London falling? Times get tough for luxury property in the capital

Unsold flats, diminishing overseas demand, tax hikes, falling prices. Is the city’s long high-end property party finally winding down? Joanna Bourke takes the market’s temperature

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Two years ago Sir Elton John sang “I’m still standing” beneath the chimneys of Battersea Power Station. The rock star had been invited to perform at a lavish party to celebrate the redevelopment of the historic building into luxury flats.

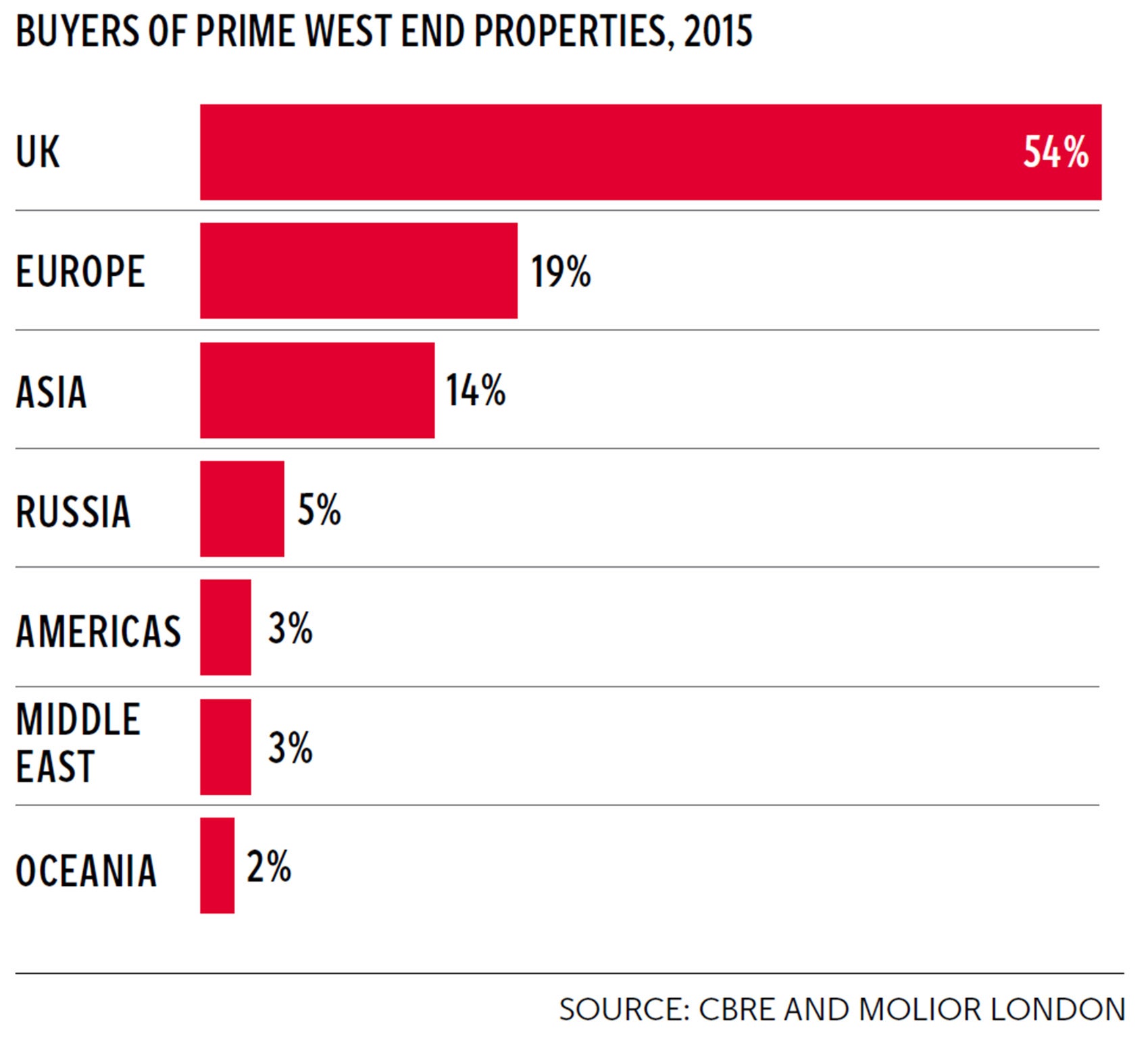

The London property market was booming. International investors viewed London property – in particular its luxury flats – as an ideal place to shelter money from political and economic turmoil. Plus London prices always seemed to be rising. Mark Collins of the property agent CBRE summed up the attraction by citing “the robust economy, low interest rates, world class education and favourable exchange rates”.

But is the party over? Is the market “still standing”? According to London Residential Research, sales are falling in some of the most affluent areas: sales of new-build flats in Kensington & Chelsea and Westminster were down 47 per cent in 2015.

Earlier this week, the property agent JLL warned that there is a diminishing appetite for properties costing £2m and over in new-build developments. And the investment bank Morgan Stanley has forecast the price of new upmarket London flats to fall by as much as 20 per cent this year.

Riaan Kruger is the head of sales and lettings at Garton Jones. He is selling a £2.3m three-bed flat at One Nine Elms, where residents will have access to a gym, swimming pool and 24-hour concierge service. Mr Kruger says there is “no disputing” there has been a slowdown in demand for properties over the £2m range. But he believes there is still a large potential buyer market.

“The same pool of buyers still exists, yet there is now just so much more property for them to choose from,” he explains. “Nine Elms alone has over 20 developments on offer and thus competition for buyers has increased.”

But not all real estate experts agree that there is a queue of buyers. Trevor Abrahmsohn, the managing director of Glentree International, says a raft of overseas buyers have been deterred from snapping up homes owing to new UK tax burdens.

In November last year George Osborne shocked the property market by announcing a new 3 per cent additional stamp duty rate from this April on property bought as a second home or buy-to-let.

Before that the Chancellor had also increased stamp duty on properties in excess of £1.5m to 12 per cent. Mr Abrahmsohn says this has made the market “more circumspect and considered”.

He adds that he has heard of a number of buyers from Malaysia, Singapore, Hong Kong and China “walking away” even if they have exchanged contracts and paid a deposit. “They would rather lose 10 per cent than complete the purchase and lose a lot more, even before the developments are complete. The changes to buy-to-let tax is the straw that broke the camel’s back and some developers are nursing a massive over-supply of these properties.”

In recent years luxury developments would often be showcased in Singapore, China and Malaysia. But this is now grinding to a halt, says Mr Abrahmsohn. “The capital is no longer perceived as a safe haven for property investments and we have lost this inflow of foreign capital.”

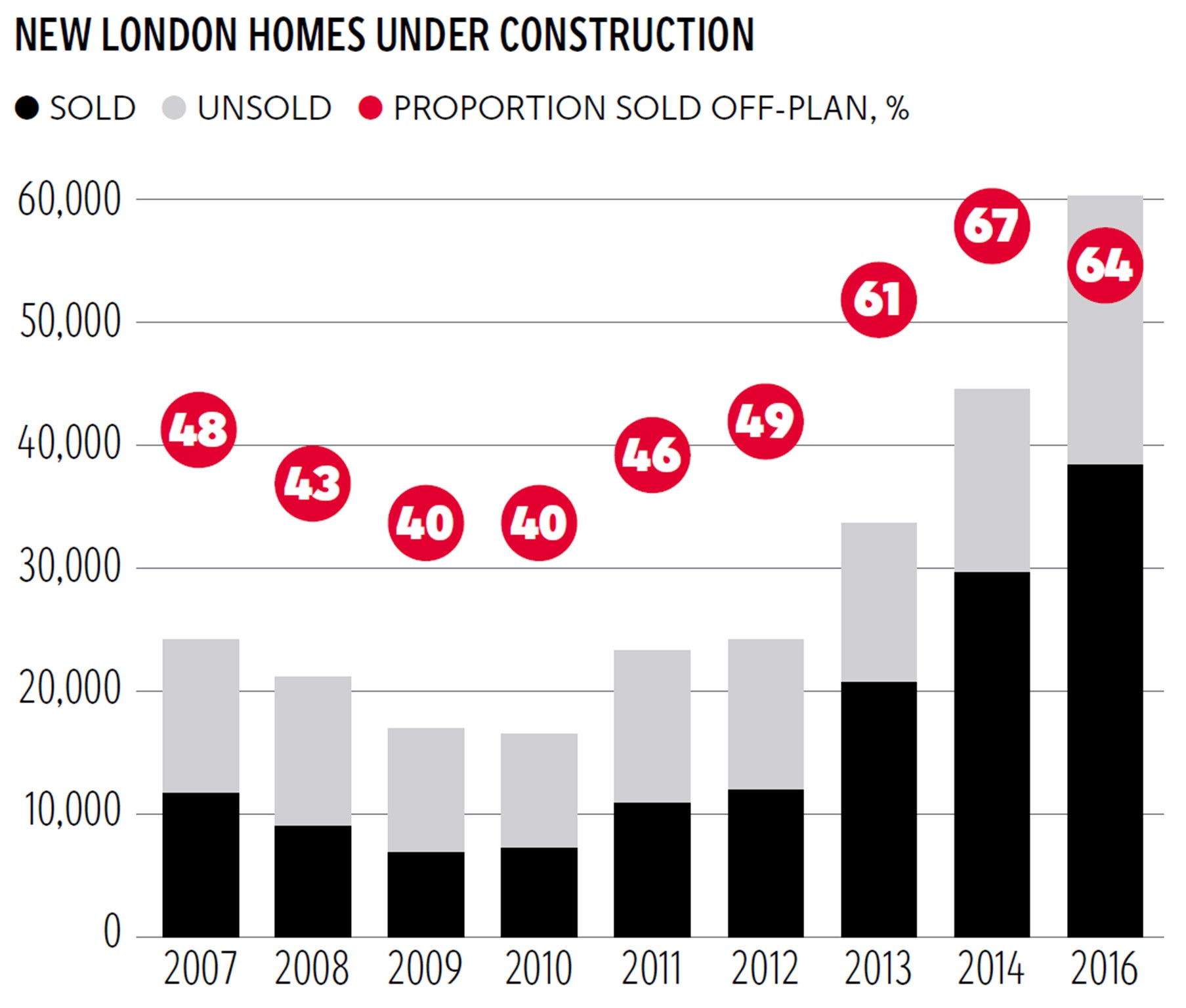

Research compiled for The Independent by CBRE and Molior London, shows that last year more than 60,000 new homes were under construction in the capital, of which more than half were bought off-plan, many by wealthy foreigners. But while the new data shows that 64 per cent of the homes in 2015 were bought-off plan, it also reveals this has slowed from 67 per cent in the previous year (see graph).

Other factors that seem to be spooking would-be-buyers, including British ones, are political uncertainty ahead of a London mayoral election in May and the European Union referendum in June.

However, a handful of companies insist it is largely business as usual, albeit at a slower pace. Killian Hurley, the chief executive of housebuilder Mount Anvil says his firm sold 17 homes costing £1m or more in the first two months of 2016, up from 11 in the same period last year. A spokesman for Battersea Power Station says nearly all of 1,500 new homes in the first wave of the redevelopment have been presold.

Walter Mythen of the agent Johns&Co, also points out that there could be confusion about how many luxury properties are currently on the market: “Often vendors use multiple agencies… so it can look as if there are many more properties for sale than is the reality,” he says.

But the optimists seem to be in a minority. The FTSE 250 developer Capital & Counties said last week that a “challenging” property market has brought sales of new apartments at its Earls Court development, to a virtual halt. And the trade magazine Property Week has reported that FTSE 100 giant British Land is struggling to sell luxury homes in central London.

The London market is certainly not a party for everyone in attendance, and a number of developers might feel Sir Elton’s lyric “it’s a sad, sad situation” reflects the current market mood. It certainly is for those who gambled that London’s luxury house prices would keep shooting to the sky.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments