Why have interest rates been slashed and what will the impact be?

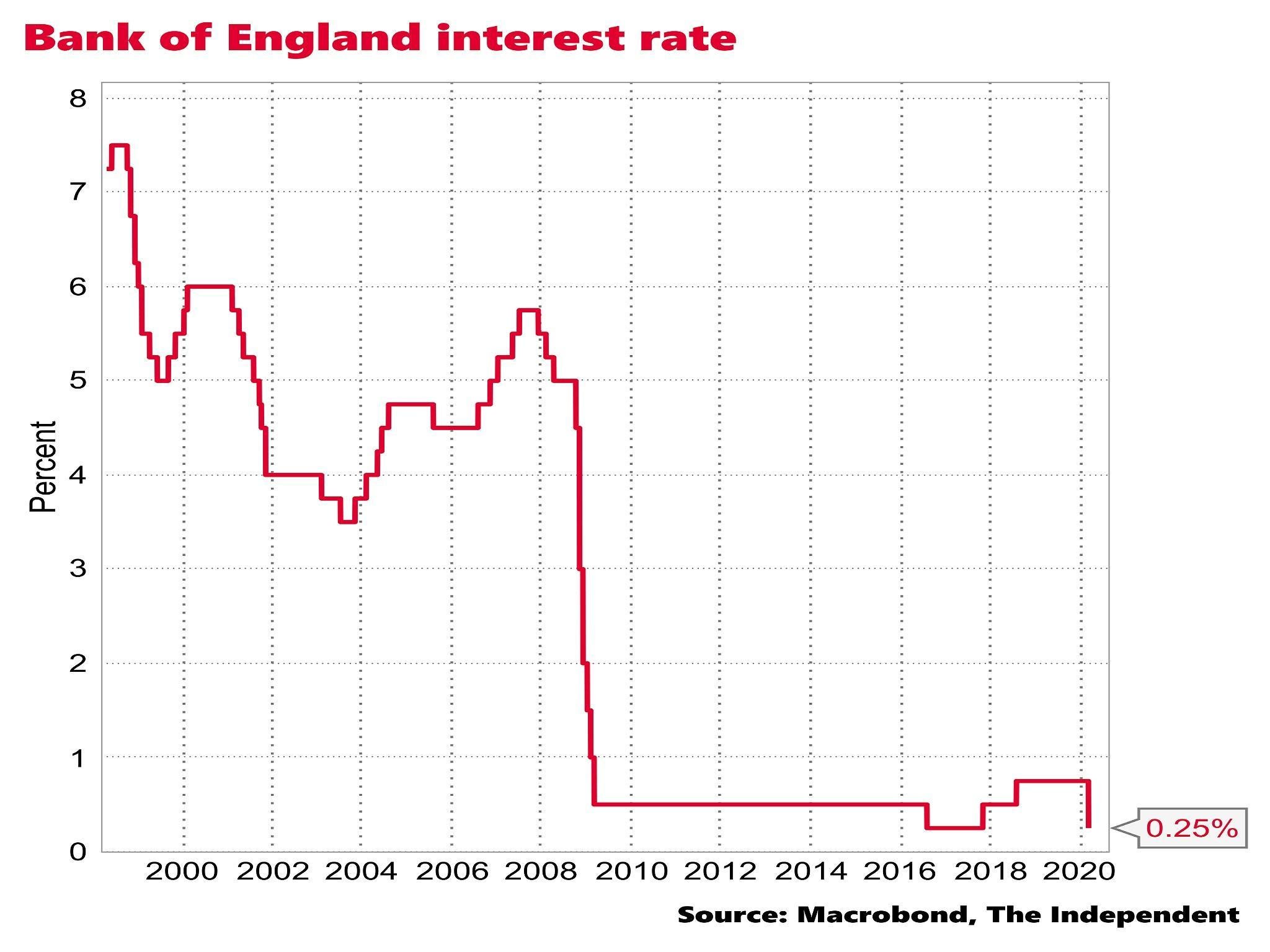

The 0.5 percentage points cut takes the Bank of England’s official borrowing rate from 0.75 per cent to just 0.25 per cent, as low as it has ever been in history. But what will this cut in the cost of borrowing achieve?

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.The Bank of England on Wednesday morning cut interest rates by the largest amount since the 2007-09 financial crisis.

The 0.5 percentage points cut takes the main borrowing rate from 0.75 per cent to just 0.25 per cent, as low as it has ever been in history.

It was also the first cut to come outside of the schedule of the Bank’s regular round of monetary policy meetings since the last recession more than a decade ago.

So why has the Bank taken such drastic action?

And what is it likely to achieve?

What’s prompted this cut?

Fears about the impact of the coronavirus emergency on the UK economy.

Figures from the Office for National Statistics today showed that the economy was weakening anyway, with the annual growth rate dropping to 0.8 per cent in January.

The concern is that the global Covid-19 crisis could tip the economy into outright recession again.

Will it work?

The rate cut has been welcomed by industry groups but many analysts are sceptical about the extent to which the rate cut in itself will help.

The problem faced by many businesses is not that bank borrowing is too expensive, but that they may not be able to meet their debt repayments if their custom dries up.

And for mortgage borrowers it’s not clear that the prospect of cheaper monthly repayments will induce them to spend more if they are scared to go out or if the government is encouraging them not to for public health reasons.

“Lower interest rates [won’t] do much for firms and households needing to service debt while facing a sharp drop in income because of lower demand or inability to work,” said Andrew Goodwin of Oxford Economics.

So what’s the point of it?

Some hope that it may send a signal that the Bank is taking the crisis seriously and that this will help prevent a total collapse of confidence.

The Bank of England is supposed to be operationally independent of the government when it comes to setting interest rates, yet it coordinated this cut with the Treasury to coincide with the Budget and to reinforce the confidence effect.

The fact that it put its any concerns about a compromise to its independence to one side indicates how grave the Bank thinks the situation is.

Did the Bank do anything else?

It also unveiled a scheme to funnel cheap funding directly to commercial banks on the condition they use it to support lending to small- and medium-sized companies.

The Bank is thus directly incentivising commercial banks to help vulnerable firms in this time of crisis.

“The support for the cash flow of small- and medium-sized businesses through additional bank lending capacity may be at least as important as the headline interest rate cut,” said John Hawksworth of PricewaterhouseCoopers

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments