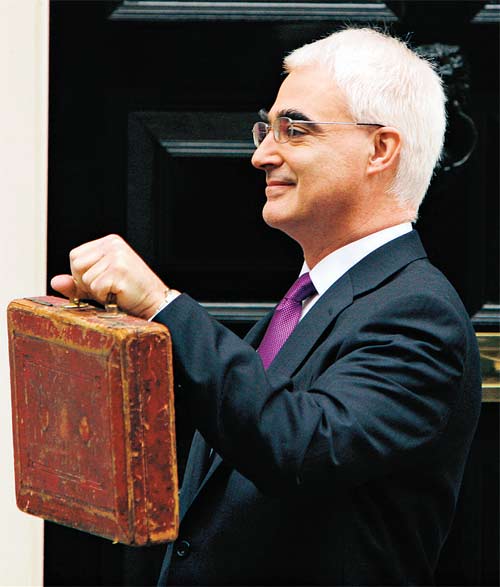

Will your finances be hit by the Budget?

A few people will benefit from Darling's decisions, a few will suffer, and the rest? James Daley finds out

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Alistair Darling's first Budget was of little consequence to the average British citizen. If you don't drink too much, smoke too much or drive a gas-guzzling car, you're unlikely to feel any difference to your bank balance whatsoever as a result of the various initiatives announced on Wednesday. However, if you either have children, are over 60 or are a claimant of tax credits, there were a handful of minor measures which may put a few extra pounds in your pocket every year. Furthermore, a raft of tax changes announced at last year's Budget are now on the brink of coming into effect – and these will also have a marginal impact on every taxpayer.

Child benefits

Mr Darling declared that eliminating child poverty was one of the main aims of this year's Budget and, as a result, introduced a handful of measures which will give a small amount of extra money to Britain's poorest parents. Those who qualify for child tax credits will get an extra £50 as of April 2009, while the Government will also stop counting child benefit in its means-testing calculations for housing and council-tax benefits as of October 2009. This will be worth up to an additional £884 a year for claimants of these benefits.

Child benefit for first-born children is also set to increase next April – to £20 a week. However, this is not quite as generous a measure as it may seem. Regular inflationary rises should have seen child benefit reach £19.50 a week by April 2009 – so Wednesday's announcement will only mean an extra 50p a week on top of that.

Savings

One of the more interesting new initiatives announced on Wednesday was the creation of the Savings Gateway – a scheme which will see the Government match the monthly savings of those on low incomes. To qualify, you'll need to be claiming either working tax credit, incapacity benefit, severe disability allowance, jobseeker's allowance or child tax credit (at the maximum rate). The scheme will match monthly savings up to £25 a month, but will not be introduced until 2010.

Although originally announced last year, the Chancellor also confirmed that annual ISA limits will rise from 6 April this year. Investors will now be able to put up to £7,200 a year into a stocks and shares ISA, or up to £3,600 in a year into a cash ISA. The Capital Gains Tax (GGT) rate will also change in April, from 40 to 18 per cent. But taper relief will also end, meaning some investors will see an increase in the amount of CGT they pay.

Income Tax

Changes to the income-tax regime were also first unveiled last year, but will come into effect next month. As of 6 April, the basic rate of income tax will drop from 22 to 20 per cent, while the starting rate of 10 per cent – which currently applies to the first £2,230 of income above the personal allowance of £5,225 a year – will be abolished. At the same time, national insurance bands will be widened, meaning that most people will pay less tax but more national insurance.

According to accountants Blick Rothenberg, these changes will amount to a net gain of around £333 for a single person earning around £32,000 a year. However, at the other end of the scale, someone earning a salary of around £10,000 a year will find themselves paying £100 more tax each year due to the abolition of the 10 per cent band – although this should be recoupable in tax credits.

As of April 2009, the national insurance bands will be increased again, and the higher income-tax threshold will also be increased to £43,000. This will help take thousands of individuals out of the top 40 per cent tax bracket, but will also see them paying more national insurance.

Pensioners

The sharp increase in fuel bills over the year has been a blow for most UK households. However, such price hikes tend to hit pensioners the hardest, as they spend more hours at home and as a consequence spend more on heating. To tackle this issue, the Government introduced the Winter Fuel Allowance a few years ago, and this week announced it was increasing it, to take account of the latest energy price rises. As a result, pensioners over 60 will receive an extra £50 a year, a total of £250, while those over 80 will receive an extra £100 a year, giving them a total of £400 a year. The Chancellor also put some pressure on energy companies to introduce more "social tariffs" for the least well-off households.

Cars

Another theme of this week's Budget was cleaning up the environment. As a result, Mr Darling announced plans to overhaul Vehicle Excise Duty, increasing car tax for people who own vehicles with high levels of carbon emissions, and reducing it for those with cleaner cars. As of 2010, those with cars that emit less than 130g/km of carbon dioxide will pay no car tax in their first year, while those who own cars that emit more than 225g/km will pay £950 in their first year.

One piece of good news for motorists was a delay (until October) in imposing the annual increase in fuel duty, due to the current high price of oil, which has sent petrol prices soaring.

Housing

There wasn't much in the Budget for homeowners. However, the Government confirmed an overhaul of its HomeBuy initiative, which will now offer some public-sector workers (such as teachers, firemen and nurses) a loan of up to 50 per cent of the price of their first home, repayable when they sell.

Drinking & Smoking

Drinkers were some of the hardest hit by the Budget, with taxes on alcohol set to rise by 6 per cent above inflation from Sunday. This will put 4p on a pint of beer and 14p on a bottle of wine, and the tax will continue to rise 2 per cent above inflation for each of the next four years. Tax on cigarettes also increased, putting 11p on a packet of 20.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments