Knowledge gap leaves Britons vulnerable to money laundering criminals

More than 70% of consumers have never heard of the term ‘money mule’ and few are aware of the true risks associated with becoming one

A major new social experiment suggests millions of Brits would be prepared to take on an illegal job as a money mule, highlighting significant failings in our understanding of the risks of laundering stolen money for criminals.

Money mules, who are tasked with withdrawing and transferring money to other accounts while keeping a small proportion themselves, are often unwittingly recruited by seemingly innocent adverts regularly linked to activity including organised crime, people trafficking and terrorism.

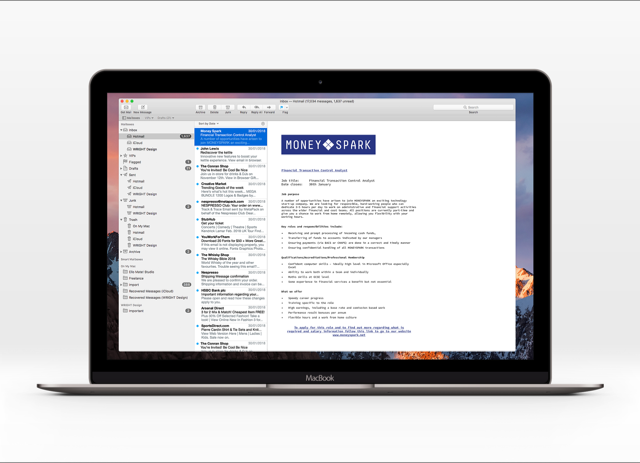

To test whether we would understand what we’d be letting ourselves in for, entirely legit international bank Santander presented 2,000 British adults with a falsified job description to work at a fictitious company called Money Spark as a ‘Financial Transaction Control Analyst’.

Details of the role included ‘receiving and processing of incoming cash funds’ and; ‘transferring of funds to accounts indicated by our managers’.

While some people were suspicious of the description of the role and spotted the tell-tale spelling mistakes and bogus link in the ad, one in three said they would definitely apply for the job if they were looking for work.

In fact, one in four said they would leave their current job to join the Money Spark Company. What’s more upon learning the job was a front for criminal activity, almost one in ten said they would accept the job anyway. Only 15% correctly spotted the role was for a money mule.

The experiment threw up huge gaps in public knowledge that could leave retail banking customers exposed to potentially life altering risks, including a jail sentence for money laundering.

While we’re familiar with this phrase, more than 70% of consumers have never heard of the term ‘money mule’ and few are aware of the true risks associated with becoming one.

More than two thirds of the ‘applicants’ in the study failed to realise that becoming a money mule and partaking in the movement of stolen funds (unwittingly or not) could lead to a jail term in excess of three years. A quarter of people expected any punishment would be no more than a fine or a warning.

Money launderers can in fact face a maximum prison sentence of 14 years.

This form of criminality is an increasing problem, with the latest official statistics showing that the number of Britons using their bank account for money mule activity has grown by 55 per cent in the past year. Around 4 per cent of respondents to Santander’s research believed they, or someone they knew had been approached by a criminal looking to recruit money mules, with this figure doubling to eight per cent for those in the age bracket 18-24 years – that’s around 453,360 young adults across the UK.

Chris Ainsley, Head of Fraud Strategy at Santander UK, commented: “Criminals often target vulnerable people, such as those desperate for a job, and our research illustrates how easily some people can be tricked into falling victim.

“We are seeing a rise in the number of fake job ads such as the one used in our experiment and raising awareness of the issue is key to preventing people unwittingly getting involved, and ultimately facing life changing consequences for their actions.”

Youth is certainly a risk factor. There was a 75% increase in the misuse of bank accounts involving 18-24 year olds during the first nine months of 2017, according to data released late last year by Cifas, the UK’s fraud prevention service, and Financial Fraud Action UK (FFA UK), which works against financial fraud on behalf of the UK payments industry. The vast majority of this was money muling.

“Money muling is money laundering and criminals are using young people as mules in increasing numbers. We know that students are particularly vulnerable as they are often short of cash,” warned Katy Worobec, head of fraud and financial crime prevention, cyber and data Sharing, at UK Finance - the organisation behind FFA UK.

The organisations have jointly launched a ‘Don’t be fooled’ campaign to highlight the risks and make clear the kind of serious crimes a mule would be facilitating.

"When you’re caught, your bank account will be closed, making it difficult to access cash and credit. You could even face up to 14 years in jail. We’re urging people not to give their bank account details to anyone unless they know and trust them. If an offer of easy money sounds too good to be true, it probably is.”

“This is a serious issue that not only has consequences for the money mule, but for society as a whole,” added Simon Dukes, Chief Executive of Cifas.

“The criminals behind money mules often use the cash to fund major crime, like terrorism and people trafficking. We want to educate young people about how serious this fraud is in the hope that they will think twice before getting involved.”

More information about ‘Don’t Be Fooled’ can be found here. www.moneymules.co.uk

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks