General Election 2015: Is the election crushing growth?

Surveys suggest that uncertainty over the outcome of the poll on 7 May is hitting investment by firms and depressing consumption. How worried should we be?

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.George Osborne, famously, likes to be photographed on visits to factories where he is shown pulling levers while wearing a hard hit and a luminous vest. The message the spin doctors want to convey is not very subtle: here is your dynamic Chancellor, quite literally keeping the economy moving.

Yet there has been a flurry of reports suggesting that politicians – or at least the uncertainty being thrown up by next month’s general election, in which these politicians are vying for power – far from helping the economy are holding back growth.

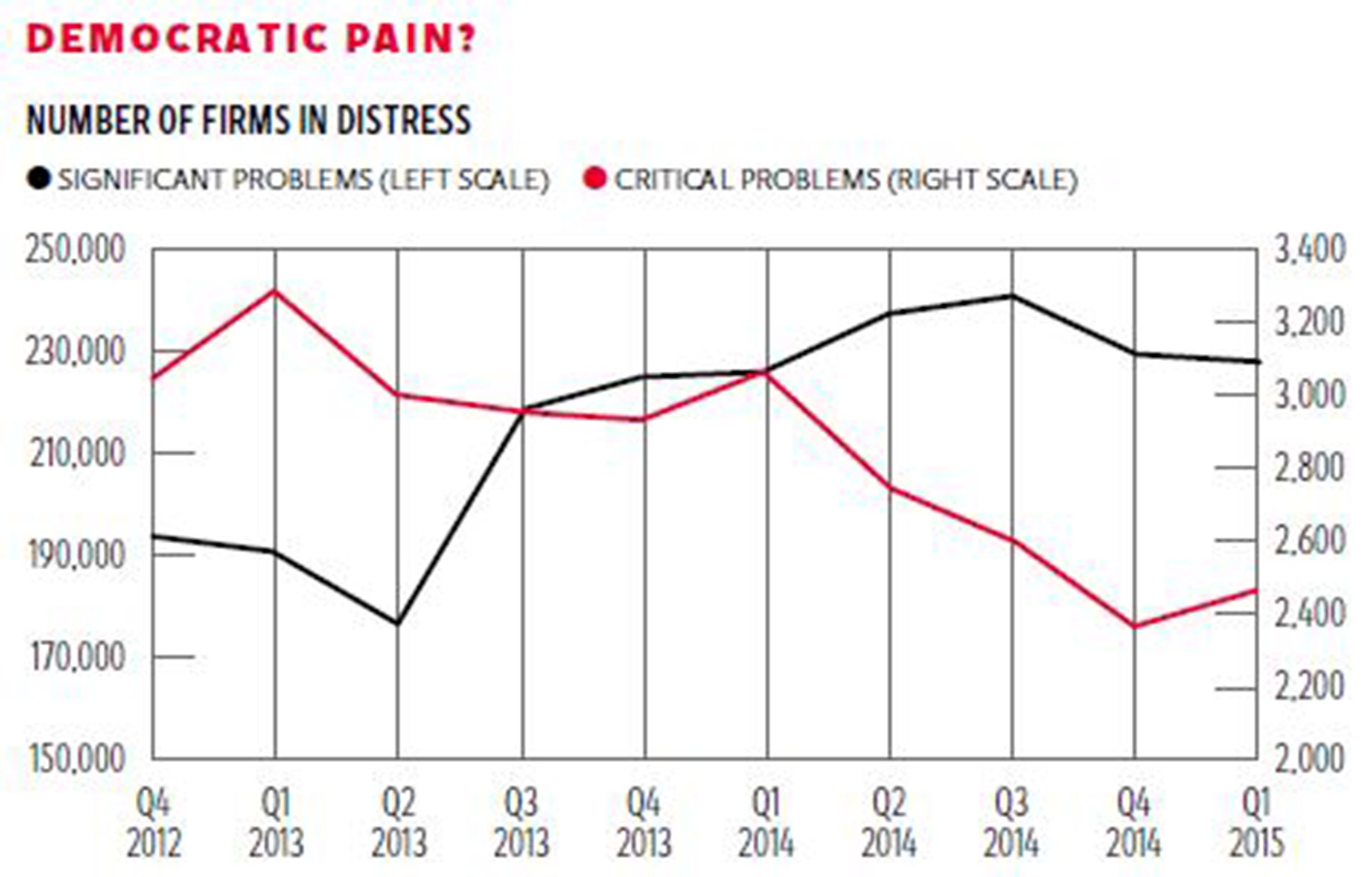

Yesterday Begbies Traynor, a firm specialising in corporate restructuring, became the latest commercial outfit to sound an alarm about the impact of the 7 May poll.

“Swathes of UK businesses guarded against the worst case scenario by postponing their growth plans until after the result,” said one of the firm’s partners, Julie Palmer, pointing to an uptick in the number of firms registering critical finance problems in the first quarter of 2015.

That view echoed the findings of a survey of chief financial officers in FTSE 350 firms last week by Deloitte, which showed investment intentions falling to a two-year low in the first quarter of the year. Only half of executives said they would be increasing their capital outlay over the next 12 months, down from a high of 80 per cent at the beginning of last year and the lowest since early 2013. Ian Stewart, Deloitte’s chief economist pointed to “mounting political risk” as one of the drivers of the fall.

A poll yesterday by the recruitment firm Interim Partners seemed to back that up. It showed concerns from 60 per cent of senior executives about the impact of pre-election uncertainty on private sector economic activity.

Are you undecided about who to vote for on 7 May? Are you confused about what the parties stand for and what they are offering? Take this interactive quiz to help you decide who to vote for...

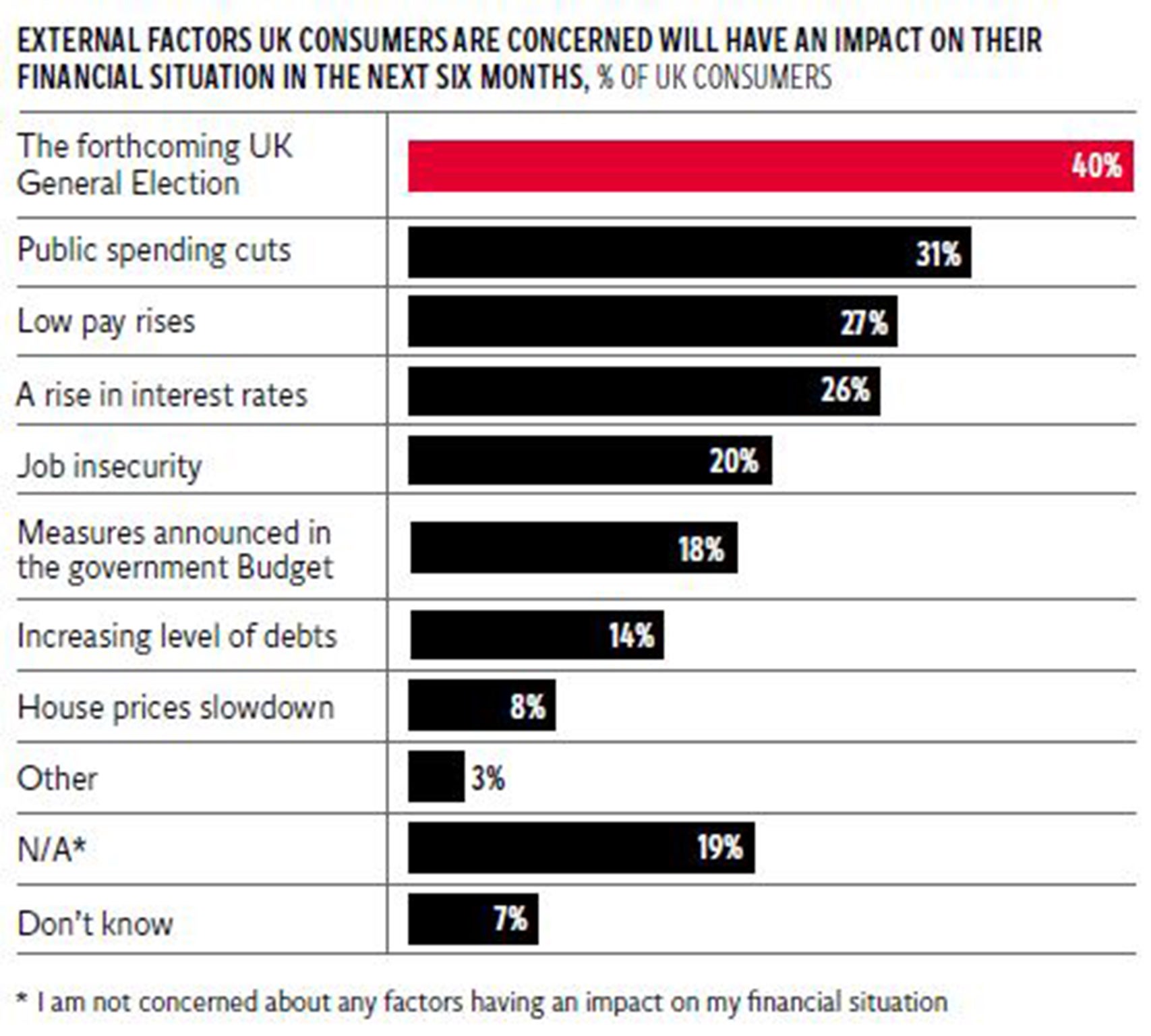

Consumer confidence, rather than business investment, has been the primary motor of recovery since 2013. Yet a separate survey by Deloitte released yesterday suggested the election result could be casting a chill over that area, too. The accountancy firm’s consumer tracker showed 40 per cent of people are concerned about the potential impact of the election on their finances, making it the biggest single worry. And a Barclaycard survey last week reported one in five shoppers delaying spending on holidays and home furnishing until after polling day.

Estate agents are fretting, claiming that the prospect of Labour’s mansion tax on £2m-plus homes has hammered the market. “That is putting a cork in the top end of the market, and that affects the chain of buyers and sellers,” said Tony Jamieson of Clarke Gammon Wellers, in Surrey.There is also hum of concern from the City of London about the possibly waning appetite of foreign investors to buy the new British government debt coming on to the market.

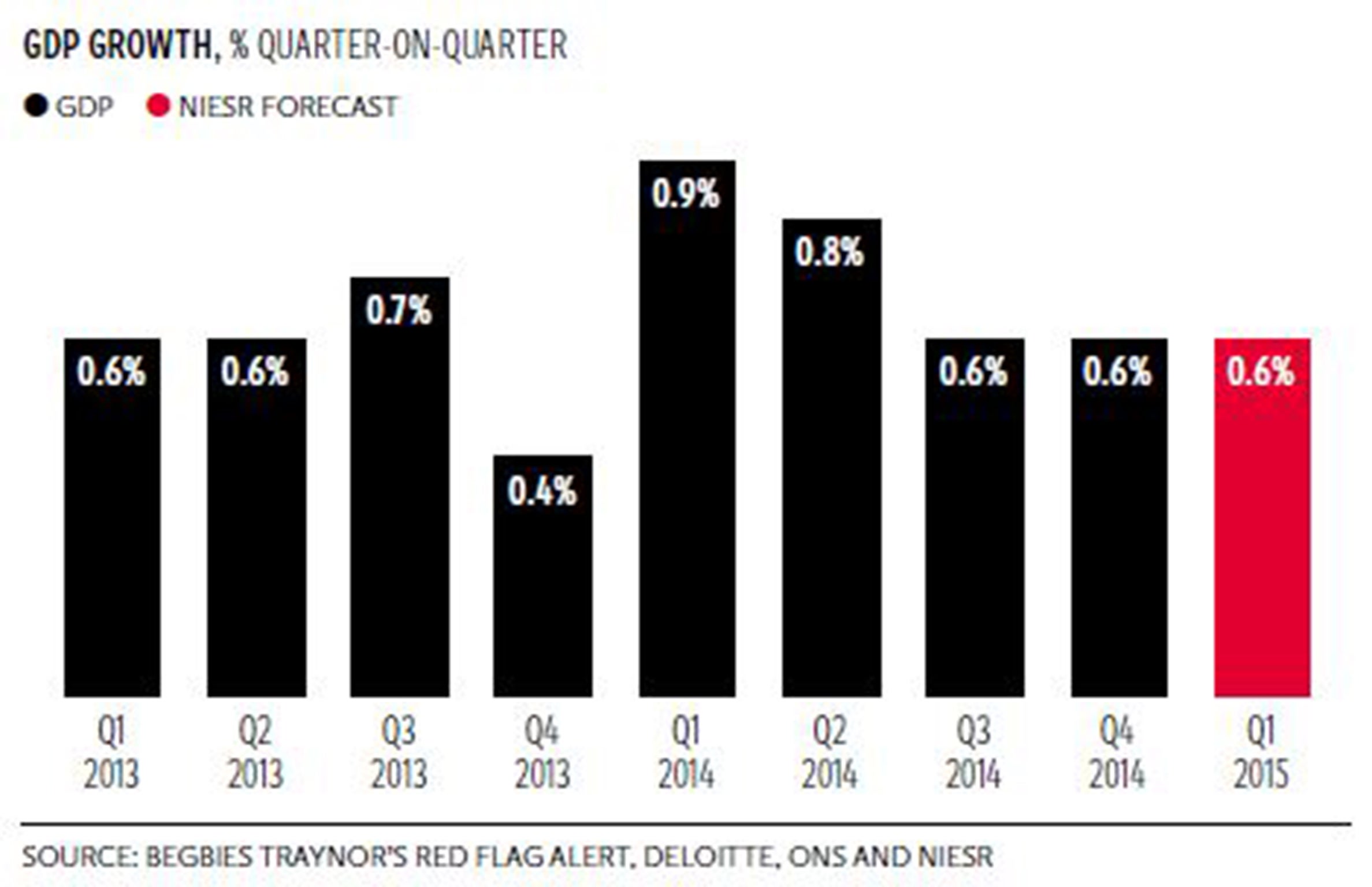

It seems to add up to an alarming picture of stagnation and fragility. But is it true? Is election uncertainty really dampening the recovery? The broad picture is ambiguous. Business investment did dip in the final quarter of 2014, according to the Office for National Statistics, breaking a long run of expansion. But the overall GDP growth figures held up reasonably well at 0.6 per cent.

And the most watched surveys of business intentions are still pointing to continued expansion. The indexes of investment intentions from the British Chambers of Commerce and CBI quarterly surveys do not show any serious decline.

It is a similar story with most consumer confidence indicators. The GfK consumer confidence index strengthened to +4 in March, the highest level recorded since 2002. The latest Deloitte consumer tracker, despite showing fears about the election, also showed an overall strengthening of confidence.

Similarly, in financial markets there is not much evidence of panic. The Government’s effective 10-year borrowing costs is close to historic lows at around 1.57 per cent. That suggests that there are still plenty of buyers for UK debt, despite the uncertainty of the election outcome.

GDP growth is forecast by some analysts to moderate to 0.4 per cent in the first quarter. But that hardly represents a collapse. And forecasters at the National Institute of Economic and Social Research (NIESR) think it won’t actually decelerate at all and that momentum will be kept up by strong consumer spending, supported by the fall in the global oil price.

Some economists say that what comes after polling day is more economically significant than what precedes it. “For us the big crunch point is after 7 May,” said Andrew Goodwin of Oxford Economics. “First of all, how long does it take to form a government? And second, how durable is it? Will we have a government that can actually govern? That’s the much bigger risk.” The prospect of the UK departure from the European Union, after a possible 2017 referendum, is often cited as something that really could put the kibosh on the recovery.

Yet Simon Kirby of NIESR is sceptical of the idea that government policy is the dominant influence on business confidence. “What type of uncertainty are we talking about? Policy uncertainty? Or uncertainty over future demand? The latter is far more important than the former,” he said. In other words, the UK’s economic fundamentals may matter more than how people cast their votes on 7 May.

The Independent has got together with May2015.com to produce a poll of polls that produces the most up-to-date data in as close to real time as is possible.

Click the buttons below to explore how the main parties' fortunes have changed:

All data, polls and graphics are courtesy of May2015.com. Click through for daily analysis, in-depth features and all the data you need. (All historical data used is provided by UK Polling Report)

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments