A year on from intern Moritz Erhardt's death, has banking industry changed its ways?

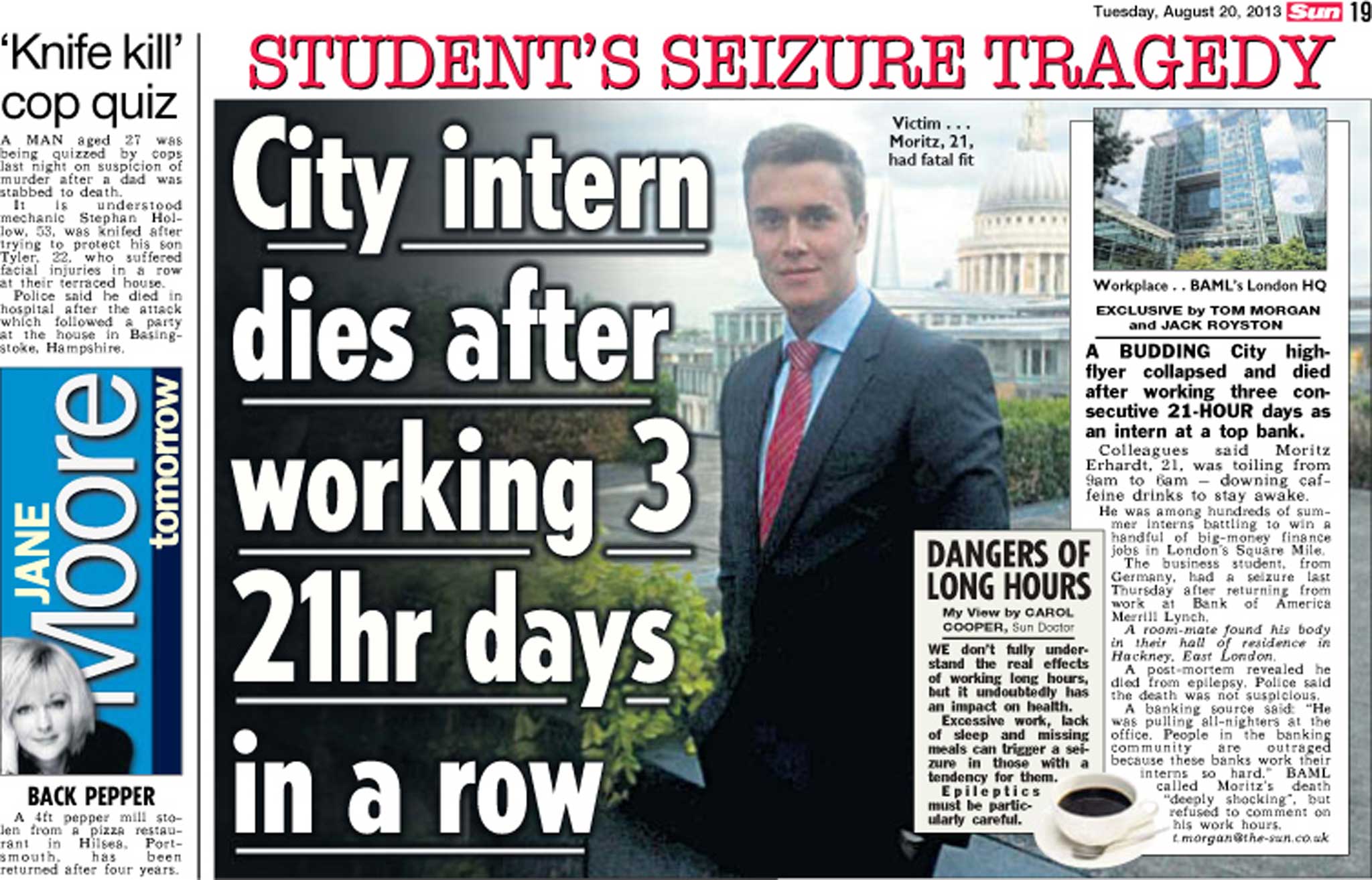

After he was reported to have worked 72 hours straight as an intern at a City bank, Moritz Erhardt suddenly died. On the anniversary of that tragedy, Joshi Herrmann asks this summer’s young recruits whether the Masters of the Universe are keeping their promises to take better care of the little guys

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Last month, I received a text message from a 24-year-old German girl – let's call her Alexandra. "Hey, I've been doing a lot of thinking about our conversation and I really hope we can meet this week to discuss further. I'm hoping to get a bit of my life back on Friday and this weekend, hope it works with you?" This particular German girl is working as an intern on one of the toughest investment banking desks in London, and "our conversation" referred to a 20-minute chat on the phone the week before, about her internship. A year on from the tragic death of Bank of America Merrill Lynch intern Moritz Erhardt, she had agreed to help me with my piece about how the banks are now treating their youngest charges.

The interns currently serving their summer stints at the business end of investment banking are the putative future stars of finance, each having beaten off the competition of up to 50 others to secure their place. Numbering about 500 in London this summer, they work in the banks' Investment Banking Divisions, the high-octane desks where huge company mergers are brokered and complex debt products are devised – the place in the City where the hours are the longest and the rewards the highest. Most of the youngsters started work on their nine- or 10-week placements the moment their university term finished and earn about £800 a week for their toil. Their aim is to be offered an "analyst" job by the end of the summer, with a starting salary of £45,000 or more. But, as Alexandra and the other interns interviewed for this piece make very clear, the banks don't hand out such prize jobs easily.

On the phone, Alexandra told me the hours were tough ("I leave between midnight if I'm lucky and four when I'm less lucky"). But she said the bank had been open about that from the start, and she liked the work. "I really enjoy finance – it's intellectually very engaging, it's got a strategic element to it, it's very analytical. I've always had that slightly workaholic vibe," she told me on that occasion.

By the time we meet for the first time face-to-face, at a pizza joint on Columbia Road, east London, her mood has darkened. "It's gotten tougher," she says, looking around as if to check her colleagues aren't sitting around us. "The hours have been OK, although crazy irregular. What's gotten properly hard is the people." I ask what she means. "They think they're this planet's elite. They're entitled to have you as their personal slave. I feel my main job now is being the outlet for other peoples' emotional stress."

A week earlier she had sounded dog-tired but impressively resilient – a high-achieving student being pushed hard by a bank which was engaging her brain and remunerating her handsomely. Now she sounds close to the edge. "I guess I've reached that stage where I feel like this job is changing me. It is making me aggressive, very defensive, and not nice to people. Sometimes my mum calls and asks, 'Why are you not home yet?' and I go mental at her. The other interns [too], we all observe this change, it's quite disturbing."

It was emails in the very small hours that worried Erhardt's mother back in Germany last summer. She has said that she "immediately knew what had happened" when two policeman woke her at 6.30am on 16 August 2013 to inform the family that the 21-year-old had collapsed and died in his shower the evening before. He was said to have worked 72 hours in a row before he died. On the evening that the news broke, another intern staying in the same block as Erhardt told me he thought the German had worked eight all-nighters in two weeks.

The inquest into his death found that he died of an epileptic seizure which could have been unrelated to his exhaustion, though the coroner noted: "One of the triggers for epilepsy is exhaustion and it may be that because Moritz had been working so hard his fatigue was a trigger for the seizure that killed him."

Bank of America Merrill Lynch did not disclose to journalists how many hours Erhardt had been working, saying it did not have a formal monitoring system in place, but launched a "very, very serious" global review of working hours. The bank has since made "extensive changes to our junior banker programmes", according to a spokesman. Interns "do not work weekends" and "accrue four days of holiday entitlement during their internships" – though the spokesman did not say whether all interns are required to take those days off.

The bank recently announced it was hiring 40 per cent more interns this summer, to improve the work-life balance of its youngest charges, and says it has appointed managers to monitor workloads. Similar measures have been announced by other giants of investment banking, with JP Morgan vowing to increase its junior staff by 10 per cent – assumed to include interns – and make them take off one whole weekend a month. Goldman Sachs is discouraging staff from working Saturdays. Deutsche Bank told us it has "implemented a more thoughtful policy" with regards to interns, in which "holiday is encouraged and tracked" and "weekend work is the exception". (The banks say that some of their reforms were in the planning before Erhardt's death.)

"Interns being overworked isn't a new thing," says Sarah Butcher, editor-at-large at recruitment website eFinancial Careers, who reports frequently on the issue. "But banks will be very alert this summer – I think a lot of high-level memos will have been sent around. They were already struggling against the problem of people not wanting to work in banking as much recently. So stories about people's health being affected and a tragic death are only going to make it harder for them to attract people."

This summer's interns have been discovering how effective the banks' new measures really are. But speaking to them isn't easy. "The bosses have really locked down on any info being given to external sources after all the recent bad publicity," one intern tells me when I ask whether they will speak anonymously. When I ask a friend to introduce me to another, I'm told that "She won't do it if she has any intention of getting a job."

When we approach the main banks for basic details of their internship programme, such as the number of interns and the start dates, some reply, but the reticence of others is noticeable. Lazard says: "We do not comment on staff details"; Credit Suisse offers: "The details you are requesting are confidential"; and Rothschild declines "the invitation to participate on this occasion". While summer internships are the main recruitment process for London's most important industry, it's an issue on which some of the City's key players have gone very quiet.

One person who doesn't seem to believe the banks' reassurances about working time is the Bank of America Merrill Lynch intern who set up the private Facebook group for his peers to chat about their experiences, which we have seen. When a fellow intern mentions a gym deal that the bank offers its summer charges, he writes: "I'll be really quite frank here and place a bet that the vast majority of us are kidding ourselves into believing [that] as interns we will a) have the time for the gym and more importantly b) the energy."

When I mention the gym story to a public school-educated 21-year-old intern who asks me to call him Ben, he chuckles. (In order to protect the anonymity of the three interns who have contributed to this article, we have chosen not to name the banks where they work, though they are three of the biggest firms in the world.) He says that at the beginning of the internship, someone from the human resources department told the interns that looking after themselves was vital, including using the gym deal. But when he asked his line manager for a form, the request was met with astonishment: "You are doing an investment banking internship; do you really expect you are going to leave for a full hour in a day to go to the gym? If you want to exercise, go for a run at five in the morning when we don't need you."

In his second year at university, Ben is a sporty, confident type who doesn't seem fazed by the surprising anecdotes he tells from his first four weeks in the City. "Last week I was super-shattered after some late finishes, I think it was 11.30pm, and I had nothing left to do, so I asked one of the guys if I could go home to get some sleep. And he said: 'You're an intern – you really shouldn't be saying that kind of thing.'" Though he felt his fatigue was "a health issue", Ben stayed a bit longer and says he doesn't usually resent the very long nights. "As bad as I feel on those evenings, it's always been what I signed up for. You only have to do it for two months."

Questions were being asked about the health of bank interns long before the Erhardt story. Butcher recalls that an intern writing an anonymous diary for eFinancial Careers six years ago "became really ill, with skin rashes and exhaustion, and had to drop out".

It was noted at Erhardt's inquest that he had not told the bank he was taking medication for epilepsy; one intern we speak to, who is not at Bank of America Merrill Lynch, says they decided not to declare a medical condition at the start of the summer as the form made no assurances about confidentiality. "There was no indication that it would be read by the office doctor rather than the directors on the desk," they said.

When I wrote about investment-bank interns three years ago, a friend interning at an American bank referred to "the magic roundabout" (when a taxi drops off an intern in the early hours and waits outside as they have a shower and put on a new shirt for the return commute). It has become a stock phrase to illustrate the semi-mythic expectation to pull regular all-nighters. k Ben has a new one – "Nine to five, bad", which is when an intern works from 9am to 5am the next morning, a routine he's done once. "We talk about it among ourselves, joking that we are actually doing a 9-to-5 job after all."

Has he noticed anyone measuring his hours, as the banks now say they are? "Yeah I think so, because we have cards to get into the office," he says. "I think it's going to be a measure of success at the end of the internship. I think they're going to be like – 'Hey, this guy was in the office 16 hours a day, five days in a row, that's great.'"

He hints at the suspicion many harbour, that banking internships are more about fire-testing than anything else. To be offered his internship, Ben had to get through online Maths and English tests, a Skype interview and four face-to-face interviews during a rigorous assessment day. The banks invest huge amounts in making sure every intern is – on paper – good enough to be hired at the end of the summer, including sometimes putting them up in expensive hotels before their assessments. "Of the 50 of us, we're all smart and excel at maths – the only differentiating factor is who is willing to sleep the least," says Ben.

The competition for the internships is intense. Goldman Sachs tells us it received 10,000 applications for the 350 places on its internship programme this year, more than 28 applicants for each place. HSBC says it received between 40 and 50 applications for each of its places, and UBS says it had more than 5,000 applications for 120 places. On these programmes, the elite International Banking Division interns make up about 10 per cent in the case of a few of the big banks. Bank sources say about 70 per cent of interns are likely to be offered a job this autumn; two of the interns we speak to say they would accept an offer and then "use it as leverage" to look elsewhere for jobs – either on an easier desk in the bank or at other companies.

The third intern who has agreed to speak to me is a 24-year-old Indian girl with several university degrees who tells me to call her Aanya. Her testimony is strikingly different – Aanya says she likes the Darwinian environment created by the banks. "I come from a very conservative background, where being born a woman is like being born a man with two limbs missing. Here it is very meritocratic, and nobody cares what your gender is. You work hard – you survive. You don't work hard – you have to leave. And I find that very, very, very rewarding, I find that very validating."

She says her hours aren't as bad as the others', usually finishing before 11 – though she admits they will probably get worse. "I'm going into this with a certain mindset," she says. "I'm not denying it's hard work, but everyone around you works hard, so that makes it easier. I think you have to be mature about it; you have to know your own limits and take care of yourself."

Not far from the City, in Bethnal Green, is Claredale House, the so-called "bankers' block" where many interns rent rooms if they don't have London parents or friends (including one of those who has spoken to me). It is the place where Erhardt lived in a functional downstairs room during his internship, and where he died.

In the past few weeks I've lingered outside Claredale House after midnight on a few occasions. Fewer interns than I expected trudged out of company-booked taxis (most banks offer them free after 10pm or 11pm) – though there has been a trickle. Perhaps the average banking intern is indeed getting home at a more civilised hour this summer, though our three interns laugh at the suggestion that they might have regular weekends off or that they could take their four pro-rata days of annual leave.

"For the past three weeks, I have done nothing but work and sleep," says Alexandra. "I have had no weekend. I didn't read my emails, I didn't watch films, I didn't see friends." Nor does she enjoy the atmosphere in her office. One analyst, she tells me, reacted with a crude sexual insult when she asked him for help. One of the interns she sits near had made a joke about committing suicide. She reckons he was joking, but she believes the comment is revealing of his thoughts nonetheless. "For me, it feels like an industry that is paying a fair amount of money for the right to violate some people's rights. One of the other interns said, 'I'm not even angry with the analysts for bullying us, because they probably have to. I'm angry at HR [Human Resources] for letting us down.'"

Like Moritz Erhardt, some of this year's interns are pushing themselves harder than you would expect 21-year-olds with no working experience to do, even if they do enjoy the work's competitive challenge and intellectual demands. And whether or not Erhardt was killed by long hours or pure bad luck, his name is ever-present in the tired conversations they have on the steps of Claredale and as they eat breakfast, lunch and dinner at their desks.

"For a long time I thought, yeah, [Erhardt] put pressure on himself and that was stupid," says Ben. "But I'm starting to think, when you're in this environment for so long and you don't interact with anyone else from the outside world, maybe you stop being able to step back and get perspective on the situation, and you just push yourself that little bit more to get this job. And then you push yourself until you really can't do it."

Details of the interns interviewed have been altered to protect their identities. Additional reporting by Xin Fan. @joshiherrmann

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments