Researchers say the snowball method is the best way to pay off debt

'Focusing on paying down the account with the smallest balance tends to have the most powerful effect on people's sense of progress'

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Researchers say the snowball method is the best way to pay off debt – here’s a simple spreadsheet that can make it work for you

If you’re struggling to pay off debt, you’re not alone. The average household with credit card debt owes $16,061 (£11,500), according to a recent report by NerdWallet.

And while there are many strategies to eliminate debt for good, one method proves most effective: Prioritising accounts with smaller balances, rather than those with higher interest rates, also known as the snowball plan.

That’s according to new research from the Harvard Business Review. After conducting a series of experiments in which participants simulated paying back virtual debts, researchers concluded that the factor that made the biggest impact on how hard participants worked wasn’t the amount they were paying back or how much was left in the account afterward, it was the percentage of the balance they ended up getting rid of.

Although it makes more sense mathematically to pay down accounts that carry the highest interest rates first, they found that it was more motivating for participants to see small balances disappear.

“Focusing on paying down the account with the smallest balance tends to have the most powerful effect on people’s sense of progress – and therefore their motivation to continue paying down their debts,” writes Remi Trudel, one of the HBR researchers.

Personal finance blogger Derek Sall knows that feeling well. He used the snowball method to pay off roughly $100,000 worth of debt (including his mortgage).

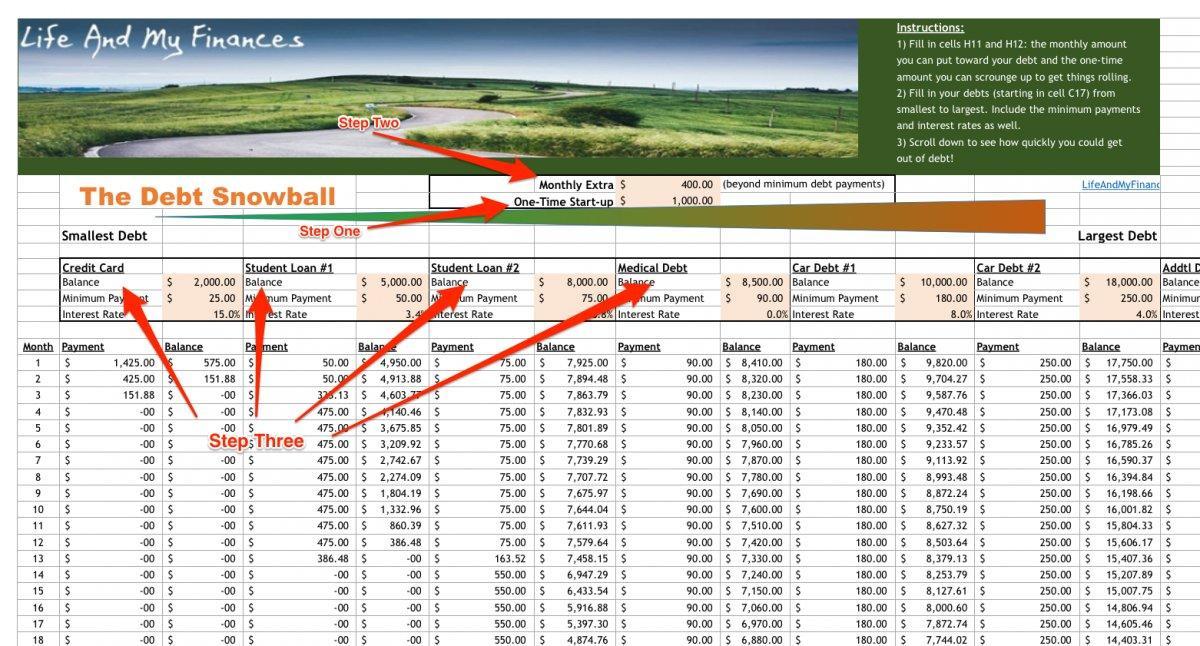

The strategy worked so well for Sall that he decided to share his spreadsheet for paying back debt on his blog, Life And My Finances, to help others take advantage of it.

“I suggest that people pay off their debts from smallest to largest and ignore the interest rates entirely,” he writes on his blog. “Sure, that 18 per cent credit card debt might freak you out like crazy. But if you tackle the smaller debts with intensity like I know you want to, you’ll get to it sooner than you think – and then bust it out sooner than you ever thought possible!”

Though your debts might feel overwhelming, the spreadsheet breaks them down into a simple payment plan. Here’s how to use it:

Figure out how much you can dedicate to paying off debt right now. The higher you can make that initial lump sum, the less you’ll have to pay later.

Figure out how much you can put toward your debts above and beyond the minimum monthly payment.

Enter all debts, smallest to largest, including interest rate and minimum monthly payment for each. The spreadsheet will automatically calculate how many months it will take you to become debt-free if you concentrate on paying off one account at a time.

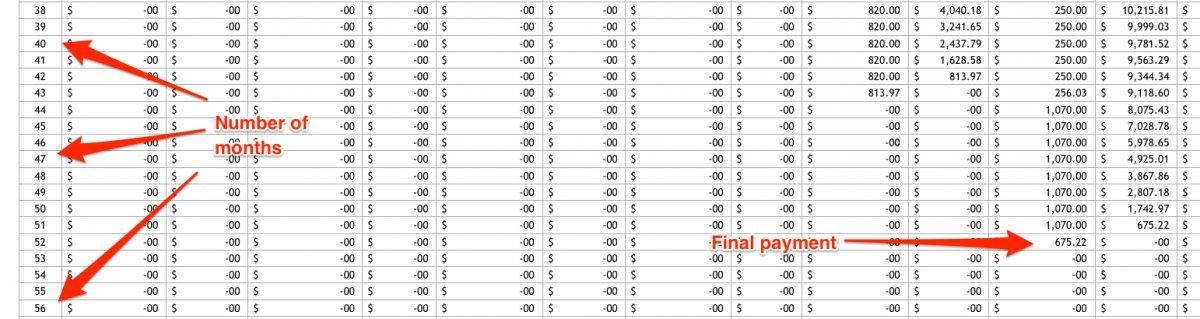

Here’s a look at the bottom of the spreadsheet, which reveals how many months it will take you to pay your debt in total:

After you’ve figured out how long it will take you to reach financial freedom, Sall recommends figuring out how you can speed the process up. “The faster you tackle your debt snowball, the more likely it is that you’ll get finally get out of debt!” he reiterates.

Read more:

• May tackles new Brexit Rebellion

• Philip Hammond and Mark Carney are in China to secure £1 billion of trade deals

• Facebook admits that social media can be bad for you

Read the original article on Business Insider UK. © 2018. Follow Business Insider UK on Twitter.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments