Keep racking up the debt and then pay less interest: that's life for the chosen few

While many people will be rejected for credit as the banks get tough, others may find they are rewarded for borrowing more. Emma Lunn reports

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.The more money you borrow, the cheaper it could be. It might not be moral, but this is the startling reality unearthed by a new study.

A review of the personal loans market by research firm Defaqto reveals that in some circumstances borrowers could end up paying less each month by taking out slightly larger sums with the same lender.

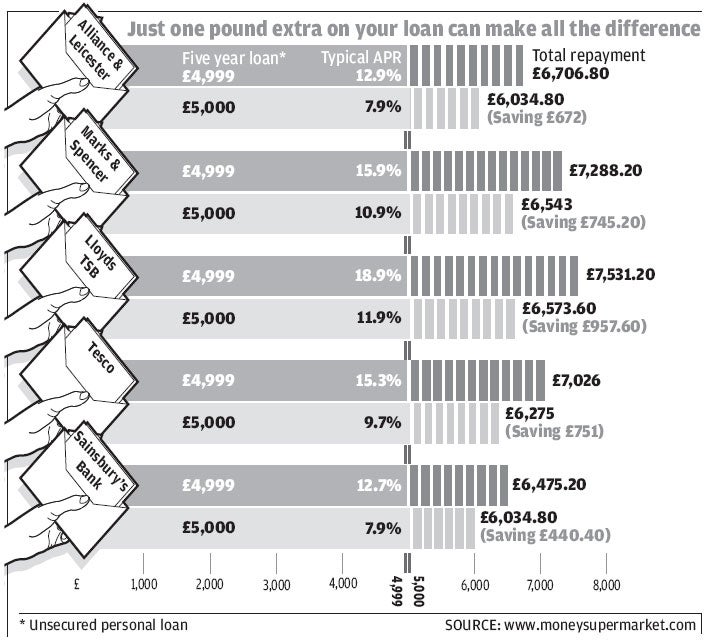

The anomaly arises because of the way most lenders structure their deals, which differ according to the "tier" that the loan size falls into. Generally, a higher interest rate is charged on the lowest tiers, and rates then decrease as the amount borrowed increases. In some cases, borrowing just £1 more can drastically reduce the amount you pay back.

For example, if you were advanced £4,999 by Lombard Direct, the typical annual percentage rate (APR) would be 15.9 per cent and you would have to pay back £7,117.20 over five years. But if you borrowed an extra £1, the typical APR would drop to 7.9 per cent and the total repayments over five years would be only £6,034.80 – a saving of £1,082.40.

Similarly, a loan of £4,999 arranged on the internet with Direct Line would cost you £7,117.20 over five years, whereas by borrowing £5,000 you would pay only £6,101.40 during the same period – a saving of £1,015.80.

Defaqto consultant David Black comments: "Borrowers should take care when choosing the size of loan they want, because a little effort in researching the interest rates charged on different tier levels could save them a considerable amount of money."

However, following the credit crunch, only borrowers with impeccable credit ratings are likely to be accepted for the most competitively priced loans. Price-comparison site Moneysupermarket.com warns that people could struggle to get good deals on loans as banks get tougher with their lending criteria.

Tim Moss, head of loans at Moneysupermarket, says: "Loan acceptance rates are decreasing, showing that now, more than ever, pro- viders are looking for lower-risk customers to help reduce the chances of having bad debts on their books.

He adds: "The trouble now is that people with near-spotless credit records are finding it difficult to get a loan, or are only being offered one at a higher rate."

It is argued in some quarters that a clampdown on easy borrowing is long overdue in light of the high debt levels in the UK. Credit Action, the independent money-education charity, says the average household debt, excluding mortgages, currently stands at £8,956 and is on the increase.

However, the Banking Code, the voluntary set of standards for the industry, is designed to make sure that banks do not lend to people who could not afford to repay the debt.

Adrian Lloyd, spokes-man for the Banking Code Standards Board, says: "Under the code there is a commitment for all the banks and building societies that are signed up to it to demonstrate responsible lending. If things do go wrong and people get into financial difficulties, then our code also says quite a lot about how to handle cases of financial difficulty under the general heading that people must be treated sympathetically and positively."

For borrowers who already have a loan – and who enjoy a credit rating that will make them eligible for another one – there are often benefits to be exploited by switching mid-term. "Best buy" loans are currently priced at around 6.5 per cent, while the average loan rate is nearer 11 per cent. According to the price-comparison site uSwitch.-com, consumers with an £8,000 loan taken out over five years could save an average of £180 by transferring to a best-buy deal halfway through.

Switching is not as difficult as some people might think. One in four loan providers allow consumers to move loans without any penalty, and 67 per cent charge just one month's interest – an average of £39.

Mike Naylor at uSwitch says five years is a long time to stick with the same provider as rates fluctuate constantly. "For example, in the second half of 2007, more than 30 providers increased loan rates by around 1 per cent APR," he says. "However, since the last base rate cut at the beginning of December, eight major lenders have already cut their rates by up to 5.5 per cent APR.

"With more base rate decreases predicted over the next 12 months," he adds, "it's possible that we may see other providers following this example and offering more competitive deals than those that were available last year."

Some borrowers might be better off bypassing the traditional banks and lending institutions in favour of individual loans. According to Zopa – launched in 2005 as the first peer-to-peer lending website – more people could be borrowing money from strangers this year because of the increasingly stringent criteria applied by the banks.

Zopa (Zone of Possible Agreement), is an online market where people meet to lend and borrow money. Borrowers are generally offered competitive rates, normally around 7 per cent for a £3,000 loan repaid over three years, while lenders receive an average of 7 per cent return on their money.

On Zopa, all borrowers are identity-checked, credit scored and risk-assessed, and anybody lending £500 or more has their money spread across at least 50 borrowers. The default rate since launch has been low, at 0.2 per cent.

Wherever you go for a personal loan, there are several factors to take into account as well as the APR. For example, some loans charge a penalty if you want to repay them early, while others automatically add on the cost of payment protection insurance. PPI is rarely considered the best solution for consumers' needs, and even if you do want it, your lender's cover isn't usually the cheapest.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments