New ISAs: Government set to include peer-to-peer lending in tax-free savings accounts

Peer-to-peer lenders can offer higher returns to savers but come with much higher risks

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.The Government is set to confirm plans announced in March's Budget to include peer-to-peer loans in tax-free Isas.

P2P loans offer much higher returns to savers than normal deposit accounts, but come with much higher risks.

People who use the online platforms can usually get 6-10 per cent returns, compared to around 2 per on savings accounts. The money is lent to small businesses or individual borrowers.

But the risky nature of them led to fears that including them in an Isa would lead to people taking on more risk than they are happy with.

To counter that the Government has set up a consultation with the P2P industry and consumer bodies to ensure that potential investors understand that the loans carry greater risk, which is why they pay higher returns.

Of particular concern is the fact that the loans are not protected by the Financial Services Compensation Scheme.

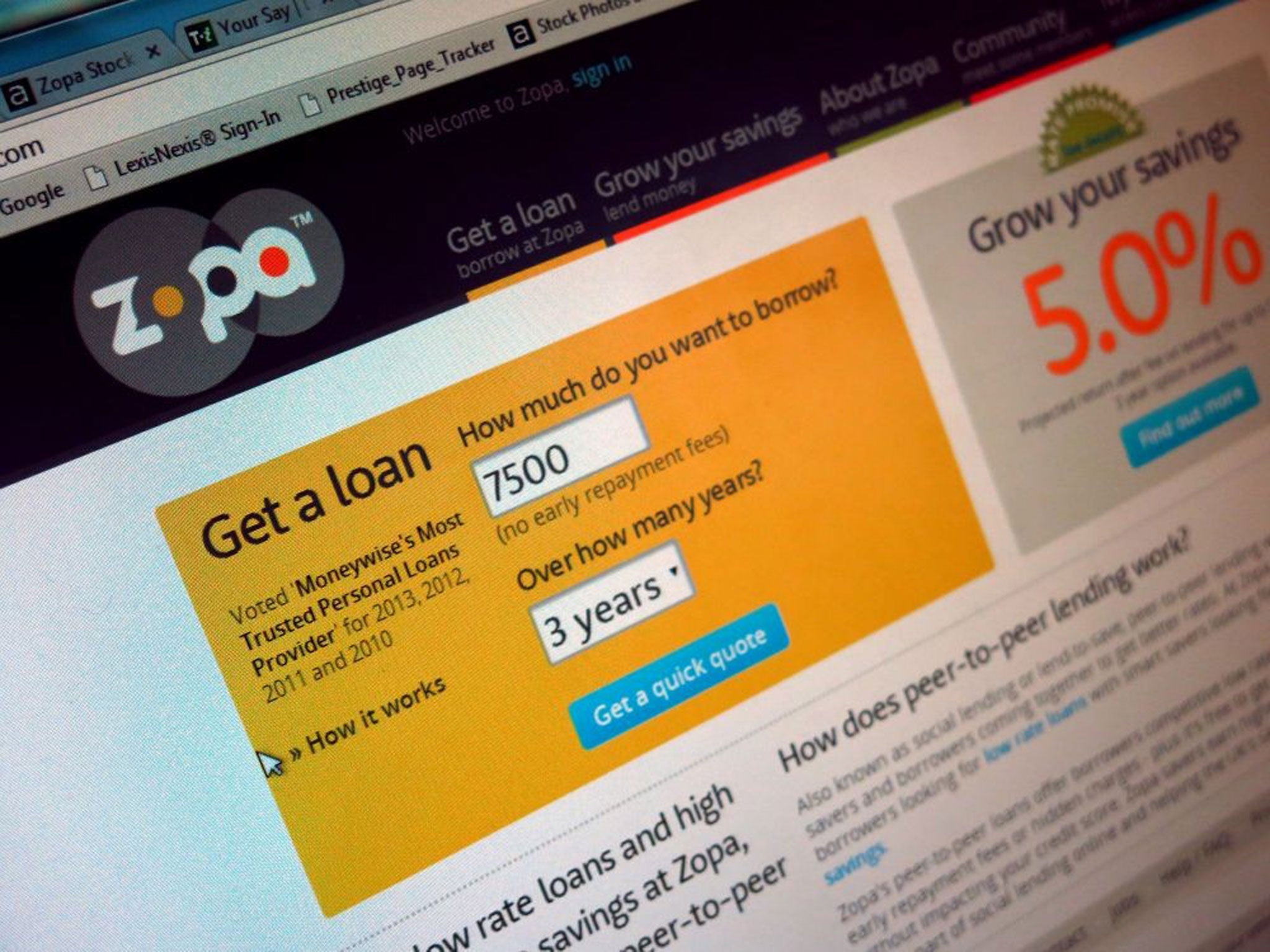

But that has not detered P2P fans who have to date loaned £1.6bn through such sites as Zopa, Ratesetter, Funding Circle and ThinCats.

A Treasury consultation paper is due out today to explore how P2P investments can become Isa-able and the new P2P Isas are expected to be launched to the public next April.

At present people can invest up to £15,000 in a tax-free Isa, whether in shares, funds or deposit accounts. It was expected that any investments in P2P Isas would have to be included as part of the overall £15,000 allowance.

But rumours have begun circulating that suggest that P2P Isas may be launched in addition to existing Isas.

As the consultation is set to launch, P2P chiefs said the move will be a major boost to their industry.

Samir Desai, chief executive of Funding Circle, which uses P2P lenders’ cash to loan to small businesses, said: “Inclusion of peer-to-peer lending within Isas will be another stamp of credibility on our sector. Not only will it give investors a better deal, but it will help even more small businesses access the finance they need to grow, which in turn helps the economy. It's a win, win win.”

Kevin Cayley, managing director of ThinCats, which also lends to small businesses, said: “Today’s announcement is another colossal step for the P2P industry that could give people access to a new standard of return on their Isa.

“Consumers could now have the opportunity to earn significantly more interest on their tax free savings allowance and help UK SMEs grow.”

Investment expert Danny Cox, head of financial planning at Hargreaves Lansdown, was more cautious. He said: “P2P is an interesting market and one where lenders can substantially improve their headline rates of return compared to cash accounts. But investors are heavily reliant on the credit checks and risk assessments performed by P2P firms and must understand the risks that borrowers may not pay back all of the interest or the capital.

“It’s still a relatively immature market and, unlike a savings account, investors have no FSCS protection. However regulation of the industry from last April and the potential for Isa next year increases the market’s credibility.”

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments