How to stop your credit limit from being slashed

James Daley gives advice on staying in the banks' good books and the best new deals around

Britain's credit card companies have been tightening their belts over the past few months – raising interest rates and fees, cutting back credit limits and turning down an increasingly large number of applications. Last week, Egg outraged consumer groups when it went one step further – unveiling plans to close the accounts of more than 160,000 loyal customers, who it no longer wanted on its books.

The internet bank, which was bought by Citigroup last year, said that these customers were being booted out to reduce the levels of risk across its credit card business. However, a large number of those affected claim to have never stepped outside of their credit agreement, raising suspicions that the bank also used its review as an excuse to clear out some of its less profitable clientele – those who regularly clear their balances and never rack up any interest.

Unfortunately, it's unlikely that Egg will be the last bank to make such a brutal move. American Express and a handful of other major lenders have slashed the credit limits of thousands of customers since last autumn, in a bid to claw back their exposure at a time when capital is still hard to come by, and the economic climate is worsening.

The banks have also been under pressure to keep up with new European regulations, which means they have to keep more money on their balance sheets for every pound of potential credit they grant to their customers.

Keeping a good credit rating

The uncertainty in the lending market means it's well worth keeping close tabs on your credit arrangements over the coming months. If you're the kind of person that likes to keep a few cards gathering dust at the back of your wallet, just for emergencies, Mike Naylor of Uswitch.com, the comparison site, says you should consider whether you really need them. "It can be a security risk to have lots of different cards, especially if you don't know where they all are," he says. "So it may be worth working out which ones you really need and getting rid of the rest."

It's also a good idea to take a look at your credit file, to see what kind of shape you're in. Egg says it has been targeting customers whose credit scores have deteriorated since they first became customers of the bank. With a whole multitude of factors affecting your overall credit score, it's easy to be completely oblivious to any changes in your rating. For example, failure to inform the credit agencies that you've split up with a former partner can mean your own score continues to be affected by their behaviour. Failure to get yourself on to the electoral roll when you move address will also work against you.

You can check your credit file by visiting the websites of any of three UK credit agencies – www.experian.co.uk, www.mycallcredit.co.uk and www.equifax.co.uk – or by using services such as www.checkmyfile.com. For a few pounds, you can check your credit file instantly, and start ironing out any inaccuracies or unwanted financial ties.

If you're one of Egg's unwanted customers, James Jones of Experian says you needn't worry about being left with an even worse credit file after your account has been closed down. In fact, the move may work in your favour. "Depending on the circumstances of the individual and policies of the lender, it could have a positive effect on your credit rating as a lender might view an application from someone with a lower number of cards as more attractive," he explains.

Finding a new deal

If you're looking for new credit cards, they're still relatively easy to come by for all but those with the worst ratings. And even then, if you're willing to put up with an APR of over 30 per cent, then there are still one or two lenders who are likely to take you on. Websites such as www.uswitch.com and www.moneyfacts.co.uk allow you to search for the best deals currently available, while www.moneysupermarket.com goes a step further by listing cards that fit specific credit profiles. This is useful for identifying lenders that are more likely to accept your application.

"Every time you apply for a card, it leaves a footprint on your credit file," says David Black, head of banking at Defaqto, the financial analysts. "So you don't want to over-apply for credit."

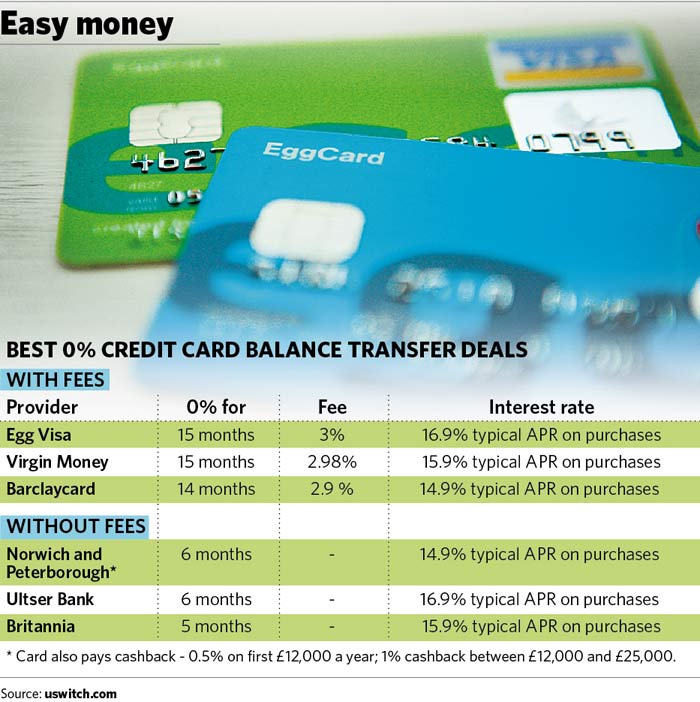

If you're looking for a card which offers 0 per cent for balance transfers, most now charge fees of between 2 and 3 per cent. There are, however, three cards which still offer 0 per cent transfers for no additional fee: Britannia Building Society (five months at 0 per cent), Ulster Bank (six months at 0 per cent) and Norwich and Peterborough Building Society (six months at 0 per cent).

If you're after a card that will pay you cashback when you use it, Black recommends the American Express Platinum card, which offers 5 per cent on purchases (of up to £4,000) made within three months of taking out the card. After that, customers receive 0.5 per cent on the first £3,500 spent a year, 1 per cent on the next £6,500 and 1.5 per cent on anything after that.

Alternatively, for car drivers, Black suggests the Shell Mastercard, which pays 3 per cent on all fuel purchases at Shell petrol stations and 1 per cent on all other transactions. However, you have to make at least one purchase at a Shell station each month to get your rebate.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments