Chinese changes may offer investors new hope

China has unveiled reforms to overhaul its economy. How should investors react? Simon Read asks the experts

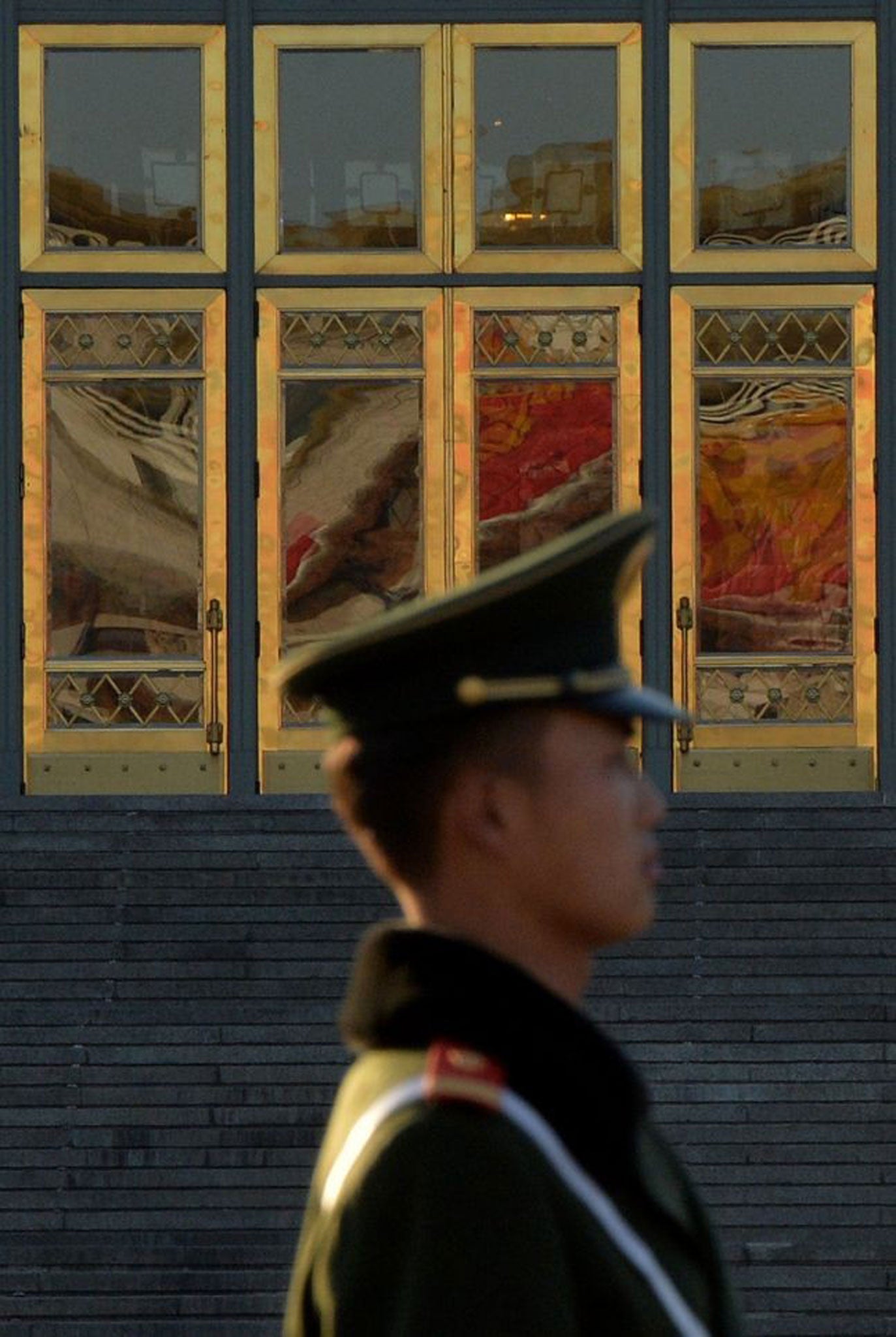

A top-level annual meeting of the main Chinese Communist Party officials this week – known as the third Plenum –resulted in a statement that there will be significant reforms under the recently elected new president and premier during their decade in power.

But does that mean investors should flee or rush to invest in the region as a result? "We must approach announcements about economic and social reform with a degree of caution," said Dean Cook, investment analyst at Duncan Lawrie. "Given China's size, it cannot overhaul its long-established institutions overnight, but this week's events have set a positive tone from which real change may soon occur."

He said that if China is committed to the reforms, then foreign investors can also think more seriously about committing to investment in the region. "Real economic growth and investment opportunities can present themselves, but only if these statements of intent are translated into action," said Mr Cook.

"Overall, the statement is as detail light as we had expected," said Craig Botham, emerging markets economist at Schroders. "But the changes it hints at are positive ones, and we see signs of genuine attempts to rebalance and reform.

"Any reduction in state control and regulation is to be welcomed. Still, the emphasis on continued public ownership suggests the process will be a gradual one at best."

Brian Dennehy of FundExpert.co.uk believes the outlook now for China is positive. "Most experts are anti-China, largely due to the debt issues and also because they don't believe China can switch quickly enough to a domestic-focused economy before the demographic time-bomb blows up," he said.

"However I would point out that the Chinese stock market is cheap, and sometimes all or most of the bad news is already priced into the market."

As such he believes there will be growing opportunities at a company level. "These will be exploitable through a fund focused on under-researched small and mid caps, such as Fidelity China Special Situations, Fidelity China Consumer, Threadneedle China Opportunities and Henderson China Opportunities," said Mr Dennehy.

The economic transition in China will certainly take years, he conceded, and it is not clear how and when this will be reflected in their stock market. "So for believers who are a tad cautious, investing monthly in China is ideal," he added.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments