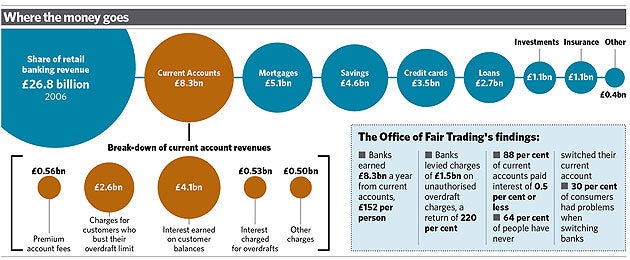

Free banking is a myth: charges on current accounts reach £8bn a year

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Britain's biggest high street banks are making £8.3bn a year from customers' current accounts, exposing as a myth the notion of free banking, the Office of Fair Trading said yesterday.

Publishing a review of the UK current accounts market, the OFT said that Britain's high street banks were failing their customers, and the market was in urgent need of reform.

The report revealed that banks are currently charging their customers more than £2.5bn a year in charges for going over their overdraft limit. The OFT also criticised the banks for the complexity of their charges as well as their lack of transparency, claiming such opacity made it impossible for customers properly to compare current accounts.

Of those who incurred bank charges in 2006, almost 40 per cent were affected six times during the year. Furthermore, the report said, fees had increased dramatically over the past few years, some by as much as 75 per cent.

The OFT expressed particular concern that very few people move banks. Only one in three people in the UK has switched current account provider, one of the lowest rates in Europe.

Although the OFT now plans to consult on possible remedies to improve the market, it warned that it would not be afraid to force a new regime on the industry if it could not come up with a voluntary solution. "This market is not serving consumers well," said John Fingleton, the chief executive of the OFT. "Customers lack the information they need to choose the best deal and this, in turn, weakens the banks' incentives to compete. There is much the banks could do to improve how the market works, and we hope this report will encourage them to take steps to do so."

Consumer groups welcomed the report. "This report concretes the fact that there's no competition on charges," said Martin Lewis, of moneysavingexpert.com. "People are unaware of what they're paying, the fees bear little relation to the cost and society's poorest are subsidising the richest. It's time the Financial Services Authority's hold on reclaiming [bank charges] was lifted, and people were allowed to reclaim all the cash unlawfully taken from them.

Although thousands of customers have demanded that the banks refund their charges – after a campaign launched by The Independent almost two years ago – the FSA has granted the banks a waiver on all claims until the current test case has completed its passage through the courts. That is unlikely to be for at least another year.

"No other type of institution can take your money without asking; they need to bill you and if you disagree take you to court," added Mr Lewis. "Banks hold a unique position of trust; they can simply delete our money without question. The OFT is providing more evidence that this trust has been abused, and it's time it was sorted out."

The British Bankers' Association said: "The OFT's market study contains many good points but some of its numbers are difficult to rationalise as they use assumptions and averages and, importantly, do not recognise the costs of providing the services.

"[The OFT's] own survey found very high satisfaction rates [with the banks] with one in three people keeping a close watch for better deals.

Also, a recent study for BBC television's Watchdog programme found customers stayed with their bank because they were happy with the service and products they received and felt they would do no better elsewhere. It was not because they were either unaware of how to switch or because they felt it was too complicated....

"Banks are keen to ensure customers can continue to use their current accounts for day-to-day transactions without paying fees – as more than four out of five do now. In the UK customers do not pay a fee for their normal banking services and interest rates on savings accounts are high.

"This model is recognised as being one of the best in the world as elsewhere it is common to have to pay for using cash machines, direct debits and more. We will actively work with the OFT and our customers to continue to offer the best deals and services that we can."

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments