The Analyst: Be aggressive now and profit in future

I really can't remember such a long period of unremitting gloom for the finance sections of newspapers and radio or television programmes.

Global markets have got off to their worst start for any year, just about ever. Banks in the United States are continually writing off vast amounts of money, the UK housing market is starting to fall and to top it all off, a rogue trader has lost a king's ransom for one of France's flagship banks.

You might think it is logical not to invest any money at all right now, but these are the times when investors can sow the seeds for future profits. This is what Ed Burke, the manager of the Invesco Perpetual UK Aggressive Fund, has been doing.

Mr Burke says that market sentiment is worse now than he can remember for a very long time. He agrees that the overall picture isn't especially good, but crucially he is finding compelling value in individual companies when the FTSE 100 index falls back below the 6,000 level.

The Invesco Perpetual UK Aggressive Fund is set up for a short, sharp recession, so if you don't believe that's what will happen then this clearly isn't the fund for you. However, if it does happen, then I would expect to see this fund at the top of the performance tables.

Ed Burke's long-term record speaks for itself; he has often been the person to buy when markets have hit the skids. He runs an aggressive portfolio where the largest 10 stock positions sometimes account for over 50 per cent of the fund.

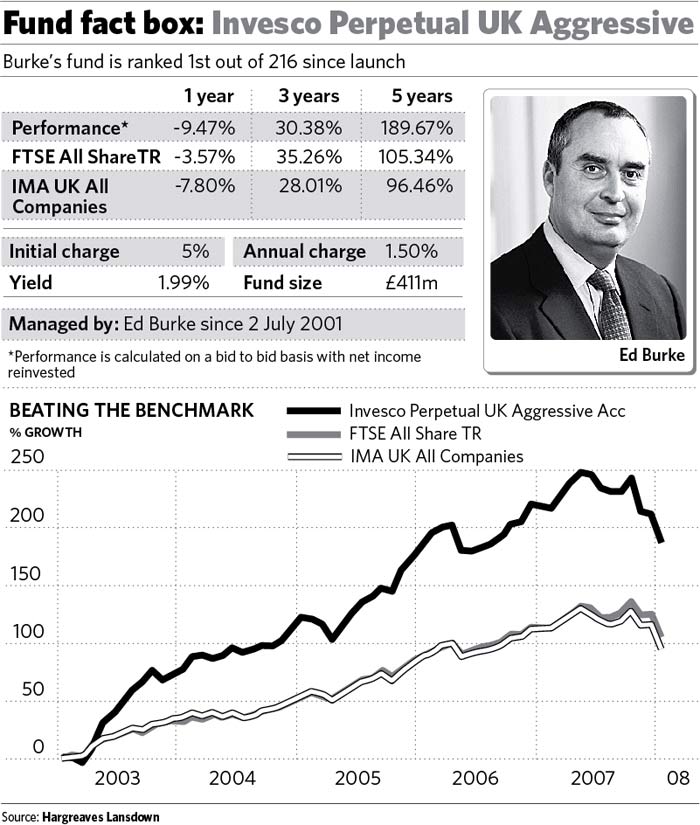

This strategy relies on his stock-picking ability for success, and in this regard he has proved himself exceptionally able. Since the fund was launched in July 2001, it is ranked first out of 216 funds in the highly competitive UK All Companies sector – the fund has risen by 131 per cent during that time, compared to a gain of just 37 per cent for the sector average.

Mr Burke admits that the last year has been rather more difficult. He has moved the fund up the capitalisation scale into the large companies of the FTSE 100, which is where he is finding the best bargains. The market falls of recent months have prompted him to move aggressively into the most beaten-up areas, such as financial companies and housebuilders.

His move into housebuilders such as Persimmon and Bellway might appear odd given the outlook for the housing market in the UK. However, Mr Burke points out that these two companies have strong balance sheets with long land banks. This means that they don't necessarily have to buy land every year, and if they stopped buying land for just one year, it would save them some £500m.

On banks – and unlike his colleague Neil Woodford – Mr Burke feels that the exposure of UK banks to the sub-prime problems is not as bad as the market fears. He has bought into Bradford & Bingley, the share price of which has suffered due to the fallout at Northern Rock. However, Mr Burke is convinced that Bradford & Bingley is far more robustly financed and has a much more varied business than Northern Rock. It recently raised more than £6bn of cash and is one of the most liquid banks in the UK. Despite this, hedge funds are still betting that the share price will fall; if they change their minds and unwind these positions, Bradford & Bingley shares could move back upwards abruptly.

All things considered, Mr Burke believes that UK companies are in far better shape now than during previous economic slowdowns. For example, British Airways' debt is very low (£250m) compared to where it was in the 1991 recession (£4.5bn).

I always like to ask a fund manager about shares that have performed poorly for them – sometimes spectacularly so. Some managers squirm in their seats and try to change the subject, but Ed Burke is a different breed. He was forthright in admitting the mistakes he made in buying Northern Rock last year when its share price was around 700p. I like the fact that he quickly realised that had been a bad move and sold his holding at about 500p – I'm sure that lesser managers would have stubbornly held on and watched the price plummet down to the bottom at 63p. Choosing when to sell is probably a more important decision for a fund manager than when to buy.

Mark Dampier is the head of research at Hargreaves Lansdown, the asset manager, financial adviser and stockbroker. For more information about the funds included in this column, visit www.h-l.co.uk/independent

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks