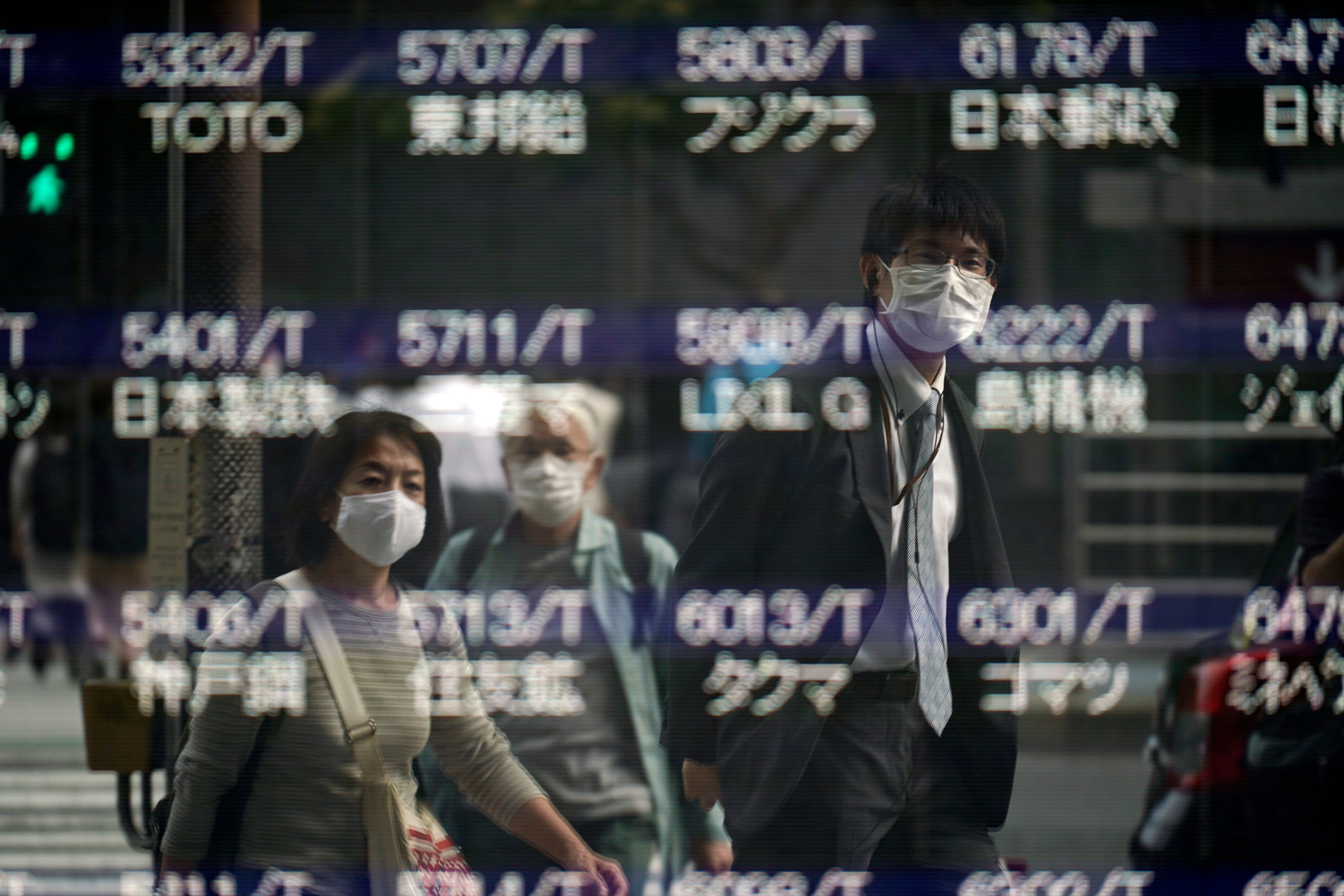

Scandal at Japanese brokerage widens with executive's arrest

The scandal at a top Japanese brokerage has widened with the arrest by Tokyo prosecutors of the vice president of SMBC Nikko Securities on charges of stock manipulation

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.The scandal at a top Japanese brokerage widened as the vice president of SMBC Nikko Securities was arrested Thursday and the company was charged with stock manipulation.

The arrest of Toshihiro Sato on charges of violating securities regulations followed arrests earlier this month of four other employees of the Tokyo-based company on the same charges.

The company and some employees are accused of propping up stock prices by putting in massive buy orders, prosecutors said.

Those arrested earlier denied wrongdoing, saying they were just carrying out normal procedures, according to Japanese media reports.

Sato’s comments were not immediately available, but the arrest highlights how Tokyo District Prosecutors suspect the top echelons of the company were involved in unlawful stock dealings.

SMBC Nikko did not return calls requesting comment. The company's CEO Yuichiro Kondo apologized at a news conference earlier this month about the scandal. He said the company was investigating internally to prevent a recurrence.

The latest arrest comes after the Securities and Exchange Surveillance Commission, the government body overseeing stock transactions, filed formal accusations against SMBC Nikko and its workers.

Upon conviction, violation of the Financial Instrument and Exchange Act carries a maximum penalty of 10 years in prison, a 10 million yen ($82,000) fine, or both. A company faces a fine of up to 700 million ($5.8 million).

___

Yuri Kageyama is on Twitter https://twitter.com/yurikageyama