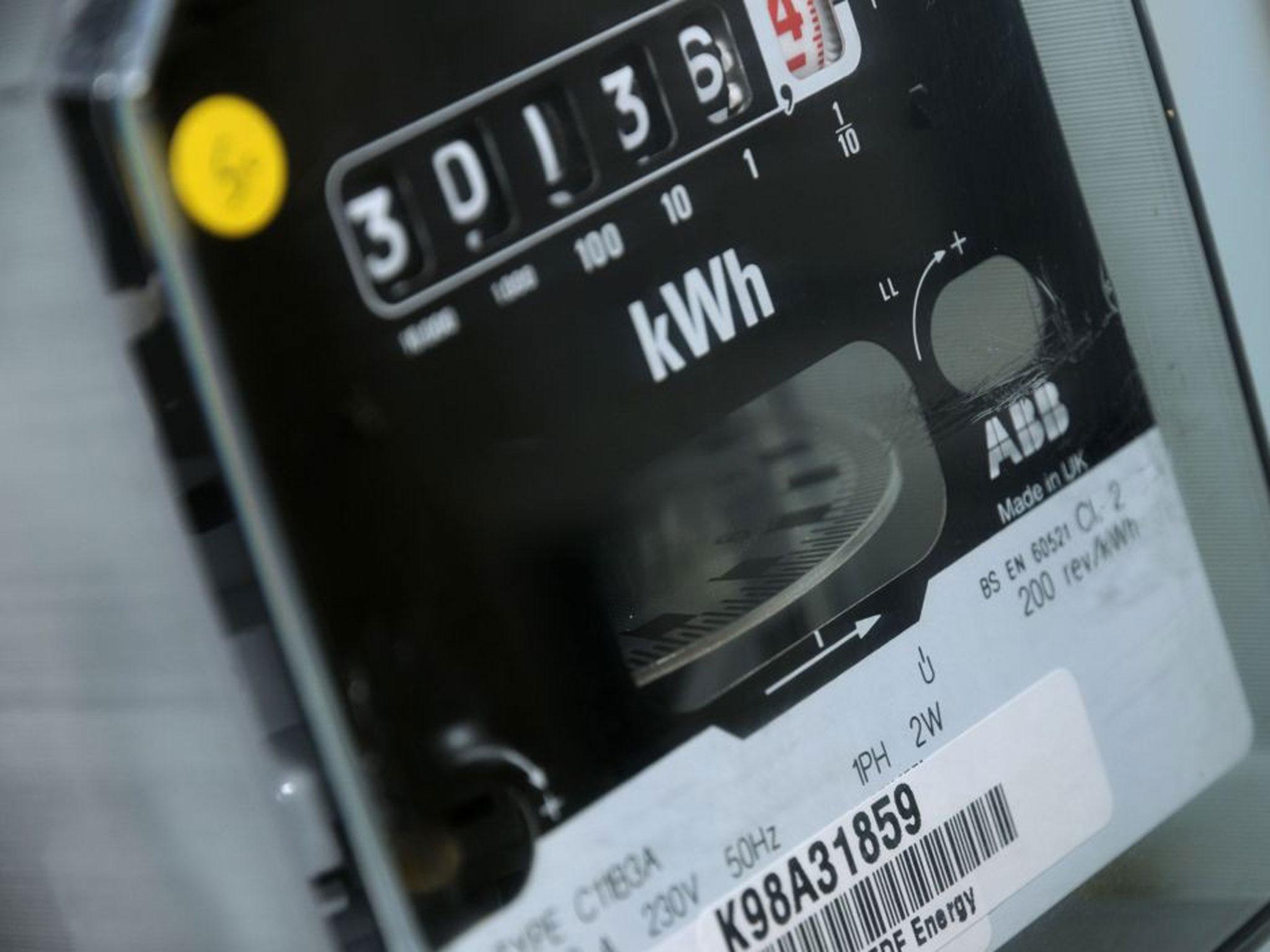

Questions of Cash: The house was empty - but British Gas decided the lights were on

The account was closed but then a debt-collecting agency demanded payment

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Q. I need some help dealing with British Gas.

My 91-year-old father moved into sheltered accommodation in May last year. I sent final readings to British Gas for his house and his account was closed. But debt-collecting agency Wescot Credit Services is now demanding payment of £434.26, covering a period during which the property was empty.

British Gas started to send bills to the empty property addressed to "The Occupier". The first one, dated 1 September, was for £243.52. I contacted the company by email to point out that the house was vacant and no gas or electricity was being used – and got an incoherent reply that seemed to blame it all on the standing charge. It still wanted the money, although from whom was not clear.

The property was owned by a trust at the time. I contacted the trustees and suggested they challenge the bill. Unfortunately they appear to have done nothing about it at all.

The property was empty from May to November 2014. British Gas wants £434.26 for the period. It is are demanding it from the trustees and the trustees have suggested my father should pay.

The house has since been sold, the trust is now wound up and my father was one of the beneficiaries. But it is wrong to expect him to pay the bill for a time when he did not live there. AC, by email

A. British Gas has agreed not to pursue you further for this debt. You cleared the account on the property in May last year – and in fact overpaid the account by £47.31, which British Gas repaid by cheque. It should have then closed the account with your father; instead, it continued to generate estimated bills. This led to the total outstanding bill of £434.26.

The company is now in contact with the trust, which has agreed to settle the bill – one that should be much smaller than the estimates.

A spokeswoman for British Gas says: "We apologise for this mistake and any distress caused."

What's our allowance after the IHT change?

Q. I am a widower – my wife died eight years ago. Until the last Budget, our inheritance tax [IHT] allowance was £325,000 for me, plus £325,000 for my wife, providing a combined allowance of £650,000. But under the Budget my allowance is now £500,000. What is the additional allowance for my wife now? BR, by email

A. Gill Smith of the accountancy firm Moore Stephens responds: "From 6 April 2017 there will be an additional IHT nil-rate band when a residence is passed to a direct descendant, as well as the existing £325,000 band.

"This will be £100,000 in 2017-18, rising in increments of £25,000 to £175,000 in 2020-21. After that it will increase in line with the consumer prices index. Therefore your total nil-rate band will not be £500,000 until 6 April 2020.

Your wife's additional nil-rate band will transfer to you on your death, at the then current rate, irrespective of when she died. So by 2020-21 your total nil-rate band will be £1m (assuming that none of your wife's basic nil-rate band was used on her death, because she left all her estate to you).

The flight wasn't so cheapo in the end

Q. I was overcharged by CheapOair for a flight booking from Faro to Luton. I have asked why the amount stated on the booking confirmation was different from that charged to me.

CheapOair informed me it would provide a refund in five to 14 days, but it has not done so. The amount is small – £7.53 – but I wonder if this has happened to other readers? JP, by email

A. We have not received any similar complaints from readers but we took your complaint up with the company, which is now processing the refund.

A spokesman says: "CheapOair has spoken to [the reader] to apologise for frustration caused. CheapOair is reviewing its customer service process and customer communications. [The reader's] experience does not reflect the high standards we strive to offer."

Up in the air over the luggage allowance

Q. I booked a holiday last November with Thomson and paid £90 extra to upgrade the luggage allowance to 20kg for five people.

I have now printed the e-tickets and realise the flight is with Jet2.com, which I know allows 22kg for luggage.

My local travel agent informs me it can refund the £90, but that I would then only have a 15kg luggage allowance as the holiday is with Thomson.

It seems unfair that we have different conditions from other passengers on the Jet2 flight. JB, Nottinghamshire

A. Thomson says it was unaware of your concern, which was not communicated to it.

Your luggage fee has been refunded and you can avail yourself of a 22kg luggage allowance

Questions of Cash cannot give individual advice. But we'll do our best to help if you have a financial dilemma. Email us at: questionsofcash@independent.co.uk

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments