No support for the self-employed? No change there

Are you a freelancer fending for yourself while everyone else seems to be getting handouts? It has always been thus. Here’s how to go it alone

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.“I didn’t really have a safety net, I earn all my money in the summer and it sees me through the winter. The nature of the work that I do is seasonal, I don’t make a vast amount of money.”

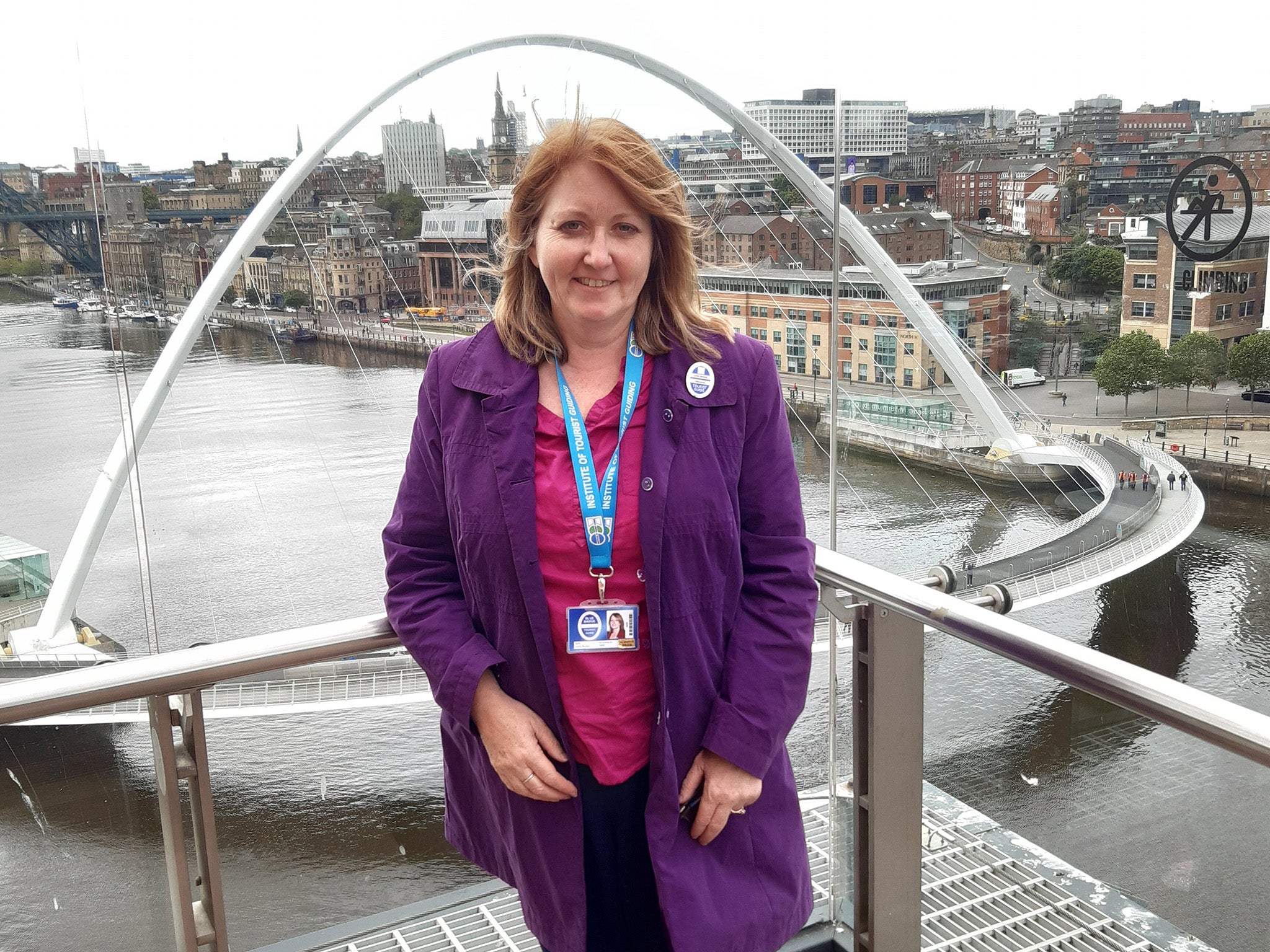

Laura Rhodes is 55 and works as a freelance tourist guide in Yorkshire and the northeast of England. She’s passionate about what she does and has secured qualifications and ongoing training to deliver the best customer experience she can.

The number of self-employed people in the UK has been growing in recent years, now more than 15 per cent of the workforce operates this way, according to the Office for National Statistics, up from 12 per cent in the year 2000.

But the way they are treated by government policy is often very different to employees. For example, in the current Covid crisis many self-employed people found they did not qualify for the Self-Employment Income Support Scheme (SEISS).

That was Laura’s experience. “I’ve had absolutely zero support,” she explains. “All I have had is a bounce back loan, which is obviously very worrying as I don’t have any income. There’s no foreseeable income from my self-employed job.”

Freelancers fell through the cracks of the SEISS for a variety of reasons – some paid themselves through dividends, which did not qualify as income. Others earnt more than £50,000 in trading profits a year and so became ineligible – a cut-off that did not exist for employees who could still be furloughed and paid up to £2,500 a month.

Laura fell foul of the rule where her freelance income must be more than 50 per cent of her total income. “A lot of my work is very seasonal, it starts in March and April, then by October I am finished. So I also have a seasonal job at a university library, I work September through to May.”

Because she earned a fraction more from her library role than her tourism job, Laura was unable to get the SEISS. “I am on about 5 per cent of what I am normally on. Because I am married and my husband has a job, I’m not eligible for any benefits.”

Laura is not alone in being left out of the most targeted support. IPSE, the Association of Independent Professionals and the Self-Employed, has revealed a 341 per cent increase in the number of self-employed people on universal credit since 2019.

Andy Chamberlain, director of policy at the association, says: “The massive increase in the number of self-employed people accessing universal credit reflects the financial devastation brought on the sector by the pandemic – and just how many self-employed were excluded from the more generous Self-Employment Income Support Scheme.”

Despite their growing numbers, self-employed people have been excluded from many of the safety nets that employees take for granted.

Self-employed not self-sufficient

Probably the biggest financial safety net that the self-employed are excluded from is the workplace pension scheme.

The auto-enrolment scheme has transformed the UK’s pension savings, with the majority of UK employees now placed into their workplace pension scheme. Freelancers are of course able to access the tax benefits of paying into a pension but there is no comparable national scheme to encourage the self-employed to do so, something IPSE has called a “pensions crisis”.

Another area where the self-employed were at a disadvantage for a long time was with the cost of childcare. Although tax-free childcare is now available to all workers, the predecessor scheme childcare vouchers could only be issued through a company, leaving out any sole traders.

Freelance mothers can claim statutory maternity pay for up to 39 weeks. However, unlike with employees, there is no option for self-employed fathers to claim any of that time as shared parental leave.

When the chancellor first announced the SEISS he included a warning for the self-employed: “It is now much harder to justify the inconsistent contributions between people of different employment statuses. If we all want to benefit equally from state support, we must all pay in equally in the future.”

This was widely interpreted as telling freelancers they would face higher National Insurance charges in the future. If that happens, many self-employed people will also want to be sure they will genuinely benefit equally from state support.

‘A rainy year’

Like many affected freelancers, Laura is doing what she can to boost her prospects just now. In the immediate future Laura has diversified, working more with Zoom and spending time updating her website. For the longer term, she has to pay back her bounce back loan and do what she can to increase her financial security.

“I think I will try to have a bit more in savings,” she says. “Although, there’s only so much you can do. You can save for a rainy day but you can’t save for a rainy year.”

So what help can people access right now and is it possible to make their finances more secure in the future?

Getting through today

Those freelancers who can’t access the direct help open to other self-employed people should work out what support they are entitled to. The website Turn2Us has a useful calculator to help understand what benefits an individual may be entitled to and is a good place to start.

Freelancers can also talk to their banks to find out what support may be available there, such as payment holidays. However, this kind of payment break will mean paying more interest in the long term.

It’s also vital to understand what other support may be available, for example, anyone whose income has been affected may be able to defer that VAT payments or qualify for a bounce back loan. There are some social media groups and freelancer websites that have guides to what support is available.

The freelancer association IPSE also recommends taking steps to ensure swift payment for work that you do undertake. A spokesperson says: “One vital aspect you will want to speak with your clients about is on payment terms and ensuring you are paid promptly for work. Cash flow is crucial and there should be no excuses from clients, big or small, for not paying you on time or even negotiating in good faith to come to paying invoices immediately up-front or in instalments depending on your needs.”

Mike Parkes, technical director at tax software company GoSimpleTax, recommends acting now to avoid any unpleasant tax bill surprises by submitting last year’s tax return as soon as possible.

He says: “Like many small business owners and self-employed people, freelancers are more comfortable delivering services than running the books. Their natural instinct is to ignore the deadline for as long as possible.

“By being proactive, you can tick it off your to-do list, have time to make sure it’s accurate and be forewarned of your impending tax bill.”

Some freelancers may be struggling financially and have dipped into their tax savings. If that’s the case, it’s important to talk to HMRC as soon as possible about arranging time to pay, there is a dedicated self-employed helpline for Covid-19 support.

Planning for tomorrow

Financially surviving today will be the biggest issue for many freelancers but this difficult year has highlighted the importance of looking to the future as well and taking steps to protect income and opportunities.

Diversifying could be key to long-term stability, according to Richard Alvin, group director of Capital Business Media. “We’ve all heard the saying ‘don’t put all your eggs in one basket’ and it’s true,” he says.

“Even as a freelancer, it’s beneficial to have a business plan outlining actions in case of crisis, such as avenues to income, and use this to guide the services you offer or short-term contracts you undertake.”

He also stresses the importance of having sound admin and paperwork in place. “Always ensure freelance contracts are in place, even for small projects. These can be useful if there’s ever a delay in payment or disagreement about the project itself.”

Of course, having cash in the bank is the best safety net for anyone, whether they are freelance or an employee. Dave Chaplin is CEO and founder of ContractorCalculator and IR35 Shield.

He advises: “Often contractors and freelancers enter the market when the sun is shining on the economy, not realising that someday it will start to rain. Building up a war chest of at least six months’ money means downturns can be handled.”

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments