1 Undershaft: The only way is up for the capital’s skyline, with 'the Trellis' the latest planned skyscraper

‘The Trellis’ tower at 1 Undershaft is only the latest skyscraper coming to the City, where memories of the global financial crisis are receding fast, writes Joanna Bourke

In 2008, building work in the City of London stalled after project finance dried up. A half-built tower at 22 Bishopsgate, which be-came known as “the Stump”, served for many years as a visual reminder of the lasting impact of the global financial crisis. But memories of those grim times are now receding into history.

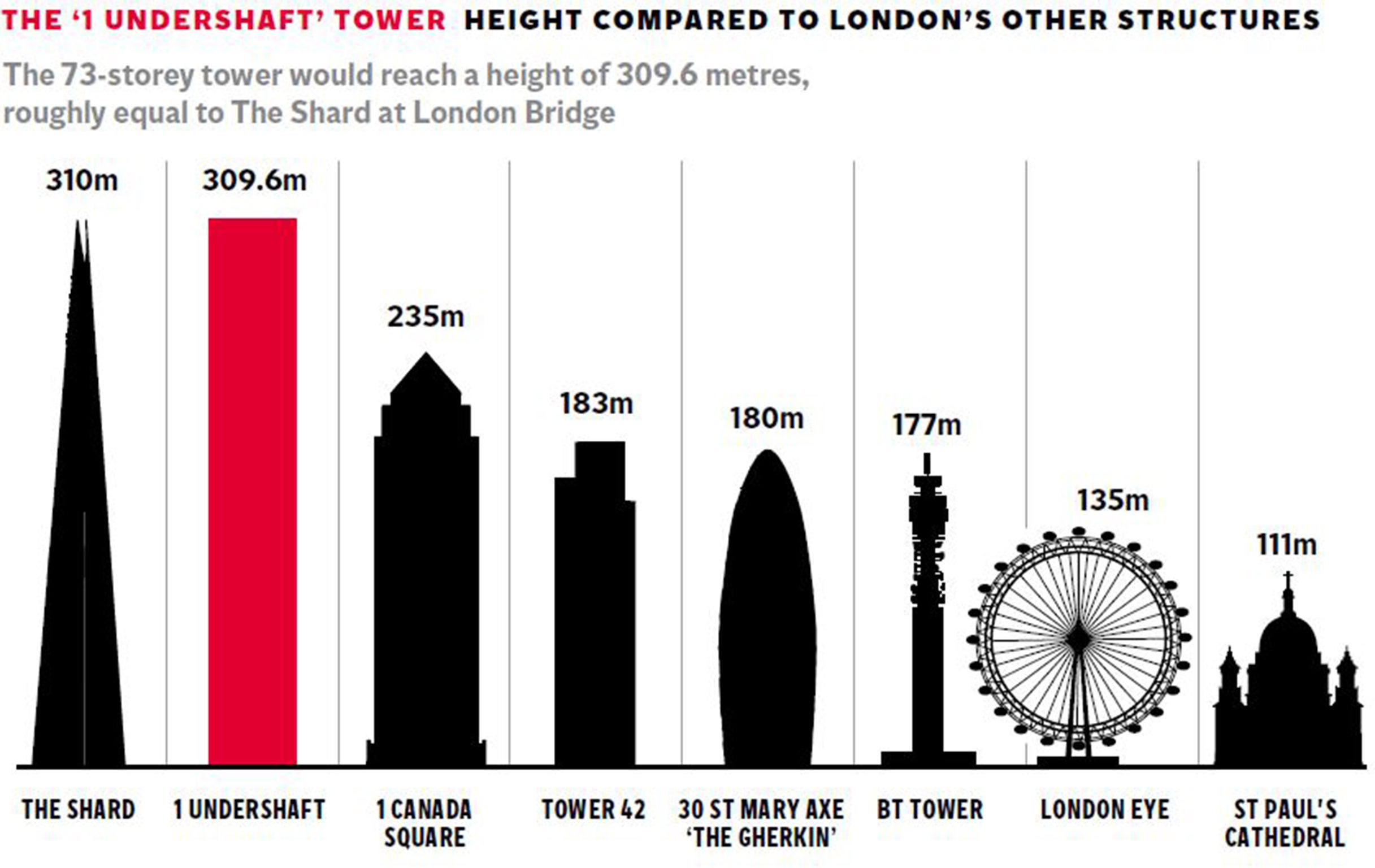

Near to the infamous “Stump”, at 1 Undershaft, another property developer, Aroland Holdings, yesterday unveiled ambitious proposals for a new office skyscraper in the heart of the City. The Singapore-based developer wants to build Western Europe’s highest restaurant, from which customers will be able to see as far as the Essex coast, on top of the City of London’s tallest property. If approved, the 73-storey office block would reach a height of 309.6 metres, roughly equal to The Shard at London Bridge.

Already dubbed “the Trellis” by some due to its vague resemblance to a garden lattice, the tower will sit on huge steel legs and will replace the Aviva Tower (formerly known as the Commercial Union building), which was damaged by an IRA bomb in 1992.

“It will be the jewel in the crown of the City of London,” boasted the architect Eric Parry.

It would also be the latest in a line of new towers for the UK’s capital that are planned or already under construction, with building work in central London in the six months to 30 September at its highest level since the height of the financial crisis in 2008, according to the agent Deloitte Real Estate.

In the City, it was up by a quarter, with 13 new starts, taking the total amount of space being built in the City market to 5.7 million square feet. Even the infamous “Stump” is finally being completed.

So what new buildings can the City expect to spring up soon and why are real estate investors more willing to press the start button on extravagant projects?

Buildings under way or coming soon that will join “the Trellis” include the 61-storey tower that will rise from the stump of the abandoned Pinnacle scheme at 22 Bishopsgate. It will eclipse the nearby Heron Tower by some 150 feet.

Over at 6-8 Bishopsgate, Japanese-backed Mitsubishi Estate London called on one of the architects helping on the Battersea Power Station development, Wilkinson Eyre, to design a 40-storey tower with shops on the ground floor and a viewing gallery on the top. Others on the way in the City include the 35-floor “Scalpel” and 100 Bishopsgate, which will rise to 40 floors.

Concerns about building without a guaranteed tenant lined up have eased, and property companies appear more willing to put spades in the ground even if they do not have a pre-let in place.

Guy Grantham, director of research at the property agent Colliers International, believes the desire to build more buildings is being driven by business occupier demand. And he said that demand is poised to intensify, with the latest Greater London Authority employment forecasts for the capital suggesting employee numbers rising by 11 per cent between 2014 and 2020.

“Based on an assumption that 75 square feet is required per person, the London office sector will need 17.5 million square feet of office space to accommodate the expanding office-based workforce,” Mr Grantham said.

He added that the City financial district is one area that will be undersupplied over the next 12 months.

Colliers International also thinks that rents will jump, making building more attractive to landlords than ever before. It forecasts growth in the City from average current rents of £70 per square foot, to £75 next year. However, some landlords in the area have already secured rents over £90 per square foot.

High times skyscrapers under construction

Address Height Developer

1 Undershaft 309.6m Singapore-based Aroland Holdings

22 Bishopsgate 278m AXA-led consortium

52-52 Lime St 190m WRBC

6-8 Bishopsgate 180m Mitsubishi Estate

100 Bishopsgate 172m Brookfield

And companies such as insurers and private equity firms will be willing to accept big rents, claims Darren Yates, head of research at agent Carter Jonas.

Mr Yates said: “Iconic buildings and towers will always appeal to some occupiers. Organisations are often willing to pay above average rents to occupy the upper floors of landmark buildings.

“One reason for doing so is an appreciation that the address itself is an asset to the company, and that the building it occupies reflects the services it offers and its values.”

With big plans often come concerns about ruined views. But the City of London Corporation is frequently supportive of skyscrapers if they are grouped together in the capital’s eastern cluster.

A spokesman for the Corporation explained: “London is growing and the City needs high quality office space to accommodate its business needs in order to compete in a global market. With no new building space, building upwards is a key solution.”

The next few years could see memories of “the Stump” eclipsed by a wave of new high-rises.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks