Retirement income gender gap is the biggest in a decade

It’s time for women to embrace more risk

At first glance, the latest numbers suggest we’re all finally winning the battle for a comfortable old age.

Official figures out this week from the Department for Work and Pensions and the Pension Regulator show equal numbers of men and women are now saving into a workplace pension.

Even the number of employees asking to join who don’t automatically qualify – often women in part-time roles who don’t earn enough – has increased dramatically.

Commenting on the figures, Guy Opperman, the minister for pensions and financial inclusion, says: “It’s great to see a whole new generation of workers in big and small businesses putting money away and planning for a more secure future. The progress we’ve made towards eliminating the gender gap in pension saving is hugely encouraging.”

But the whole truth isn’t quite that upbeat.

We know that women struggle to match the retirement savings of men for a range of complex reasons. They earn less in the first place (currently around 9 per cent less on average) and their income, and therefore retirement savings, usually take a huge hit when they take time out to care for children or elderly family and friends – still a responsibility overwhelmingly taken on by women.

Blind spots

And then there’s the question of knowledge. Most of us don’t realise we can contribute to a pension while on parental leave, for example. And far more women – almost two-thirds compared with just over half of men – are unaware of the opportunities that could help them keep retirement savings on track, the Money and Pensions Service warned this week.

“Pensions are complex at the best of times, so raising awareness of the impact key life events can have on people’s savings is vital,” Gregg McClymont, the director of policy at the People’s Pension and a former shadow pension minister, says in response to the findings.

“In particular, at a time when the average female pensioner is £7,000 a year worse off than her male counterpart, we must do all we can to reduce the gender pensions gap, and ensuring women know they can top up a pension during parental leave is part of that.”

But awareness for savers is just one piece of the puzzle – policy changes are a must, he argues.

“Women only make up a third of the workers who are eligible for an auto-enrolment pension,” he explains. “Cutting the required earnings for an auto-enrolment pension to the primary national insurance threshold of around £8,500 would bring in nearly half a million new pension savers – three-quarters of whom would be women. And abolishing a current tax flaw would ensure 1.75 million low earners, the majority women, receive much-needed tax relief through auto-enrolment that they currently miss out on.”

But the problem of retirement income inequality isn’t just about shifting national policy, or closing the gender pay gap or making sure more women are enrolled in their employee scheme or know how to maximise their tax breaks and state benefits, or even ensuring we all know how much we need to save (only a fifth of adults do, the Pensions and Lifetime Savings Association warned this week).

It’s about all of those things as well as, frankly, encouraging women to prioritise their own finances when faced with the wider demands on their cash, like stuff for the kids or the mortgage or niggling debt.

Indeed, if the results of a recent freedom of information request by Hargreaves Lansdown are anything to go by – which even shows that 20,000 boys under 15 have had pensions set up for them compared with just 13,000 of girls under 15 – that’s a message that needs to be slammed home across the family from day one.

But closing the retirement income gap also has to be about getting women to be a bit more ballsy with the money they do have.

A little more risk

The common view is that women are, on the whole, more risk-averse than men. Endless studies show they’re far more likely to ensure what money they have managed to snatch from the circumstances of modern life is held in “safe”, straightforward vehicles that barely wash their faces after inflation.

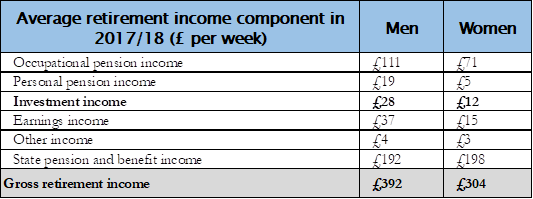

In fact, women typically received less than half the investment income of men in retirement last year – just £12 a week compared with £28 – according to data seen exclusively by The Independent.

Investment income includes interest payments, dividends and capital gains from the sale of securities or other assets that are derived from an individual’s investment portfolio.

The gender gap for income received from personal pensions is also significant, with men receiving nearly four times the amount of income from personal pensions compared with women last year – £19 for men per week versus £5 for women, research by financial adviser Salisbury House Wealth reveals.

And overall, the numbers are still going the wrong way. The difference in the amount of retirement income received by men and women was £88 in 2017/18, the latest figures available show. That’s up from £43 10 years ago.

Yes, income inequality in retirement largely stems from the gender pay gap. But some estimates suggest that could take another 60 years to close. And yet the situation is exacerbated by women continuing to overinvest in lower-risk, lower-return investments that are highly unlikely to generate the levels of income received by men.

“Here is yet another example of how entrenched the gender income gap is in retirement,” says Tim Holmes, the managing director of Salisbury House Wealth, who accuses some advisers of assuming women are risk-averse by default and simply pointing them to lower-risk, lower-return investments.

“Short of closing the gender pay gap, there are steps women can take to try to catch up with the income received by men. For example, investing more in assets with higher risk-adjusted returns, such as equities, from an early stage could help.”

He adds: “When saving for retirement it’s important to save as early as possible – there’s no secret. Working out your savings goals and investing accordingly is also important.”

For free, confidential help from independent, not-for-profit pensions specialists call the Pensions Advisory Service helpline on 0800 011 3797 or visit pensionsadvisoryservice.org.uk

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks