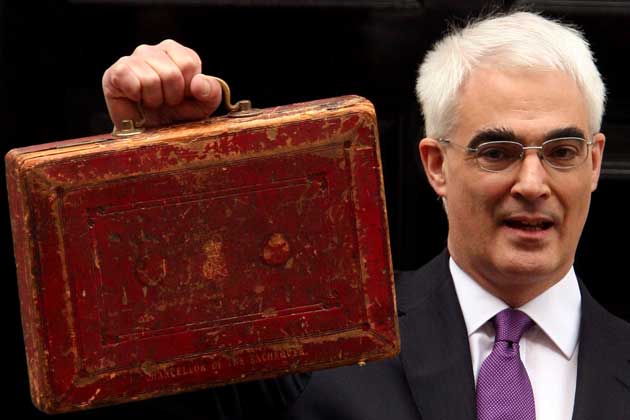

Why it's time to talk inheritance tax

The rules are changing on the amount of money you can leave to loved ones. Make the most of it

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.We have watched with fascinated horror as the value of our assets have plummeted over the past year. The FTSE is down by more than 40 per cent from the heady pre-credit-crunch days, and the value of our homes has dropped by 15 or 20 per cent, depending on which figures you trust.

But it's not just our immediate wealth and retirement plans that are affected. Since the property and equity markets started to fall in July 2007, almost £1bn has been wiped from the value of family estates, according to the solicitors Moore Blatch. As a result, some inheritance tax specialists are suggesting that now could be the perfect time to gift your assets to loved ones, and minimise the amount you're forced to leave to the state, especially as the tax-free limit is about to go up.

Death and taxes

Inheritance tax currently claims 40 per cent of any assets you have worth more than £312,000 when you die. From 6 April this year that limit rises to £325,000, and will go up again in 2010 to £350,000, largely in response to criticism that this nil rate threshold had failed to keep pace with increasing asset values, particularly property prices. There are a number of other ways to minimise your inheritance tax liabilities using the rules of the legislation, including making gifts and using trusts to share the contents of your estate according to your wishes before you die. But the current economic climate has thrown up the fundamental question of precisely when to give your assets away – because the value of lifetime gifts is measured at the time you give them away, not when you die. By passing them on, any future growth would belong to the lucky recipient, not you.

That could significantly reduce your IHT and even capital gains tax bill, says Julie Hutchison, the head of estate planning at Standard Life. "Although any gift you make will be counted towards your estate for seven years, the asset is measured at its value when you pass it on, so the improvements in the markets that we're all hoping for won't count towards your eventual IHT liability.

"It's known as value freeze," she adds. "And it works for property as well as investments. You can't just give your house away and continue to live in it to avoid the value being added your estate. But you can if you pay the new owners a market rate rent. Here you could enjoy a double whammy as the property value is as much as 20 per cent lower than it was last year and the rental prices are also low right now."

But this also applies to your share portfolio and could mean that any capital gains tax bill is lower. Because of the currently low share value, you may have lost money rather than gained it on the purchase. "What goes down may also come up," Hutchison adds, "but right now you have the opportunity to put some structure around your IHT planning while prices are low."

Too generous?

But although it feels like you're giving away less, it's worth remembering that you're giving away the same proportion of your estate. It makes no difference if its value has gone up or come down. Geoff Tresman, chairman of Punter Southall Financial Management, warns that now is not the time for rash decisions. "We're in a situation where people's overall assets have devalued by 20 to 30 per cent," he says, "but you're still giving away the same proportion of your estate."

"Anyone thinking of giving away their assets have to use the same criteria now has you would have done a year ago. If you have a lump sum that you can get genuinely do without then by all means gift it. But very few people can afford to gift anything simply to reduce their IHT liability. And once you've committed to it, there's no way back. If you're absolutely sure that your standard of living won't be affected there is nothing wrong with handing over you assets. But you have to be very certain of your financial position to give up capital."

How to give it away

Taxpayers waste £190m every year on unnecessary IHT payments, according to financial research company Defaqto, and the experts are keen to clarify that using the rules to limit your bill is tax planning, not tax evasion. Minimising your inheritance tax liability is all about a long-term planning strategy. "Firstly, find out if you have an IHT problem or are likely to have one," adds Tresman. "Most of your personal possessions, such as clothes and electronic equipment, will be considered worthless. It's easy to work out – the value of your assets minus any outstanding debt."

"One trick is to use the Treasury's IHT forms as a dummy run," Hutchison suggests. "This can also help with record keeping." You can download them via the HMRC website at www.hmrc.gov. uk/inheritancetax/iht- probate-forms/index.htm. If at that stage you believe the value of your estate will exceed the nil rate band, particularly in a few years when the value of assets are expected to rise again, it's time to start using the allowances that the legislation affords you.

The biggest change to inheritance tax law now means that the allocation is transferable between married couples and civil partners. This means that if one spouse dies their allowance transfers to their partner. Once the second partner dies, the nil rate band that applies to the entire joint estate is effectively double the individual rate. That threshold is currently £624,000 for the 2008-9 tax year, and will go up as the individual rate increases. The other good news is that it is backdated indefinitely so if your parents were stung twice in the past it's probably worth seeking professional advice to see if you can make a claim.

Meanwhile, annual and occasional gift allowances mean you can give several thousand pounds away every year without it counting towards your estate. These include a £3,000 a year gift, perhaps £3,000 for one child or £1,000 for three children. You can also give small gifts of up to £250 a year to as many people as you wish.

You can also give £5,000 in wedding gifts to a child. Grandparents can give £2,500 for the big day. You can also make regular gifts out of your income, though these really do have to be regular to be eligible for IHT exemption.

Once you've mopped up some of your estate this way you can also give larger gifts, but the value will remain in your estate for seven years on a tapering basis. If you die before the seven years is up, the value of the gift will be subject to tax at 40 per cent, dropping to 8 per cent before becoming exempt from your estate. This is where the debate about low value property and share values come in. Pass on a larger gift like this and it will be subject to tapering inheritance tax for the next seven years, but the value of those assets is calculated now, not in seven years' time when it should have increased in value.

But at this stage IHT planning gets more complicated, and financial advisers start talking about writing assets and even insurance policies into trust. The basic theory is that by using a trust, your property or investment is held by a trustee for the benefit of your chosen beneficiary. As such, the asset could be exempt from your estate because it ultimately belongs to your beneficiary, not to you. It's a legal way of giving away your money and gives you control over the conditions of the gift. You can even settle your life insurance policy into trust so that the money goes to your beneficiaries rather than through your estate when you die.

"And if you have a sum of money that you know you won't need but want the income, you can settle the money into a discretionary gift trust," says Tresman. "This means you take income from the trust but on your death, the [underlying investment value] is owned by the beneficiary, not you. It is a very effective way of moving money outside your estate."

Prepare for the worst Keep your will up to date

Fluctuating asset values mean now is a good time to review your will – or write one if you are part of the 50 per cent of UK adults who don't have one. "Most people leave gifts on two bases; their monetary value and sentimental value," says Andy Kirby, senior trusts and tax manager, for Moore Blatch. "Usually, this is based mostly on the approximate calculation of physical items such as property, equity portfolios, or cash in the bank. However, the events of the past 18 months mean that these calculations can now be significantly awry and the benefactors may, albeit inadvertently, leave vastly different values to the beneficiaries.

"If a death has already occurred, use the HMRC loss relief rules that already exist to ensure that you don't pay inheritance tax based on the price of an asset that has fallen dramatically between death and sale."

If you are concerned about your IHT liability, consult the experts. They will charge you for their time, but that fee is usually a fraction of the amount you will save on your tax bill. Independent financial advisers can look at your inheritance plans and will be able to put you in touch with a solicitor and accountant where necessary.

Go to www.unbiased .co.uk for a list of independent financial advisers in your area. The Society of Trust & Estate Practitioners provides a list of their members at www.step.org or call 020-7838 4890.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments