian cashmere brand Loro Piana apparently came after years of negotiations.

Those who know Mr Arnault well, say that at the age of 65 he is planning for the next generation to eventually take over his empire. His daughter Delphine Arnault, is second in command at Louis Vuitton, while son Antoine Arnault has board positions at brands Berluti and Loro Piana.

He also has three younger sons – Alexandre, Frédéric and Jean – with his second wife, who may also one day play a part in his sprawling empire.

Yesterday LVMH issued a statement to say that Mr Dumas and Mr Arnault expressed their “satisfaction that relations between the two groups, representatives of France’s savoir-faire, have now been restored”.

But Mr Arnault’s family investment vehicle, Groupe Arnault, retains 8.5 per cent in Hermès.

Perhaps one of Mr Arnault’s wolf cubs may one day decide to disregard all this savoir-faire and instead end yesterday’s entente cordiale.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments