What kind of measures could the chancellor take to combat the cost-of-living crunch?

The government is running out of time to find solutions to high energy prices ahead of the new cap in April

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.The government will struggle to find a quick fix for the cost-of-living crunch ahead of key deadlines, including March’s spring statement from the chancellor.

Energy bills are set to rise sharply in the spring, with a planned price-cap change potentially increasing prices by as much as 50 per cent, according to economists.

The new cap will be set on 7 February and will come into force in April. It will potentially take the energy bill for an average household to around £1,900, but the story does not end there: analysts predict it will rise further this year, to over £2,200 in the autumn.

So great are the expected increases that it is no longer a conversation about whether the government should intervene to mitigate the pressure on households, but by what means it should do so.

Spending or borrowing some money is therefore “inevitable” for the Treasury, if it wants to ease a “living standards shock” for Britain’s poorest this April, economists at the Tony Blair Institute (TBI) warned in an analysis shared with The Independent.

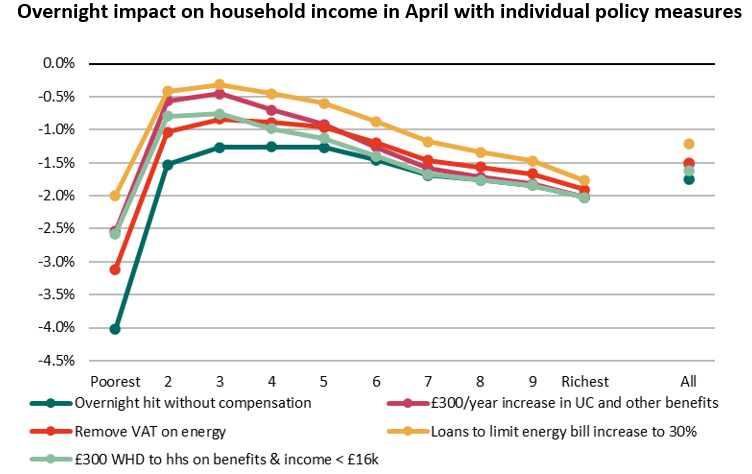

While cutting VAT on energy bills has a degree of cross-party support, it is unlikely to be enough to prevent such a shock on its own, the study suggests. A typical household will only save around £90 if they no longer have to pay the 5 per cent VAT charge on their energy bill, according to the TBI.

Meanwhile, slashing green levies on household bills, which are meant to pay for the costs of tackling climate change, would leave the Treasury having to find £5bn from general taxation – “equivalent to around 1p on the basic rate of income tax”, the analysis found.

One Tory MP told The Independent on Monday that the chancellor had been taking soundings from backbenchers on their view of how best to tackle the cost-of-living crisis, and that such a rise in general taxation would be a tough sell on top of the planned hike in national insurance contributions this spring.

And while Mr Johnson has “talked up” the Warm Homes Discount, this would be a “limited and very patchy” route by which to give low-income households a helping hand, the TBI said.

The government has not yet offered up its plan for tackling the impact of higher energy bills. But Labour has.

The opposition party has suggested imposing a windfall tax on North Sea oil and gas production. This would raise £6.6bn, from North Sea oil and gas profits (£1.2bn), oil and gas receipts (£2.3bn), and higher-than-expected VAT receipts (£3.1bn).

However, redistributing this money by allowing more households to receive the Warm Homes Discount – potentially reaching some of those who missed out because of the patchiness the TBI describes – is not so easy. The institute found that it would be “bureaucratic”, and that “take-up rates would probably not be as high as for established benefits”. Rather, it would be better to offer a temporary boost to universal credit, alongside pension credit and some legacy benefits.

Doing this would cost about the same as the £2.5bn lost to the exchequer if the government were to cut VAT from bills. Overall, it would offer £300 per year to 8 million lower-income households, according to the TBI analysis.

Labour’s plans might help target workless and low-income households with children, but it would be around £6bn more expensive than if the government were to put more weight on offering loans to suppliers, economists found.

These broader loans could include allowing suppliers to put off paying “supplier of last resort” costs. This is one leg of Labour’s plan. But it could be extended, the TBI said, by letting suppliers set prices below the cap laid out by Ofgem.

But with the Treasury having to offer some kind of guarantee to borrowing by suppliers, it risks “putting the taxpayer on the hook for losses” if wholesale energy prices maintain their highs.

Overall, No 11 might go for a combination of bigger loans than Labour, a smaller uplift to benefits, and avoiding the VAT cut, as it would offer a handout to high-income households. This would cost around £2.5bn, according to the TBI.

Still, whichever plan the Treasury settles on, there is clearly no easy option for a chancellor who was keen to craft an image as a low-tax Tory.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments