What happens now Greece's financial bailout is over?

But how did the country get here? Does this mean it has repaid its debts? And is the economy finally recovering?

Greece’s international bailout programme formally concluded on Monday.

But how did the country get here?

Does this mean Athens has repaid its debts?

And is its economy finally recovering?

What happened to Greece?

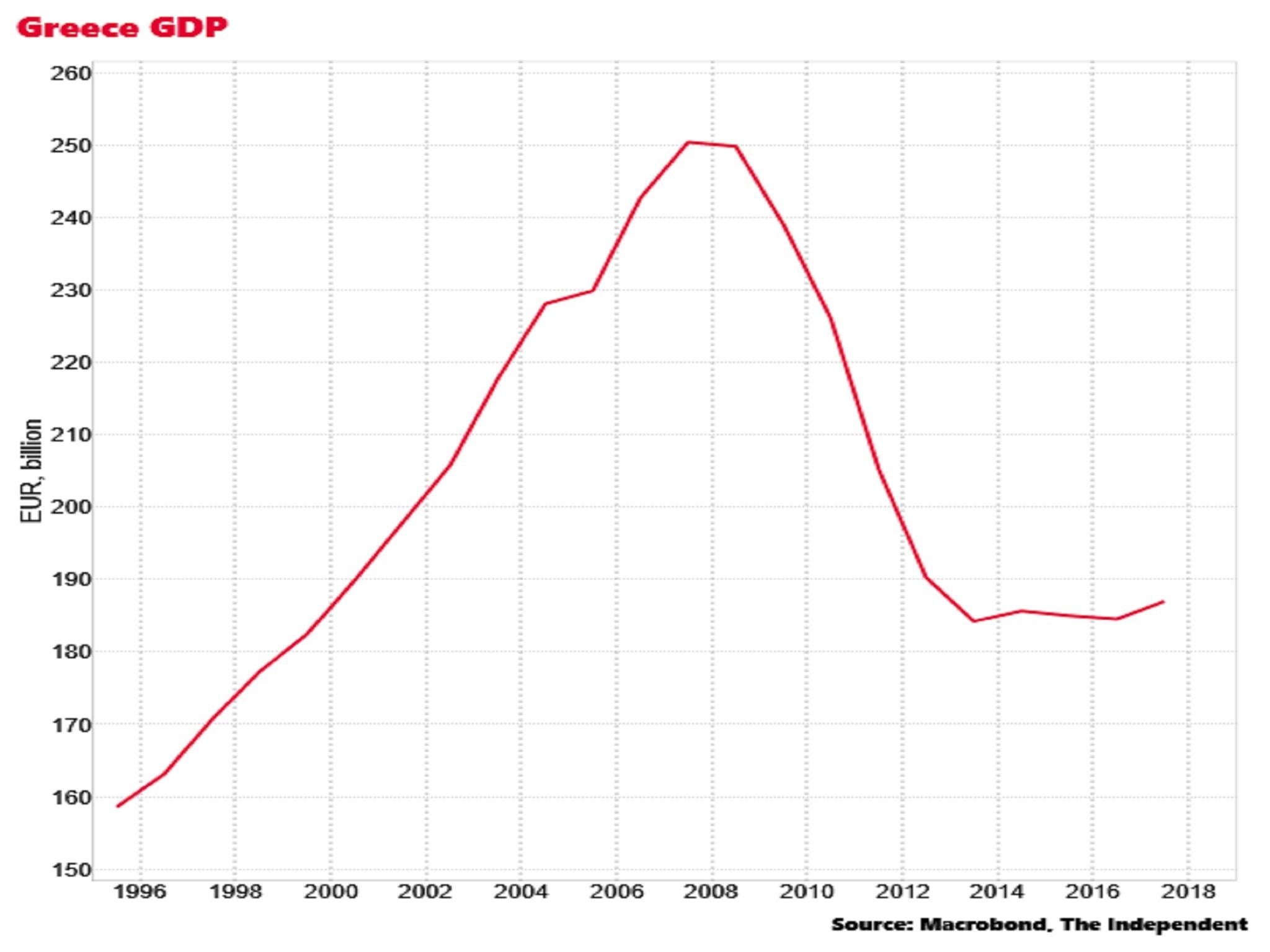

The government in Athens borrowed excessively in the 2000s, taking advantage of the low market-interest rates available to members of the eurozone.

It also covered up the true extent of government debt.

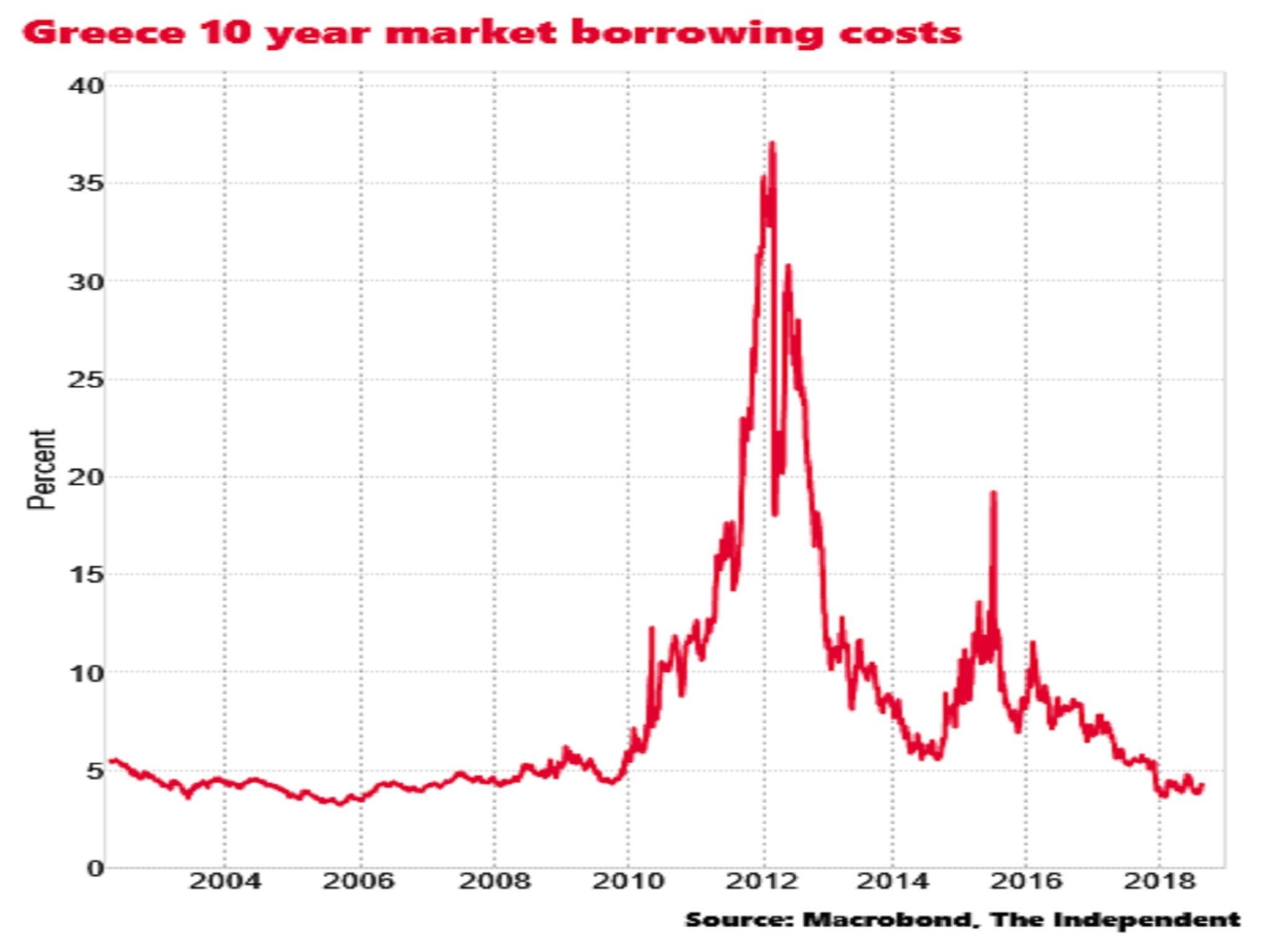

The country was hit hard by the global recession in 2008 and financial markets suddenly panicked in 2010 that they would not get their money back from Greece, forcing up the state’s cost of borrowing to levels that would have led to default.

Rather than allow Greece to default and crash out of the eurozone the rest of the single currency bloc, in conjunction with the International Monetary Fund (IMF), bailed out Greece to the tune of €220bn (£197bn).

But as part of this bailout they imposed severe austerity on the country.

They expected this to result in an economic shock, but also a reasonably rapid recovery as structural reforms boosted investor confidence.

Yet the recovery never happened, investor confidence did not return and Greece’s economy continued to contract severely.

In 2015 the country elected a radical left government which threatened to leave the eurozone if austerity was not eased. But at the 11th hour – and after the state was forced to impose capital controls to prevent Greeks moving money abroad – the government backed down, accepting another bailout of $90bn (£71bn) along with the requirement for further painful structural economic reforms.

It is this bailout which has now formally ended.

Has Greece paid back its debts?

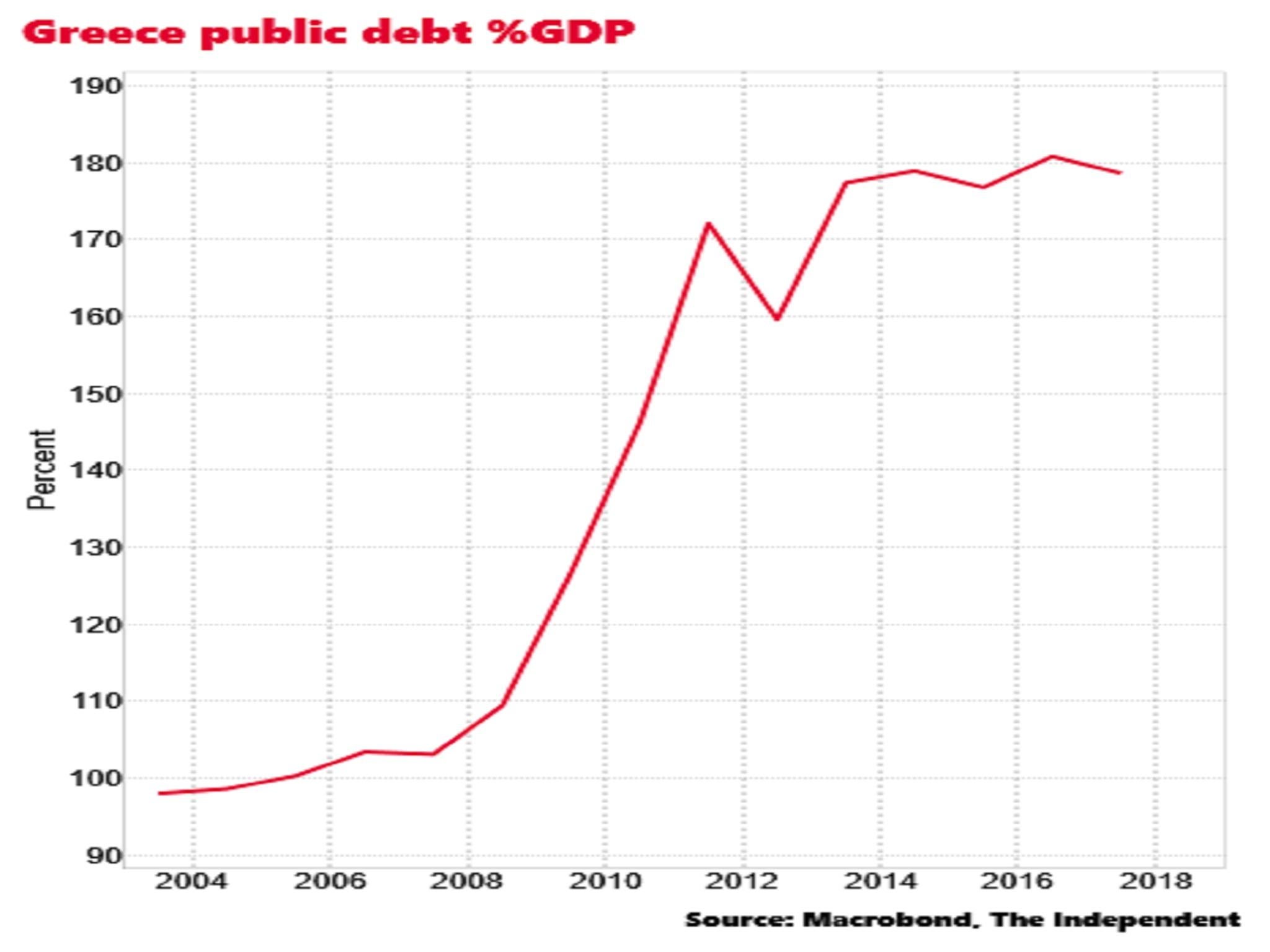

Total government debt is €316bn, still equivalent to around 180 per cent of GDP. This remains a huge burden by any standard.

Yet most of this is now owed to other eurozone governments, rather than the private markets, and it is repayable over many decades.

This has significantly reduced the risk of a 2010-style repayment crisis for the Athens government.

And can Athens now borrow freely from the private markets?

Greece’s 10-year market borrowing costs are now around 4.3 per cent.

This is a remarkable recovery from the 35 per cent in 2012 when the private debt markets were essentially shut to Athens.

But rates are not back to pre-crisis lows.

Between 2000 and 2008 there was virtually no difference between German and Greek 10-year borrowing costs.

Now the gap between the two countries’ interest rates is 4 percentage points.

It’s still considerably more expensive for Greece to borrow than it is for Germany.

It’s also more expensive for Greece to borrow than other eurozone countries bailed out in the crisis such as Portugal, Spain and Ireland.

But this isn’t necessarily undesirable. Markets clearly catastrophically mispriced Greek debt before the crisis, helping to encourage the overborrowing.

The current market lending rates are much more realistic.

What about the Greek economy?

Unemployment has been coming down but it still stands at 19.5 per cent of the workforce, the highest in Europe.

GDP has risen in recent quarters, expanding by 1.3 per cent in 2017.

And the IMF forecasts growth picking up to 2 per cent this year.

But the level of output remains an astonishing 25 per cent below where it was a decade ago.

The financial system, with the banks stuffed with bad loans, is still dysfunctional.

Hundreds of thousands of Greeks have emigrated.

Poverty levels have spiked and there remains immense ill will towards the institutions of the EU and other member states over their handling of the emergency.

Is austerity over?

No.

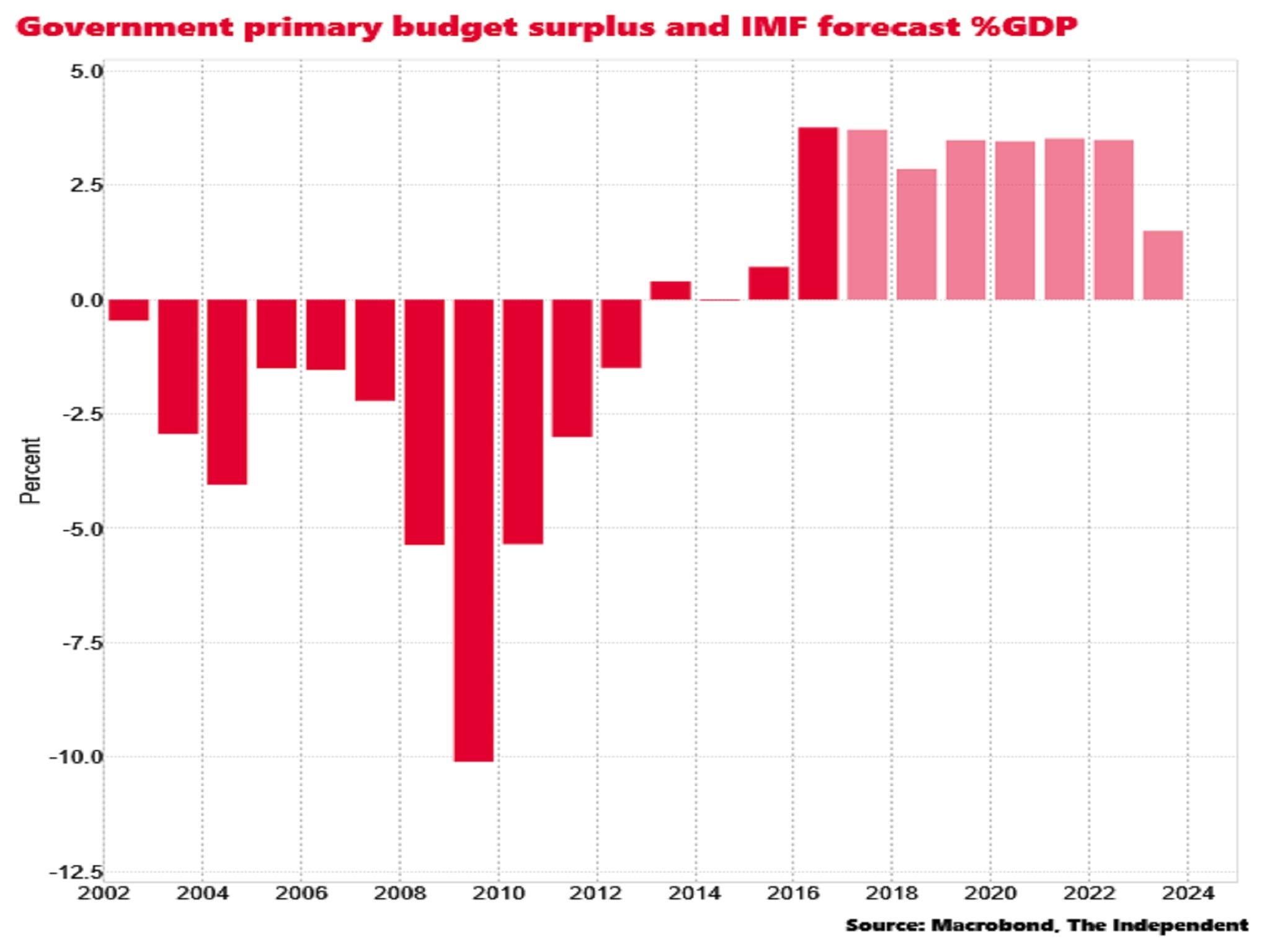

As part of its bailout, the Greek government committed to running a primary budget surplus – which is the difference between tax revenues and expenditure excluding debt interest – of around 3 per cent of GDP until 2022.

If Athens backslides, debt relief could yet be withdrawn, potentially pushing the country back into fiscal crisis.

Running a surplus on that scale entails immense spending restraint by the state.

Even the IMF warned in July that further austerity could undermine GDP growth and that “reform fatigue” could precipitate another political crisis.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks