Could Germany's domestic economic pain compel Berlin to soften its hard line on Brexit?

Does the logic stand up? How much is Germany’s slowdown actually due to Brexit? And how damaging would a no-deal scenario be for Europe’s largest economy?

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

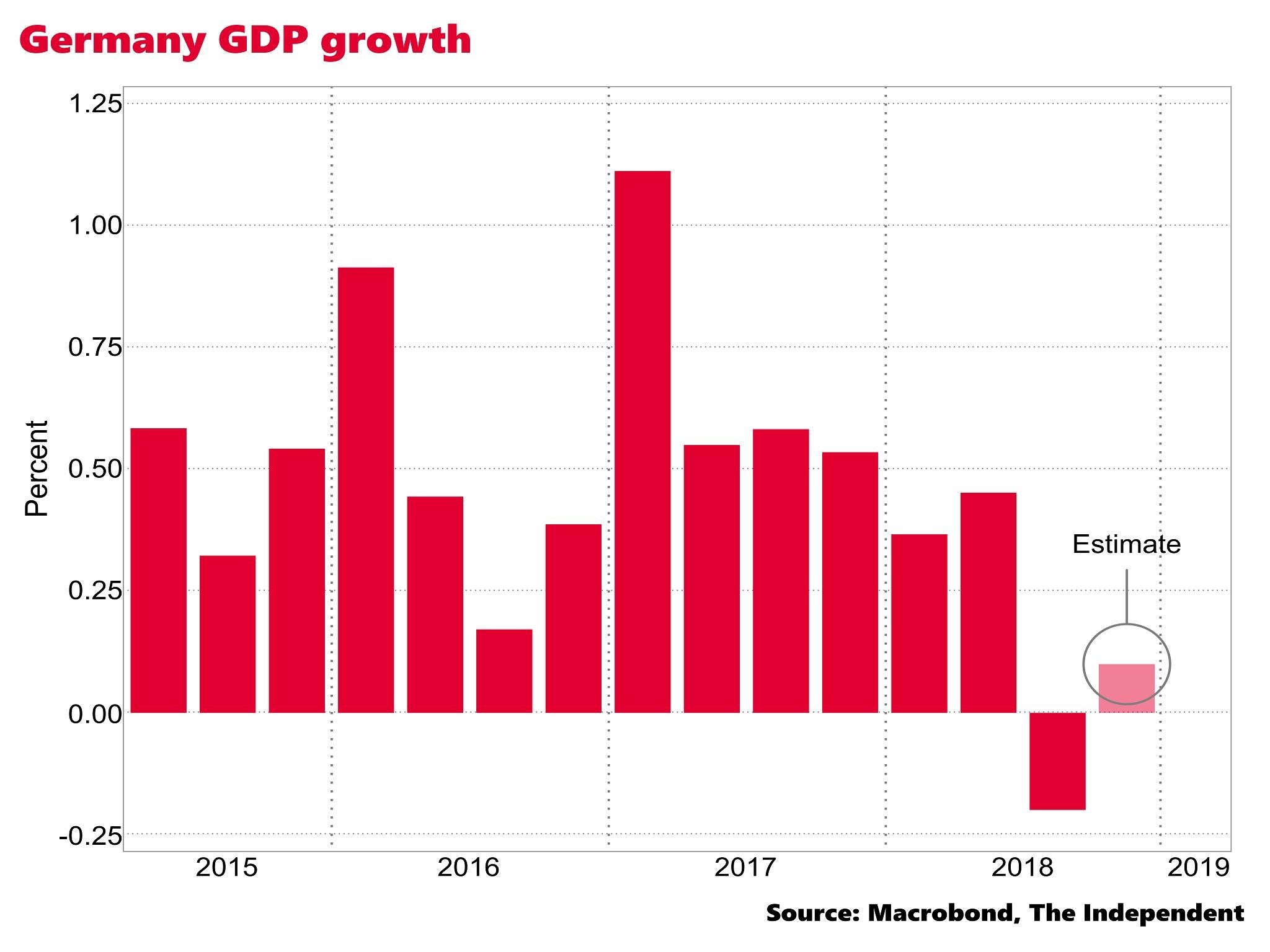

Your support makes all the difference.Germany’s Economy Minister, Peter Altmaier, this week unveiled a rather brutal downgrade in his country’s official growth forecast for 2019, from 1.8 per cent to just 1 per cent. This came on the back of the worst year of GDP growth for Germany (1.5 per cent in 2018) in five years.

And one of the reasons Mr Altmaier cited for the downgrade was the negative impact of Brexit.

This has led to some speculation that the alarming weakening of Germany economy – it only seems to have narrowly avoided slipping into recession in the second half of 2018 – could influence Angela Merkel’s stance on Brexit, perhaps inducing Berlin to be amenable to Theresa May’s proposals to revisit the Irish backstop in the Withdrawal Agreement.

If German politicians like Mr Altmaier appreciate that their own country’s economic self-interest is tightly related to avoiding a no-deal Brexit that could change the terms of trade of the EU-UK Brexit negotiations, goes the thinking.

But does the logic here stand up? How much is Germany’s slowdown actually due to Brexit? And how damaging would a no-deal scenario even be for Europe’s largest economy?

Germany exported around $95bn of goods and services to the UK in 2017, making us the country’s fourth largest export market, after the US, France and China.

But Andrew Kenningham, a Europe specialist at Capital Economics, is sceptical that a weakening UK economy ahead of Brexit was the primary reason for slowing German growth last year, noting that industrial disruption due to new automotive emissions regulations was influential in the third quarter contraction.

“I don’t think most people would see Brexit see as the main reason for it,” he said.

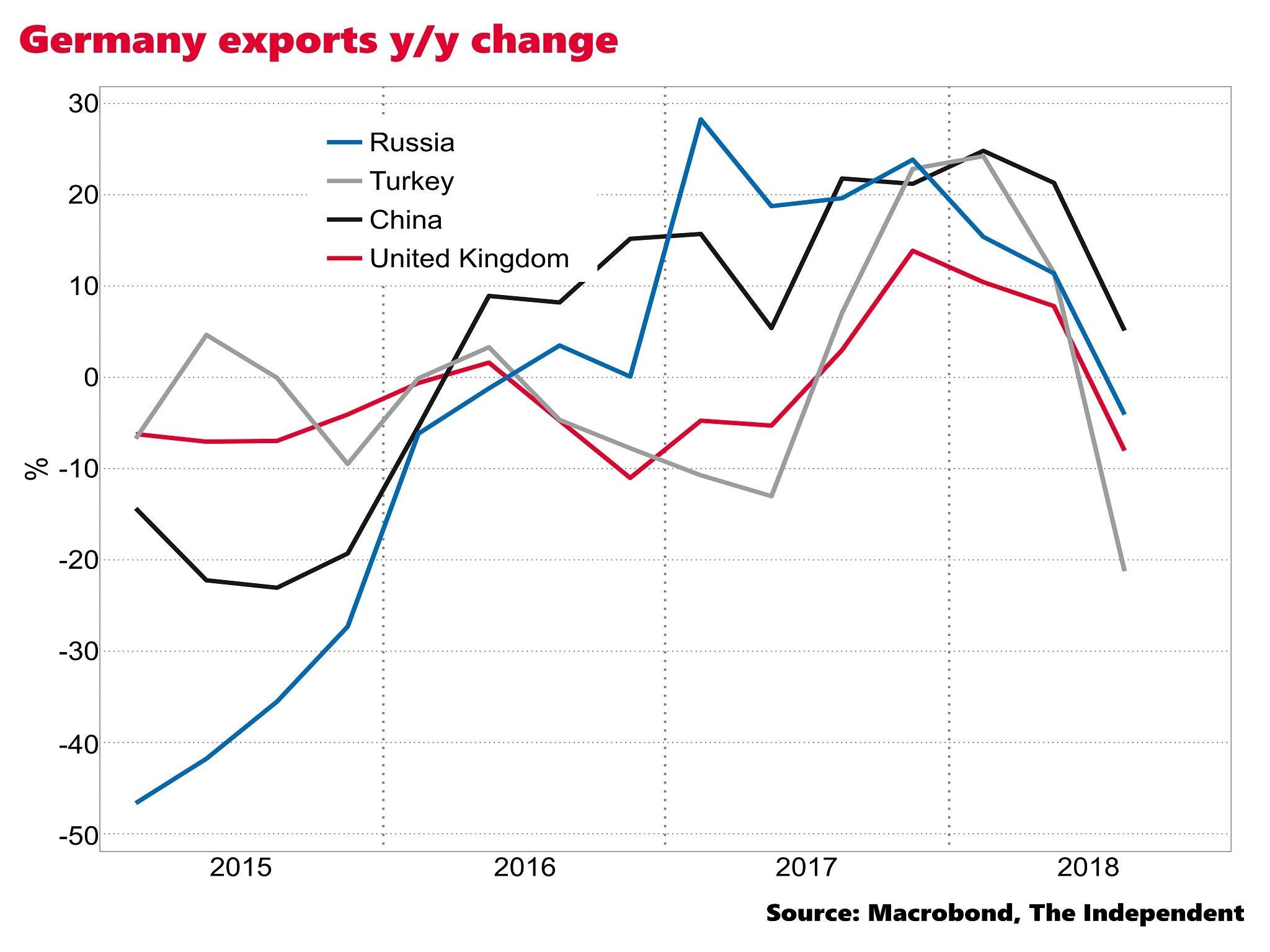

“It’s true that exports from Germany to the UK have been declining. They’ve probably been the weakest of its major export destinations. But they’ve also slowed a lot in China, they’ve slowed to other emerging economies, including Turkey and Russia. It’s not just exports to the UK have collapsed while everyone else is doing fine.”

Narrowly dodging a recession

Oliver Rakau, a Frankfurt-based economist for Oxford Economics, says Mr Altmaier was simply listing the long menu of reasons for the slowdown, rather than singling out Brexit.

“It’s quite common to mention Brexit. And the document [from the economy ministry outlining the downgrade] was more balanced – it was much more boring!”

He suspects, based on data released previously in Beijing, that the big drag in terms of German exports in the final quarter of 2018 will turn out to be due to waning demand in China rather than the UK.

But Mr Kenningham suggests that Mr Altmaier might have mentioned Brexit for political reasons, rather than economic ones.

The economy minister has been vocal for some time about the importance of avoiding a no-deal Brexit and has suggested that the UK should be allowed to extend the Article 50 process to avoid the 29 March cliff edge.

“We might take that kind of statement [from Altmaier] with a pinch of salt because often they have their own incentives to exaggerate the impact of these things because they’re trying to influence the policy debate,” he says.

But what about the hugely important German car industry? Here the bigger hit to business has been Donald Trump’s trade wars, rather than Brexit, according to analysts.

“German firms produce a lot of cars in America, in the UK, in China. Those car companies have all been struggling. Exports of German cars to the US have been collapsing. But that’s not a factor which will have been driving the German GDP figures. That would be part of GDP in the countries where the cars are produced. The flow of those profits [back to Germany] would show up in gross national product (GNP), not domestic product.”

Nevertheless, concerns about Brexit could be dampening corporate business investment in Germany, which has been relatively weak.

Exports falling – but not just to the UK

But what about a no-deal Brexit in March? How damaging would that be for Germany? Could that rising threat galvanise politicians in Berlin?

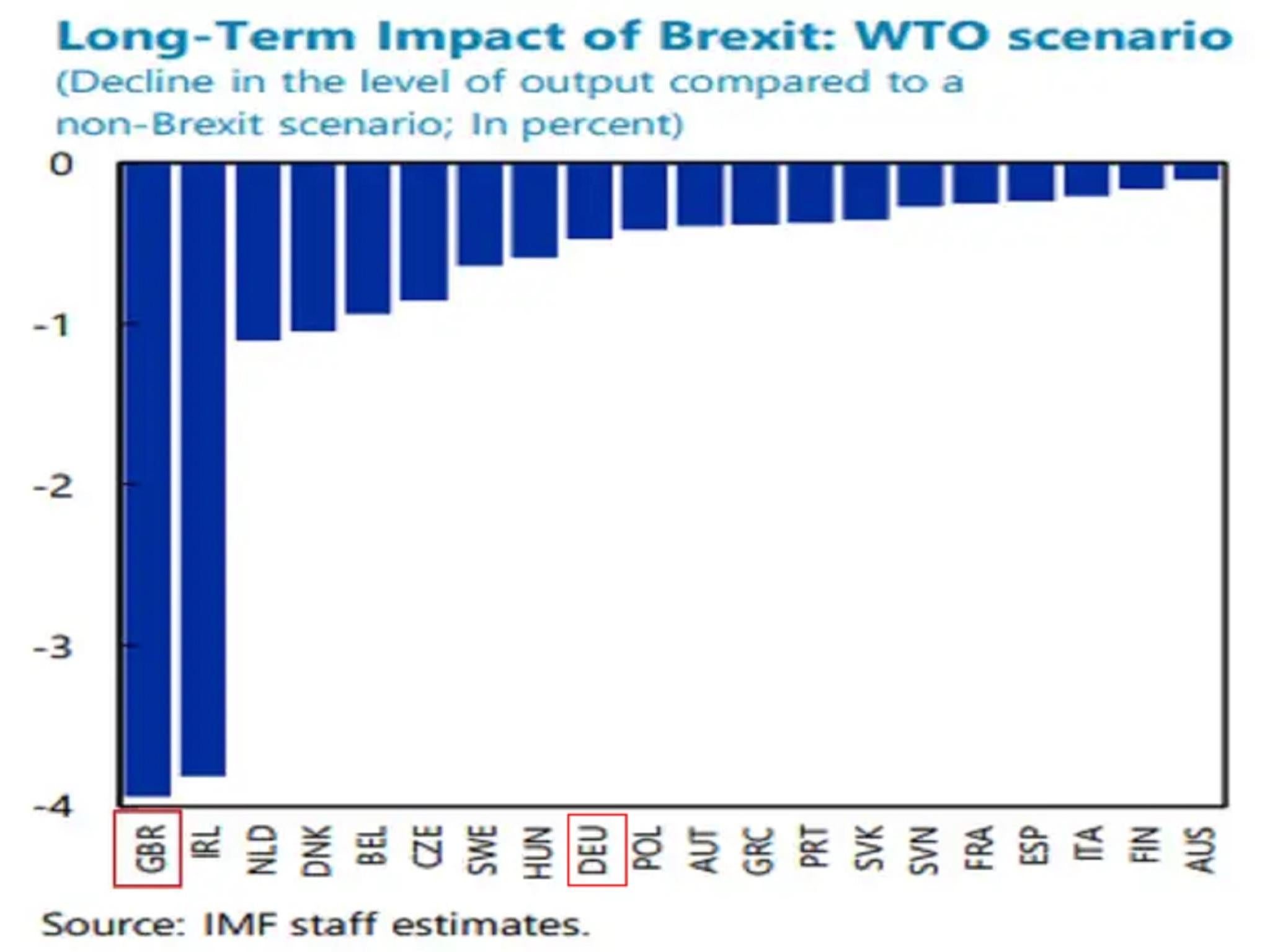

In the long-term the IMF estimates that the UK being forced to trade on bare World Trade Organisation terms would cost the UK almost 4 per cent of GDP, versus less than 0.5 per cent for Germany.

But what about the immediate impact, the disruption in 2019?

Mr Kenningham notes that Germany’s exports of goods and services to the UK account for around 3 per cent of its GDP.

“Even if they were hit hard – say a 10 per cent fall for a few months – it wouldn’t have a huge impact if you look at it arithmetically,” he says.

But he concedes that’s a narrow way of looking at it.

“If you’re the CEO of BMW and you couldn’t get your car parts to Cowley [in Oxford] that could have a big impact on business sentiment. It would be a major headache.”

And Mr Rakau thinks that a no-deal would certainly increase the chances of Germany tipping into recession.

More pain for UK than Germany from no-deal Brexit

So could car companies, and German industry more broadly, come to the rescue of the UK government and put pressure on Ms Merkel to accommodate the British, perhaps at the expense of Ireland, which wants the backstop to be entirely untouched?

Analysts are not expecting that.

“I know it’s often cited in the UK that Germany industry will put on pressure – but I don’t foresee that,” says Mr Rakau.

“Even the German industrial associations have put out press releases saying this is for the British side to sort out.”

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments