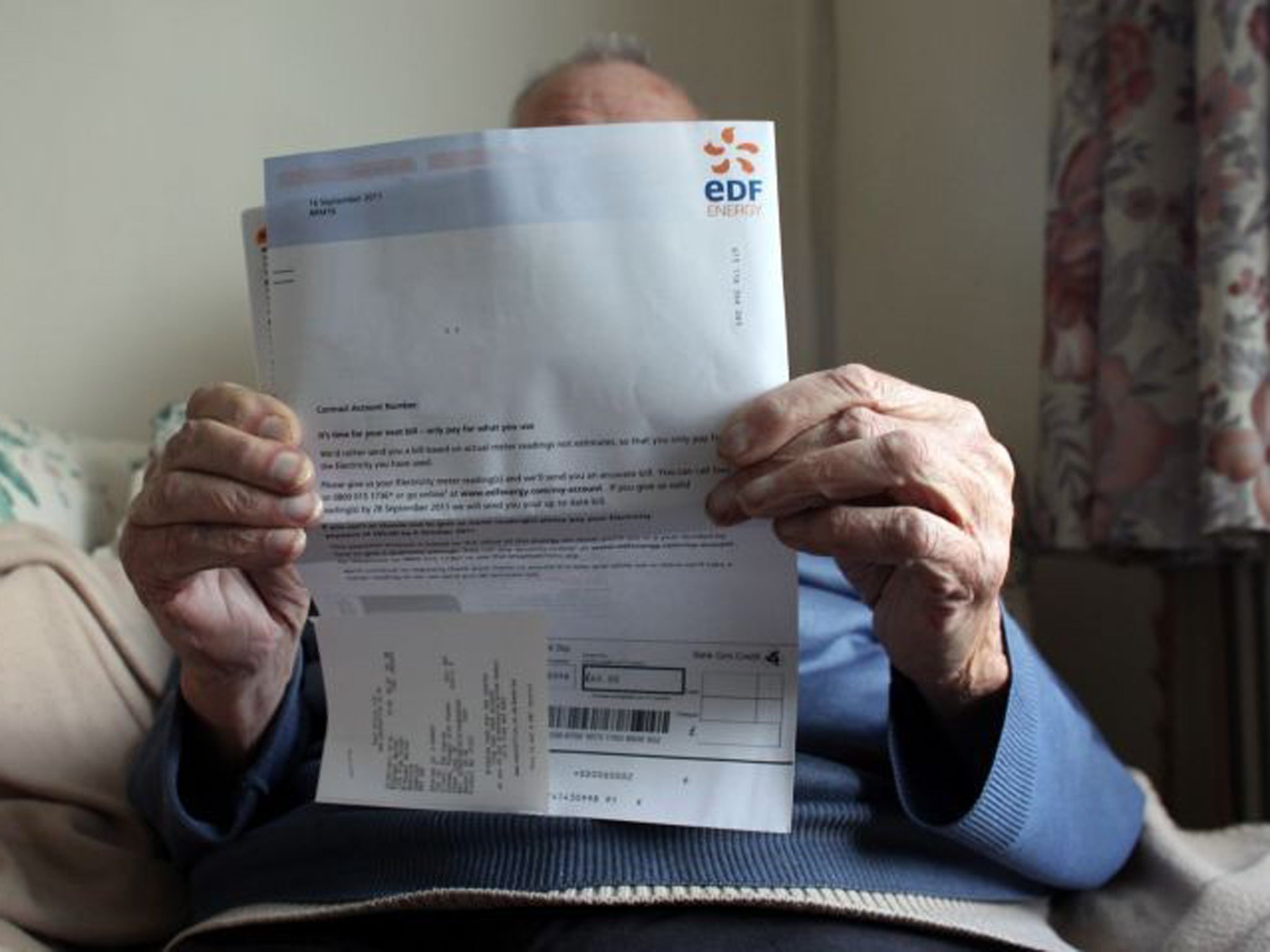

Julian Knight: Rising prices and lower annuities prey on the elderly

Retirees suffer a higher rate of inflation, so it's vital they make the most of their pension pot

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.No group feels rising prices as keenly as pensioners. They're usually on a fixed income and many of the items which seems to be rising the fastest at the moment such as energy and food makes up a large proportion of their spending.

In fact, according to Hargreaves Lansdown, a financial advice firm, the real rate of inflation affecting the elderly is at least 0.5 per cent above that for the rest of us and with a host of energy price rises about to come on stream, the lot of pensioners is likely to get worse. This makes it key to maximise the amount of income your pension pot buys in retirement.

But from 21 December, thanks to the EU, all insurers will have to ignore sex when pricing annuities despite the fact that men on average live four years fewer than women. This means that the annuities paid out to men could be cut by as much as 12 per cent, and that's a cut that will be felt month in month out for the rest of their lives – which could be as long as 35 years.

However, it has been long suspected that women's annuity rates, although they will probably rise, won't take up the slack. In effect, men will get much poorer and women will get only a little richer.

A lot of the coverage relating to the EU ruling has been on its impact on car insurance premiums. Frankly, this is minuscule in comparison to annuities and is yet another example of how we as a society live for the here and now rather than the future. But this week the likes of Prudential have already moved – in advance of 21 December – to gender neutral annuity pricing, others like Scottish Widows may move very soon.

If you are a man over 60 with a pension pot you should today look at your annuity options – speak with your financial adviser as a matter of urgency. Even leaving it a week or two maybe too late as it takes time to convert a pension pot into an annuity. Fortunately, most firms do offer to hold an annuity quote for a period of around a month but, make no mistake, the amount of money you will receive a couple of months from now will be lower.

Longer term, with the Government pushing out ultra low paying debt it's likely that annuity rates will fall further.

Of course, there is a minority of people – particularly with bigger pension pots (over £250,000) – who are better off leaving their money invested but, for the rest, failing to weigh up the options now could potentially cost thousands even tens of thousands of pounds. With the rising cost of living so high for pensioners, that's money that could be badly needed.

New scandal same old story

It may not be as dramatic or as damaging a scandal as payment protection insurance but for the umpteenth time the financial services industry has been found with its fingers in the till.

This time its largely useless identity theft and card protection insurance. Basically this was the age-old wheeze of persuading people to pay for cover that they already had. In particular, customers were told that they were covered for up to £100,000 if their card was stolen completely ignoring the fact that the card issuer was duty bound to cough up anyway.

The Financial Services Authority has fined the insurer CPP £10.5m – that's with a 30 per cent discount. Reading through the FSA declaration it's like PPI in microcosm – pushy sales techniques, misleading marketing material and plain and simple greed.

How many more of these scandals do we have to go through?

A true Celtic tiger

Regular readers (hello Mum) may have noticed my absence from the Money pages for the past three months. I have been covering economics for the paper. In particular writing about all things eurozone.

Part of the job was to keep a keen eye on the rock and roll world of bond markets and sovereign debt and how the ratings agencies grade countries. Last week, an agency Fitch upgraded Irish government debt. Five years on from the financial crisis Ireland's bonds are no longer considered junk.

It's been a painful process which is nowhere near over, but the Irish have borne it with real guts. They recognised their problems early, didn't run away from their debts nor rioted in the streets like the southern Europeans. The nation has shown it is truly tigerish.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments