David Kuo: This could be the year that brings Japan out of the doldrums

Investment Insider

The future looks promising for Japan, according to new figures released by the Organisation for Economic Co-operation and Development (OECD).

The Paris-based think tank said that its leading indicator of economic activity for members countries rose for a third consecutive month in November, adding that Japan is showing "clear signs of accelerating economic activity".

The fact that Japan has been singled out by the OECD to grow quickly is noteworthy. The East Asian archipelago's economy has at best been moribund in recent years. Many investors are wary about investing in Japan and they are probably right to do so. But it is important to look beyond Japan's domestic problems and focus on valuations.

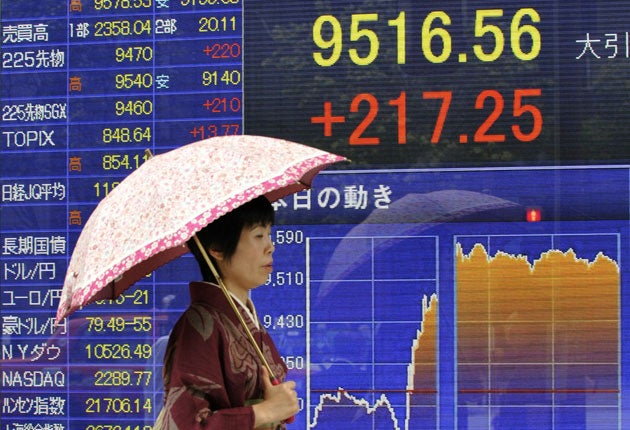

The market is valued at about 16 times earnings, and the dividend yield on Japanese shares is 1.8 per cent – about 50 per cent higher than the yield on 10-year Japanese bonds. Normally, you would expect bond yields to be higher than dividend yields.

Shares on the Japan stock market climbed from a low of 8,824 points at the end of August to 10,510 points today – a rise of 19.2 per cent. And it is still the world's third largest economy behind the US and China. There have been stellar performance from Isuzu Motors, Fuji Electric and Hitachi. Shares in Isuzu topped the list of high performers in the Nikkei 225 index last year. Likewise, shares in Fuji Electric rose almost 60 per cent, and those in Hitachi by 50 per cent.

If global economies expand, it is hard to see how export-led Japan can fail to benefit.

David Kuo is director of financial website Fool.co.uk

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks