Sorry, first-time buyers, but the threshold's even higher

As if high prices weren't enough, lenders are now shutting the door on 100 per cent mortgages. Laura Howard looks at the options for housing's outsiders

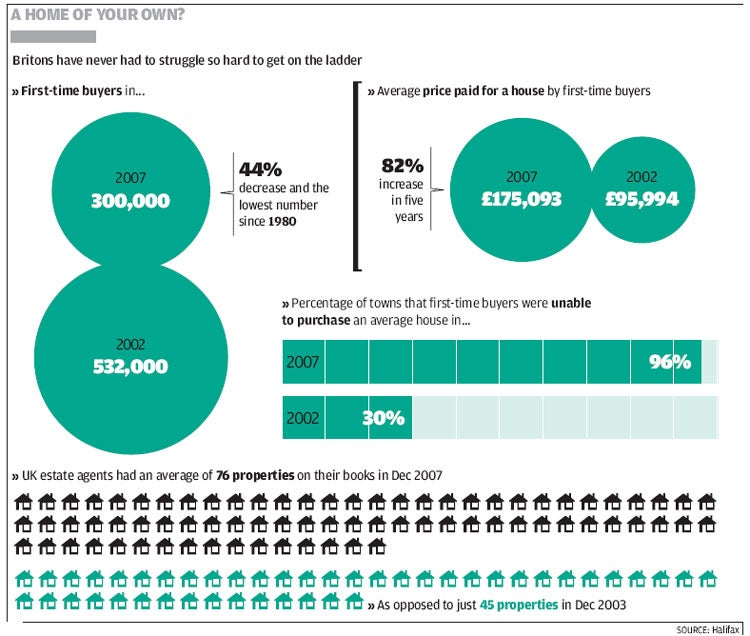

A"post-credit crunch" generation of first-time buyers are encountering even more obstacles when it comes to getting a foothold on the first rung of the property ladder.

New data from Moneyfacts, the financial-comparison service, reveals that of the 30 lenders that were offering 100 per cent mortgages to cash-strapped first-timers a year ago, just 22 remain, as banks and building societies become jittery about higher-risk lending.

But if the jangling new-year nerves exhibited by lenders is a new development, two important factors remain unchanged for first-time buyers. The first is that, despite the recent, marginal falls in the valuation of the average property, house price inflation has risen by 179 per cent in the past 10 years – from around £70,000 at the end of 1997 to £197,093 today, according to figures from the Halifax. This leads on to the second factor – that many would-be first-timers still aren't able to save enough for the big deposits required.

"Lending restraints resulting from the credit crunch come at a time when first-time buyers are already facing extremely high prices despite minute month-on-month drops," says Helen Adams, managing director of the advice website FirstRungNow.co.uk. "This means they have to overcome a 'double whammy'."

The Norwich & Peterborough, Cheshire and Yorkshire building societies have all turned their backs on 100 per cent lending since the credit crunch took hold. Tanya Jackson, spokeswoman for Yorkshire, explains: "We keep a watchful eye on the market and, in the current climate of higher rates combined with less stable house prices, we no longer wanted to be offering our members' money on this kind of lending."

Those institutions that have opted to remain in the "no deposit" territory are cushioning their risk by hiking up their interest charges instead. Abbey offers a 125 per cent loan to first-time buyers – the surplus being for buying fees and moving costs – and last week the bank raised the cost of its two-year tracker version of this mortgage by 1.15 per cent, taking the deal to a staggering 7.99 per cent. Meanwhile, Abbey borrowers with a 10 per cent deposit can still net a two-year fixed rate at 5.47 per cent.

Louise Cuming, head of mortgages at comparison site Moneysupermarket. com, says: "That Abbey has increased the price up to virtually 8 per cent, when the base rate has fallen 0.25 per cent to 5.5 per cent, shows that this type of high-risk mortgage is becoming strongly discouraged among lenders."

Those first-timers who are willing to swallow such increases on 100 per cent-plus loans to reach the first rung of the ladder may not be eligible anyway, adds Ms Cuming. "As well as pushing up the cost of high loan-to-value mortgages, lenders are reining in the criteria, so confining these loans to borrowers with extremely strong credit profiles."

However, it's not only lenders that should be exercising caution about 100 per cent mortgages. Both the big housing market indices, from Nationwide building society and the Halifax, forecast that prices will have stalled at 0 per cent growth by this time next year, meaning that first-timers can no longer rely on an increase in the value of their property as a tool to bring down their debt mountain by moving or remortgaging.

"It's borrowers who need to be wary of this type of lending. They might still be able to service the mortgage repayments if house prices fall, but they will not be able to move as they will be in a position of negative equity," warns Julia Harris, a researcher at Moneyfacts. According to figures from Nationwide, house prices fell by 0.5 per cent in December and 0.8 per cent in November.

There are some keenly priced 100 per cent deals left on the market but they tend to require security – such as restricting the deal to certain types of borrower. Scottish Widows' Professional Mortgage, for example, will lend 110 per cent to people who are fully qualified in nine different professions, including teachers, vets and accountants. In this case, a first-timer can land a fixed-rate deal of 5.89 per cent until 2013, and a two-year tracker is also available priced at 5.94 per cent.

"But obviously not all aspiring borrowers qualify for the 'professional' products," says Ms Cuming.

Ms Adams believes that with more lenders shutting the door on customers who can't put down a deposit, there will be a rise in the number of mortgages shared with parents or siblings, or simply in parents stumping up a deposit from the equity in their own home.

According to the Council of Mortgage Lenders, this could already be happening. CML data shows that the average deposit put down by a first-time buyer in November last year was a surprising 10 per cent of the purchase price.

However, some of these purchasers, while not part of a chain, could have spent time on the property ladder before and collected the equity before stepping off and buying again later.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments