Derek Pain: I'm biding my time before any Amerisur plunge

No Pain No Gain

I have never been particularly keen on resource shares. During my 50-plus years attempting to appreciate the City's often peculiar ways, I quickly came to the conclusion that they were far too risky. Indeed some minor oil and mining stocks seem to exist merely to soak up cash from their shareholders (and others), offering little, if anything, in the way of returns.

If any element of the stock market deserves the casino sobriquet it is the sector housing minor resource shares. For many years I refused to be sucked into what is little more than investment gambling. I know investing in any small company – even some big ones – can be speculative but there seems little doubt that the risk-reward ratio when it comes to the minor resource stocks, often operating in politically unstable countries, is heavily weighed against the investor.

But there is no doubt that resource shares, despite past disasters, have achieved a strong, not to say diligent, following in the past decade or so. Advanced technology has, hopefully, reduced the risk aspect of exploration and some spectacular profits have been garnered by investors who have been brave and fortunate enough to land on winners.

Although my embedded instinct was to continue to avoid explorers I felt the no pain, no gain portfolio was missing out by completely ignoring them. So it alighted on Nighthawk Energy, an oil and gas group operating in the politically safe United States. A 44p investment quickly shot to 107p. I was happy to achieve such a success. But my joy turned to sorrow as Nighthawk stumbled and the portfolio sold at a heavy loss. The shares as I write are around 3.8p.

Undaunted I decided to have a fling with Northern Petroleum. A 68p purchase went to around 95p before the stock market experienced doubts and my second oil venture is now one of the five lossmakers in the portfolio. I am still hopeful that Northern will come good and there are some high-flying estimates that should support my view. In the meantime I cannot help wondering whether I have enlisted another disappointing stock.

But hope springs eternal. Much to my surprise I find myself considering another oil play. I have yet to make up my mind whether to recruit Amerisur Resources to the portfolio but I must say the South American-focussed oil and gas group seems to have plenty going for it.

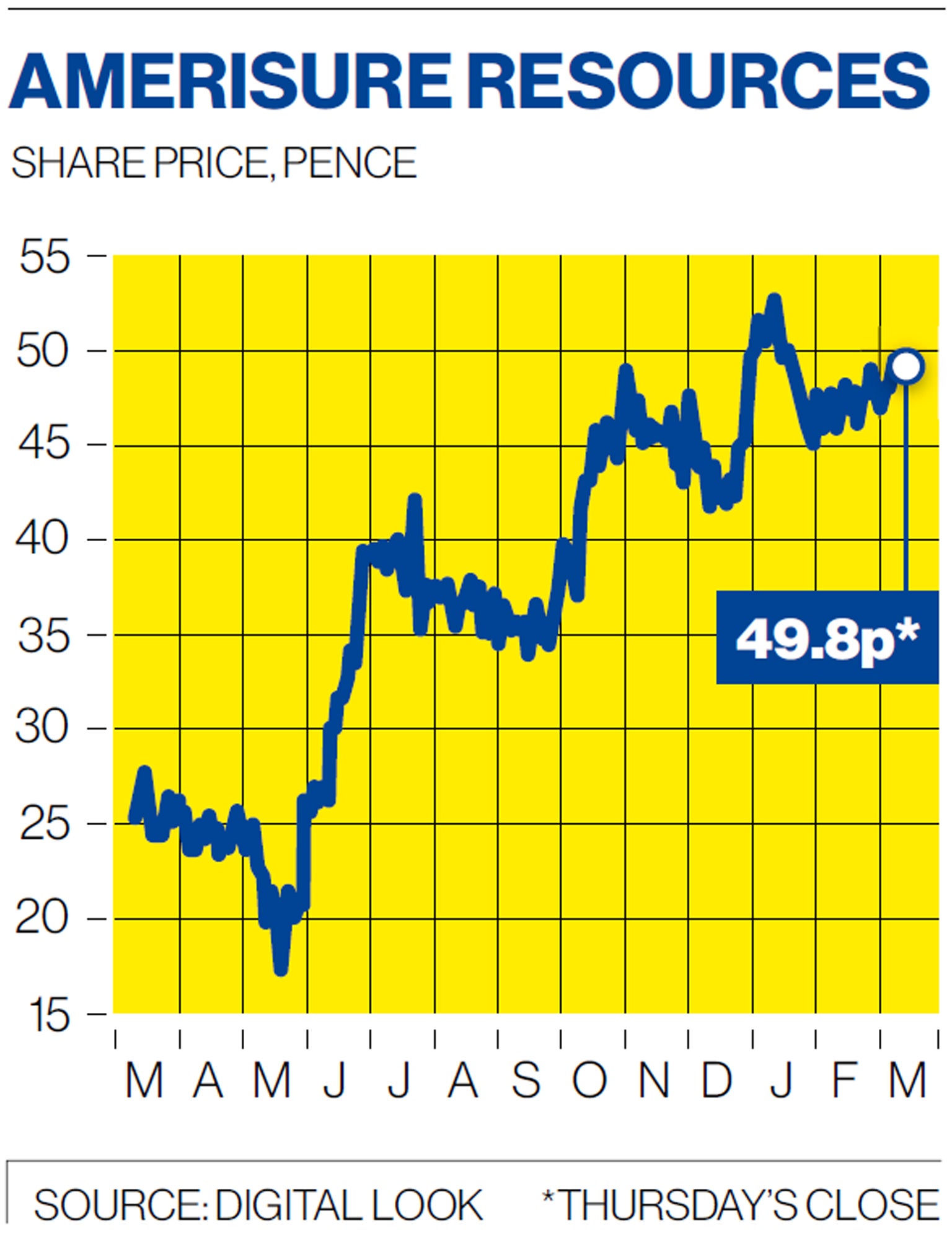

Amerisur was off my radar and my interest stems from a reader who drew my attention to the group. He clearly believes it offers a rewarding future. I must admit I found his enthusiasm infectious. But I cannot help wondering if the shares are up with – even ahead of – events. They are hovering near their peak at around 49p, having risen from 5p since 2009. Since May the price has climbed from 20p. At 49p the shares are selling at a stratospheric times historic earnings. But that mind-boggling ratio comes down to 15 if, as stockbroker Oriel Securities predicts, last year's profits emerge at some $61m (£41m). For this year about $206m is forecast. Oriel has a 62p target price.

The group is no longer a tiddler, enjoying a £503m capitalisation following the share upsurge. It operates in Colombia and Paraguay, where it has exploration and production assets. The chief executive is John Wardle, who has many years' experience of South America and its energy potential. He is expected to attend a City investment lunch next week. There is speculation about the group's future newsflow with suggestions new exploration exploits and indications of higher production will be announced soon. It is believed Amerisur has the ability to sharply increase not only its production but the amount it sells.

It does seem a nice story. And despite the strength of the shares the portfolio may yet invest. However, I think it prudent to wait for the bullish bulletins the stock market – and my reader – are convinced are on their way.

Until then the oil interest will be confined to Northern Petroleum. It has production and exploration interests in Britain and Europe but its popular claim to fame is a tiny interest, just 1.25 per cent, in what could be a rich field off the coast of – yes, South America.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments