Julian Knight: Let's make the very most of peer to peer lending

P2P is better than banks for financing business... and now it could end up in Isas as well

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.I hope this is more than just kite flying, but I have been contacted by two senior figures in the peer to peer lending industry in the last week and told that they believe the Treasury is close to agreeing to allowing P2P savings to be placed in individual savings accounts (Isas).

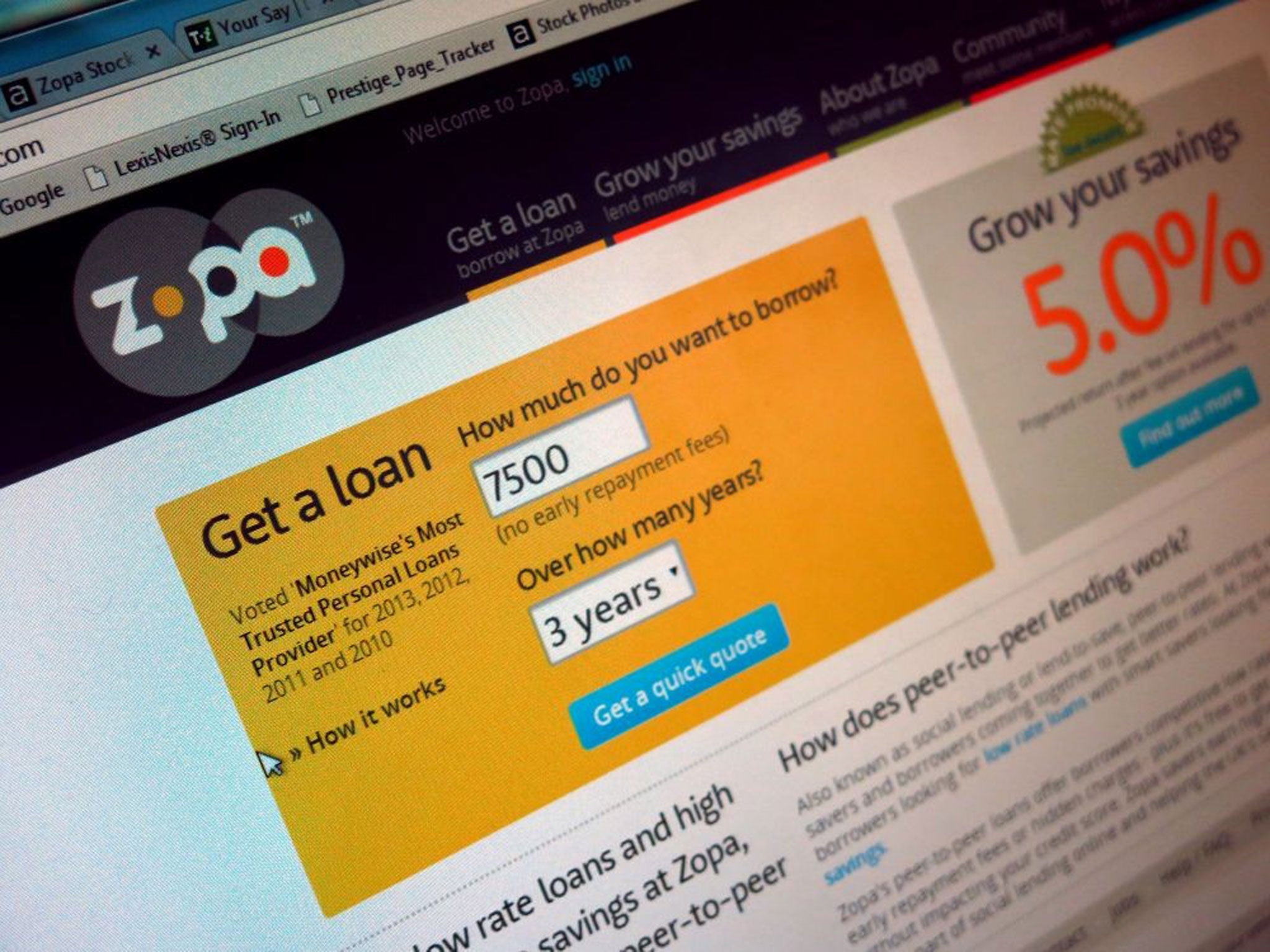

I have been a fan of P2P lending since the advent of Zopa nearly a decade ago.

As a concept it has many things to recommend it. Firstly, it allows money to circulate easier around the economy as it brings savers and borrowers together in a safe environment.

Savers' cash is pooled together and lent to multiple borrowers thereby reducing risk, and over the past decade the default rate on these types of loans has stood good comparison to the banks'.

Borrowers really appreciate not having to go to the banks too. I was with a group of entrepreneurs at a breakfast meeting and as always the subject of lack of financing from the banks was brought up.

But this time around many just said that they were no longer bothering asking banks for finance but were finding loans from the like of Funding Circle, which is a P2P firm which specialises in lending to business.

It's not that P2P lenders are being loose with their criteria, it is that they seem less bureaucratic and frankly bloody-minded than the banks.

You would be shocked at the way in which successful and long-established business people are being forced to place their homes as collateral by the big banks.

However, as yet P2P lending is relatively small - we need much more of it as returns to savers are higher than inflation in the main and it allows business to invest and create jobs.

Allowing people to place a P2P investment in an Isa will boost the amount of capital flowing into this sector enormously. Everyone will be a winner: savers will enjoy tax-free returns, businesses will receive finance, banks will have greater competition, and the Treasury will enjoy the extra tax revenues that come from economic growth and higher employment as a result of increased business investment.

As I say, I hope this is more than a kite and a real possibility.

Message meltdown

Payday lender First Financial has been fined £175,000 by the Information Commissioner for sending millions of unsolicited text messages.

All fairly run of the mill until you look at the content of some of the messages sent, which seem to be sinister at best. One popular message read: "Hi Mate hows u? I'm still out in town, just got £850 in my account from these guys www.firstpaydayloanuk.co.uk.".

More than 4,000 complaints were made about such messages as they seemed to come from friends of the recipients. The Information Commissioner said the firm had attempted to cover its tracks by sending the messages via unregistered SIM cards.

However, the blatant citing of the company's internet address in text messages meant it didn't take a rocket scientist to work out who was behind the spam texts.

The Commissioner said in the judgement that the public "was fed up with this menace and they are not willing to be bombarded with nuisance calls and text messages at all times of the day trying to get them to sign up to high-interest loans."

However, you don't need to sell too many high-cost loans to make £175,000 and I have long thought that the Information Commissioner ought to be levying far higher fines and have the same powers as the Office for Fair Trading, where they can stop firms from trading when it is shown they are a detriment to consumers.

Personally, I can think of no circumstances where a lender should be able to cold call you at home or send you a text message unsolicited.

It is simply an unwelcome intrusion.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments