Survival guide to PPI

It was the archetypal dodgy bank dealing that has been punished to the tune of £billions, but the end is nigh for the PPI cash cow

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.The Financial Conduct Authority (FCA) has called time on the mis-selling leviathan that is Payment Protection Insurance or PPI – the infamous, endemic defrauding of the Great British Public that turned into one of the greatest financial scandals this century.

So if you still haven’t claimed, or don’t know if you’re due any cash back, here’s our must-know financial survival guide. And there isn’t a questionable TV advert in sight.

PP what?

If you still don’t know what the big deal is all about, here’s the 10-second version. Payment Protection insurance (PPI) is designed to cover the repayments on loans like mortgages and credit cards if something goes wrong such as illness or unemployment for a short period of time – often a year or two. They’re usually sold as part of the loan arrangement, but you can get standalone PPI. The ones with the problems were paid for by consumers in a one-off, up-front payment. They cover a single, specific debt repayment only.

(Don’t confuse PPI with other types of cover like income protection insurance, which pays out a proportion of your current monthly income to cover your living expenses if you lose your job, become ill or sick. These policies can pay out every month for the rest of your working life if necessary and are paid for with a monthly premium rather than an up-front fee.)

Where does the ‘mis-sold’ bit come in?

The details of PPI cover and exactly what it does and doesn’t cover varies from policy to policy. There are disputes over all types of insurance policies when the customer makes a claim that the insurance company refuses because of the small print but mis-selling is more specific than that. Mis-selling means selling a product or service to a customer based on bad advice. Usually, in the case of PPI, that mis-selling took the form of adding the cover on to a loan automatically without the customer’s knowledge or consent, or selling them cover that was clearly unsuitable for their circumstances.

Why is the problem so massive?

PPI offered one of the biggest profit margins of any consumer financial product sold in the UK, so many providers pushed their staff hard to sell it. And they did in droves, selling policies to millions of people throughout the Nineties and Noughties. (Investigations by the UK financial regulator meant most providers had stopped selling standalone PPI cover by the height of the last recession.)

What’s happened now?

Unless you’ve been in some sort of media black-out for the past decade or so, you’ll probably be aware that claiming back PPI – both the premiums themselves and the interest the money would have incurred over the years – has been a huge part of consumer finance since this all this came to light. Since 2011 a staggering £24.2bn has been paid out in compensation, dramatically affecting the financial security of some of the UK’s biggest banks year after year, spawning an entire PPI claims industry, and even having a significant effect on the nation's consumer spending.

Now the FCA, the UK’s financial regulator, has decided that Brits have had ample time to take action and has announced a June 2019 deadline for claims. In fact, in many circumstances policyholders only had a six-year window anyway, or three years after discovering a problem. The deadline will be preceded by a consumer awareness campaign in a bid to sweep up any stragglers.

How do I find out if I have a claim?

The regulator forced PPI providers to send out letters to the customers that may have been affected a couple of years ago, but if you think you had a PPI policy and somehow fell through the gap, those dodgy adverts are right in one respect – you could be owed thousands of pounds. The average pay-out for mis-sold PPI is around £2,750. First get in touch with the provider that sold you the policy. If you don’t have a copy of the paperwork, even if your account has been settled, you can ask the provider for a copy of the agreement. Make sure the T&Cs are from the right period though as these will have changed over time. If, when you’ve reviewed your paperwork you believe you were mis-sold the cover – either because you were unaware you were buying it or it was clearly unsuitable – you're well within your rights to ask for your money back.

How do I make a claim?

The golden rule here is not to use a claims company. They can take up to a 30 per cent slice of your recouped cash simply for writing a letter or filling in a form that you can quickly and easily do yourself.

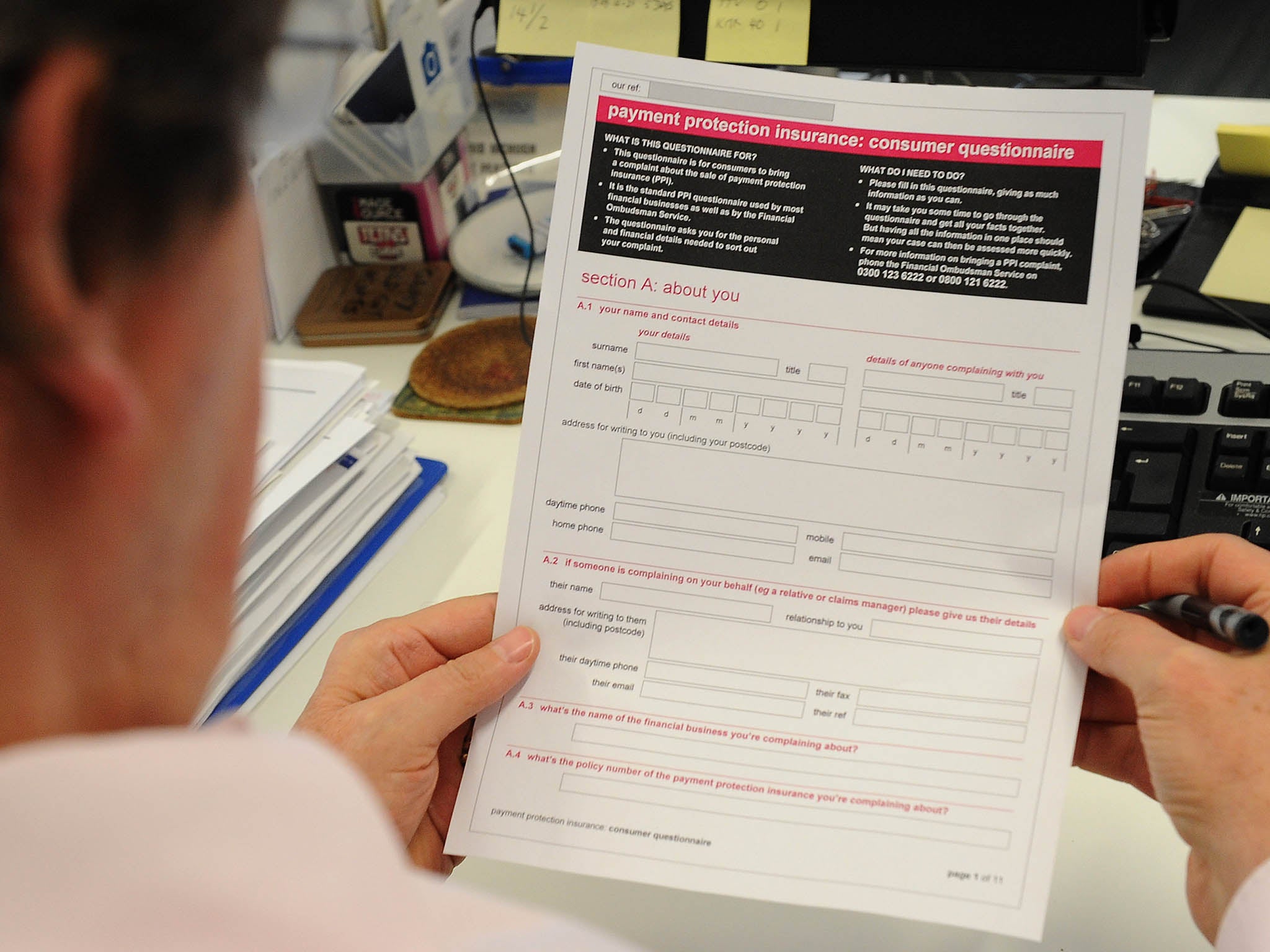

First of all, get in touch with your provider and ask for a refund. Do this before contacting the financial ombudsman as the provider needs the opportunity to respond before you escalate your claim. The spotlight on PPI mis-selling means the claims process is now easier than ever before and your provider will probably have an established system or process – either via phone, online or in some cases still with paper forms – that you simply feed your details into.

If you are unhappy with the response, feel a refused claim was unfair or are having trouble getting your provider to communicate with you, then it is time to contact the financial ombudsman – the body that deals with individual financial disputes – at www.financial-ombudsman.org.uk