Check those hidden costs of mortgage incentives

We all love freebies – but don't forget that lenders need to make money. By Chiara Cavaglieri and Julian Knight

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

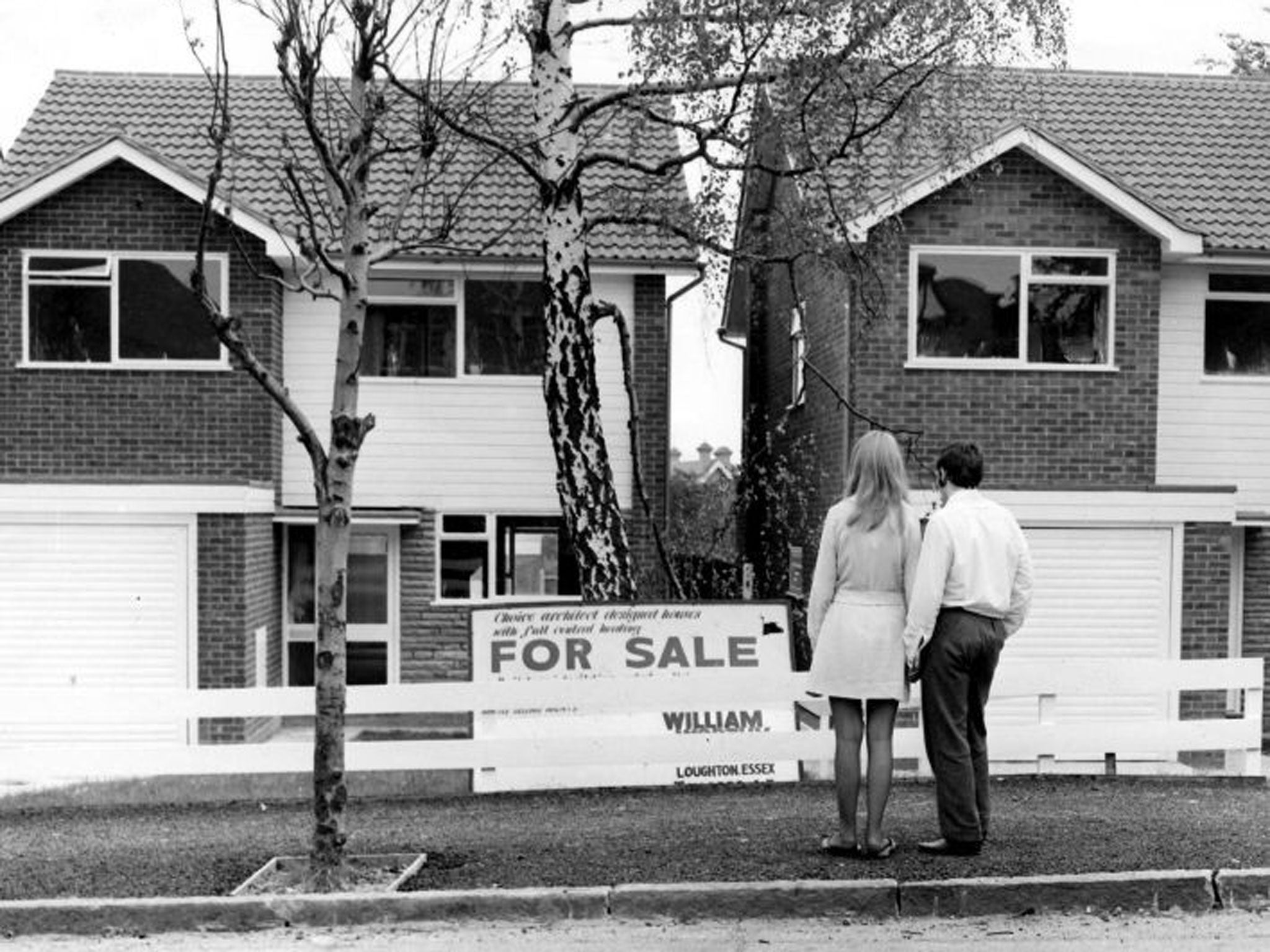

Your support makes all the difference.No one likes to turn down a freebie, but when it comes to getting a mortgage, are the perks worthwhile? In boom times, lenders were falling over themselves to win over customers and although those days are behind us, many of the big names are using freebies to attract borrowers. Cash handouts and free add-ons from lenders or developers are certainly enticing and should be factored in, but the experts warn it is rarely worth sacrificing the actual rate.

This week, TSB announced it will pay the 1 per cent stamp duty owed on properties costing between £125,001 and £250,000, for a limited time. The bank says that the average homebuyer spends more than £1,650 on stamp duty, so this should prove to be a very popular offer.

David Hollingworth of mortgage broker London & Country says: "It will certainly appeal to the first time buyer (FTB) market, knocking out a major cost that would normally need to be taken out of savings that could otherwise be directed toward a deposit."

TSB customers who are exempt from paying stamp duty and those buying property above £250,000 aren't left out either – they get £500 cashback to put towards some of the other costs associated with buying a property. This is a more typical offer, as mortgage perks tend to be in the form of cashback, free valuations and free legal work for borrowers who are remortgaging.

For example, Yorkshire Building Society has gone all out to woo FTB mortgage customers by waiving fees (usually up to £845) and offering free valuations and a generous £1,000 cashback; Halifax is offering £500 to those applying for a mortgage by 3 March; Santander offers £250 cashback and a free standard valuation as part of its Homebuyer Solution.

Free legal advice and valuations are a handy way to keep costs down, both for new homeowners short on cash having spent all their money on a deposit and anyone who wants to remortgage at a lower rate without paying through the nose for arrangement fees or other switching costs.

Charlotte Nelson of Moneyfacts.co.uk says: "Valuation and legal fees can add significantly to the overall cost and can vary in price depending on the cost of the property. Incentives such as free or refunded fees are designed to entice customers, but it can work to the borrower's advantage as it can keep their initial costs down."

Despite the appeal of getting any kind of discount or extra with your mortgage, don't assume you're getting something for nothing. Mortgage lenders aren't in the business of losing money, so you could well be paying over the odds elsewhere, or spreading the cost of that handout over the term of your loan.

Of course lenders don't make it easy for you to work out, particularly when you add in arrangement fees, which are increasingly common with the lowest rates. For example, TSB's offer of up £2,500 to cover stamp duty only applies to a limited number of its mortgages including a fee-free fix at 3.29 per cent for two years, open to FTBs with at least a 15 per cent deposit. This is beaten by the Post Office, which offers a 2.78 per cent two-year fix, but this in turn comes with a hefty £1,495 product fee, and therefore higher upfront costs.

It can also be awkward to gauge the potential benefits of free valuations and free legal fees, because the property's price may affect the cost and if it is only a standard survey, you may have to pay extra for a homebuyer report or building and structural surveys.

Other rewards are on the complicated side, such as Nationwide's Save to Buy scheme, whereby aspiring homeowners put money into a savings account – currently paying 2 per cent AER on the first £20,000 – for between six months and three years and can then apply for a linked mortgage with only a 5 per cent deposit. If you successfully apply for a Save to Buy mortgage, the cashback reward ranges from £250 for borrowers saving £2,500 to £4,999, up to £1,000 for borrowers saving more than £10,000.

There is much to admire in a product that encourages disciplined saving and brings the additional benefits of access to a high loan-to-value mortgage and up to £1,000 cashback; however, there is no guarantee of a mortgage offer at the end. If Nationwide decides not to grant you a mortgage you'll be left with a pot of money that could have been earning more interest elsewhere all that time.

With all this in mind, the starting point must be getting the right type of mortgage at the best possible rate. It still makes sense to factor in the value of incentives, but online mortgage calculators will help you compare true costs and work out the cheapest deal for your specific circumstances, taking into consideration the size of your mortgage, the rate and any fees. Once you've got the basic figures, weigh any incentives against your total mortgage cost and check for any onerous conditions, for example a mortgage that reverts to a particularly high standard variable rate (SVR) at the end of the introductory period – Yorkshire Building Society has one of the highest reversion rates at 4.99 per cent.

Where new build properties are concerned, perks from the builders are fairly common but, as always, it's important to weigh that against the price of the property. Bear in mind that lenders will expect incentives to be declared, because fingers were burnt at the peak of the market when money was lent against property values which were propped up with big incentives.

Although lenders will still accept incentives within reason, Mark Harris, of mortgage broker SPF Private Clients, says that it could affect the mortgage that can be achieved, depending on what the incentive is, and its value. "Developers tend to offer a range of sweeteners to tempt buyers to purchase a new-build property, such as discounts, rental guarantees on investment properties, stamp duty paid and interior package upgrades," he adds. "Out of all the incentives, stamp duty paid is probably the only one worth considering, given the premium normally paid on a new-build property."

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments