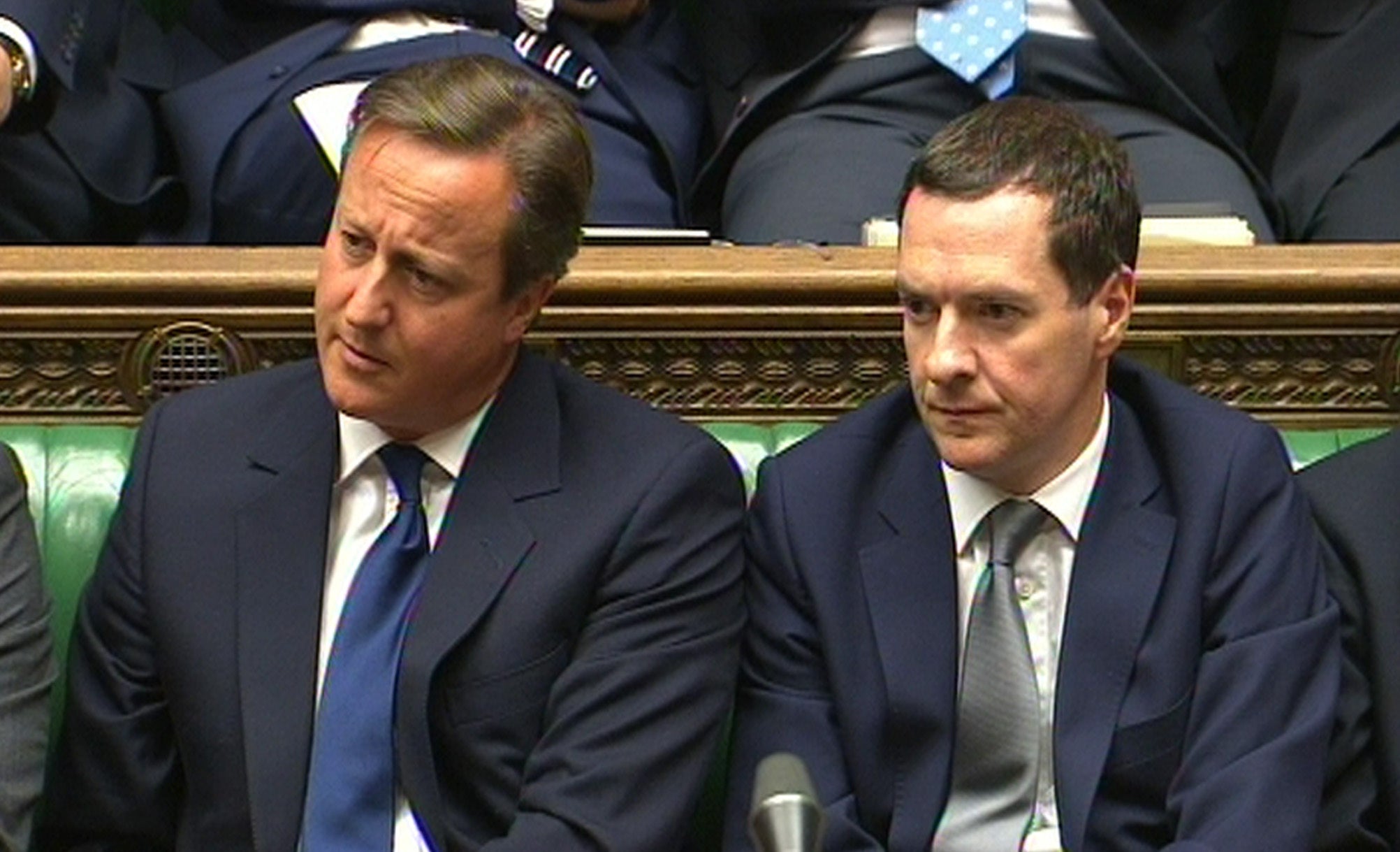

Osborne could slash pension tax breaks this month

A raft of new pension changes has led to high-rate taxpayers rushing to make the most of their retirement savings

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Pension investors are set to give the Chancellor a massive headache by putting a £6bn hole in the Treasury’s tax plans – and he could respond this month by slashing tax breaks on retirement savings.

The warning comes from Hargreaves Lansdown which reckons that higher rate and top rate taxpayers have increased their contributions by an average of 40 per cent in the current tax year.

“We expect a surge in activity ahead of November’s Spending Review,” said the firm’s pension expert Tom McPhail. “We could see an extra £6bn in tax relief being claimed by higher earners this year.”

Osborne has already mentioned intentions to change pension tax breaks in next Year’s Budget but he could yet fast forward the plans, McPhail warns.

The green paper review of pension taxation launched in this summer’s Budget follows a barrage of pension policy initiatives:

· Annual Allowance taper, set to restrict tax relief for those earning over £150,000 (due April 2016)

· Lifetime Allowance cut to £1 million (also due April 2016)

· Pension Freedoms give more access to pensions and better tax treatment on death

· Auto-enrolment is sweeping millions more savers into pensions

· State pension reform (April 2016)

· Spending cuts and government intention to balance budget

· Annual Allowance reset in Budget to phase out Pension Input Periods

“In the context of these changes, some of which will already directly affect higher earners’ pension tax relief, it would be naïve to expect that there wouldn’t be a surge in pension saving this year,” Tom McPhail said.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments