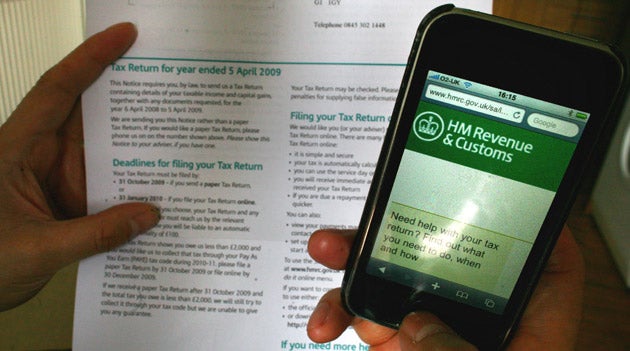

Don't lose out with a last-minute tax return

With postal workers set to go on strike, any delay in posting your form could result in a hefty fine.

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.If you wait until the last minute to send in your tax return this month, you're risking a big fine. Strike action by the Communication Workers Union (CWU) could result in your return getting snarled up with millions of other items of post, meaning it will miss the deadline.

As many as three million people could be aiming for the 31 October paper-filing deadline, if last year's statistics are anything to go by. But they are being urged to try to beat that deadline by two weeks if they want to avoid problems over mail delivery.

Chas Roy-Chowdhury, head of taxation at the Association of Chartered Certified Accountants, says: "It is always risky to put off filing until the last minute but, considering the regularity of postal strikes and difficulties in obtaining HMRC forms through the income tax helpline, taxpayers who want to avoid a fine should send their return as soon as possible."

The CWU's plans for industrial action are approaching fruition at the worst possible time from the point of view of tax returns – the union could be free to begin strike action from 15 October. It is balloting its 130,000 members who work for Royal Mail, and the votes will be counted this Thursday. Even without a full-blown strike, there have already been delays and local action in London, the South-west, Glasgow and other parts of the country. HMRC will have to announce contingency plans if there is a national strike – but taxpayers will save themselves worry if they can get their return into the post well in advance.

Online filers, whose deadline is 31 January next year, should also be thinking about their tax returns, even if they have three months longer to get their submissions sorted out. That's because there are various barriers that some will encounter online, and more-cautious people will want to get their online return sent in and accepted this month, knowing they could still file a paper return if they have problems.

In general, the system is working well. "If someone has one source of business income, some dividends and bank interest, then online filing is pretty damn robust," says Stephen Herring, senior tax partner at accountant BDO Stoy Hayward.

The problems come with more-unusual cases. For instance, farmers who use an "averaging" system of calculating their profits cannot yet file online – the HMRC still has to make the necessary software modifications for them. But other exceptions are also coming to light, such as Lloyd's underwriters, who have particular kinds of tax credits.

Very commonly, the system stops people filing online for a combination of circumstances, as with the Lloyd's underwriters, not just for one issue alone. There may well be no obvious reason for a problem that a common-sense approach could detect; instead, the software might not be able to handle, for instance, the insertion of a zero in one box if there is a minus number in the previous box.

HMRC has corrected a lot of the software glitches that it detected last year – but many remain. The way these issues usually emerge is that someone inputting information on tax returns will get error messages and be told that their tax return has been rejected, even if they have followed every instruction precisely. Very often, they will think they have made a mistake and spend time worrying and re-checking. Tina Riches, technical director at the Chartered Institute of Taxation (CIOT), suggests they check with HMRC: "The first port of call should be to phone the help desk." (See box, right.)

In some circumstances, there may be a "workaround" – a way of giving the information in a different way so that the return is not rejected by the software. There are 15 pages of these, covering 32 different situations, identified on the HMRC website (www.hmrc.gov.uk/ebu/2009-spec-indi.pdf), but they are highly technical and not intended for laypeople. Similarly, the eight pages covering 19 problem areas where online filing will probably not work at all can also be found on the website (www.hmrc.gov.u k/ebu/2009-exc-indi.pdf).

In time, HMRC says it will fix these problems, but it has been struggling with its own budget restrictions. "We know the Revenue's budget has been cut," says Anita Monteith, technical manager at the Tax Faculty of the Institute of Chartered Accountants in England and Wales.

Getting help from HMRC is easier said than done, however. Richard Murphy of Tax Research UK says: "The biggest problem is that HMRC is moving tax offices away from taxpayers and staffing helplines with people with too little training."

One issue that could affect all online filers within the next year is security. Some will have been issued with a password consisting of randomly generated numbers. However, following the discovery this summer that some passwords have been detected and used by fraudsters to make bogus claims for repayments to foreign bank accounts, HMRC is now discussing with the tax profession the best way to proceed, although it insists that "there is no issue with HMRC online systems, which have operated correctly".

The infiltration happened with the passwords of taxpayers who use tax advisers, not with people who do their returns themselves. As a result, the main worry is that HMRC will ratchet up the security systems so much that just getting into the HMRC secure site becomes onerous in itself. The public has adapted well to online filing – but having yet more passwords and gadgets could become onerous for individuals and push up the fees of tax advisers.

Be prepared: 'A tax return is 85% about gathering the information'

*Plan ahead. "This is 85 per cent about gathering information and only 15 per cent about doing the return," says Stephen Herring of BDO. You may need to ask for forms and other data from employers, lenders and others.

*Do not simply copy out figures from last year on your return. It can work in some categories – if, for instance, someone receives exactly the same rental income each year. But this year, many rental contracts have been defaulted on and even Bradford & Bingley defaulted on its Permanent Interest Bearing Shares in July.

*Pay particular attention to your pension payments. It is very easy to lose tax relief by putting the wrong figures into the boxes.

*Do not expect swift confirmation if you send in a paper return. "It may be many weeks before the return gets processed," says Anita Monteith of the Institute of Chartered Accountants.

*Ensure you are certain that your buy-to-let figures are correct if you are one of the 800,000 thought to have this income. Many landlords with repayment mortgages have incorrectly set all their monthly payments against tax.

Safety first: Don't try and con the taxman

*Declare everything you need to declare. A new, tougher system of penalties came into effect in April bringing in fines of up to 30 per cent of the tax due for careless mistakes and up to 70 per cent for "deliberate" errors.

For instance, in the recession more people may have been trading regularly on eBay or in car boot sales. Profits need to be disclosed if this is done on a recurring basis and if, according to Anita Monteith of the Institute of Chartered Accountants, "you are buying things for the purpose of reselling at a profit". She says: "The Revenue employ people to go along to car boot sales, and pose as eBay purchasers in order to track down traders."

*Be sure you can justify any dramatic fall in profits if you are self- employed. HMRC is increasingly using computer systems to scan returns and sets of accounts for odd results. Many tax advisers suggest taxpayers explain any falls in income in the spaces on tax returns built in for extra information.

Saying your profits fell because you had bad debts or because you took time off to care for a relative could pre-empt HMRC from launching an inquiry. Inquiries can be time- consuming and painful even for honest citizens.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments