Hope remains that G4S takeover can provide festive treat

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.With Christmas just a week away the thoughts of many turn to gifts. For a time during this festive run-up, I wondered whether the no pain, no gain portfolio was set to receive an unexpected seasonal present in the shape of a takeover bid for one of its constituents?

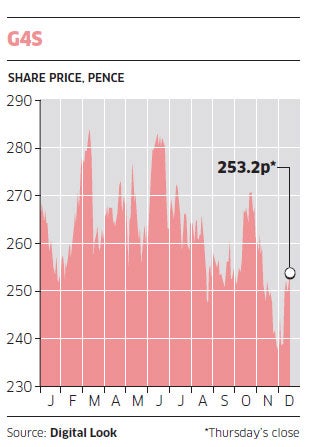

The alleged candidate was G4S, the Anglo Danish security giant that has so far failed to perform since recruited in April. It is not the first time that vague rumours of corporate action have circulated and I do not believe it will be the last. There is little doubt that some see the sprawling group as ripe for bid activity.

I descended on the shares at 264p. They have since fluctuated to as low as 235p. But, quite suddenly, they perked up. As stock market reporter Toby Green said in The Independent the yarn that private equity group Kohlberg Kravis Roberts planned a 350p shot was once again reheated. But other influences helped the shares. A large seller – possibly institutional investor Credit Suisse that once had more than 8 per cent – is known to have grown tired of the security giant. Perhaps the rump of its once powerful stake was mopped up? The signalled £5.3bn acquisition of ISS, the Danish catering to security group, by private equity player Apax could have also triggered interest. And, for good measure, G4S put through a modest deal of its own, buying a Channel Islands building services contractor.

The group was not recruited because of its takeover vulnerability. In this age of terrorism, an international security operation has considerable trading attractions, despite our Coalition Government's decisive penny-pinching campaign. With corporate activity continuing well below the level of a few years ago, the portfolio, like many investors, has been deprived of a takeover shot in the arm for a long time. So a strike at G4S would represent a welcome display of festive goodwill. But, as I write, the bid speculation seems to have run out of steam. Maybe action will occur some time next year?

NCI Vehicle Rescue, one of the portfolio's two Plus constituents, is not enjoying the best of Christmas cheer. The shares fell 7p to 32.5p after a decidedly sober interim trading update. The group's progressive profits record has come to a skidding halt with half-year profits signalled to be lower than last year's corresponding £340,000. Managing director Neil Richards-Smith says trading has been difficult but adds that the group, which offers roadside assistance and insurance, is in a "healthy financial state" with around £850,000 tucked away in the bank. Cash flow, he says, continues to be positive and "we are excited about the future of the company".

Investing in a small cap can be a speculative exercise and I hope NCI's unexpected reverse will not be too prolonged. I am surprised the trading statement did not contain any figures. In the previous year NCI, which has just added pet insurance to its range, produced interim results in November, complete with sales and profits. Presumably another example of poor figures taking longer to add up than good ones. I gather the results will be announced before the end of the year.

Private & Commercial Finance, the hire purchase group that has teetered on the brink of eviction from the portfolio, has announced an interim profit of £150,000, up from £121,000. It usually enjoys a much stronger second half display and should manage to top last year's £528,000, although the once hoped for £1m-plus looks well out of reach.

The group says tight conditions in the wholesale money market restrained growth but there are some "positive signs of an improvement as the stronger banks recover from the downturn".

Whitbread, the former top brewer now big in budget hotels, coffee shops and restaurants, has rolled out an impressive trading update, with sales in the first 39 weeks of its year up 14 per cent.

The overall Whitbread performance has prompted some in the City to forecast that the shares, recruited to the portfolio at 1,105p, will next year march on to an all-time peak above 2,200p. But the group faces strengthening competition and – together with the rest of the retail community – the seemingly ever increasing impact on consumers of the Government's spending curbs and tax increases.

yourmoney@independent.co.uk

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments