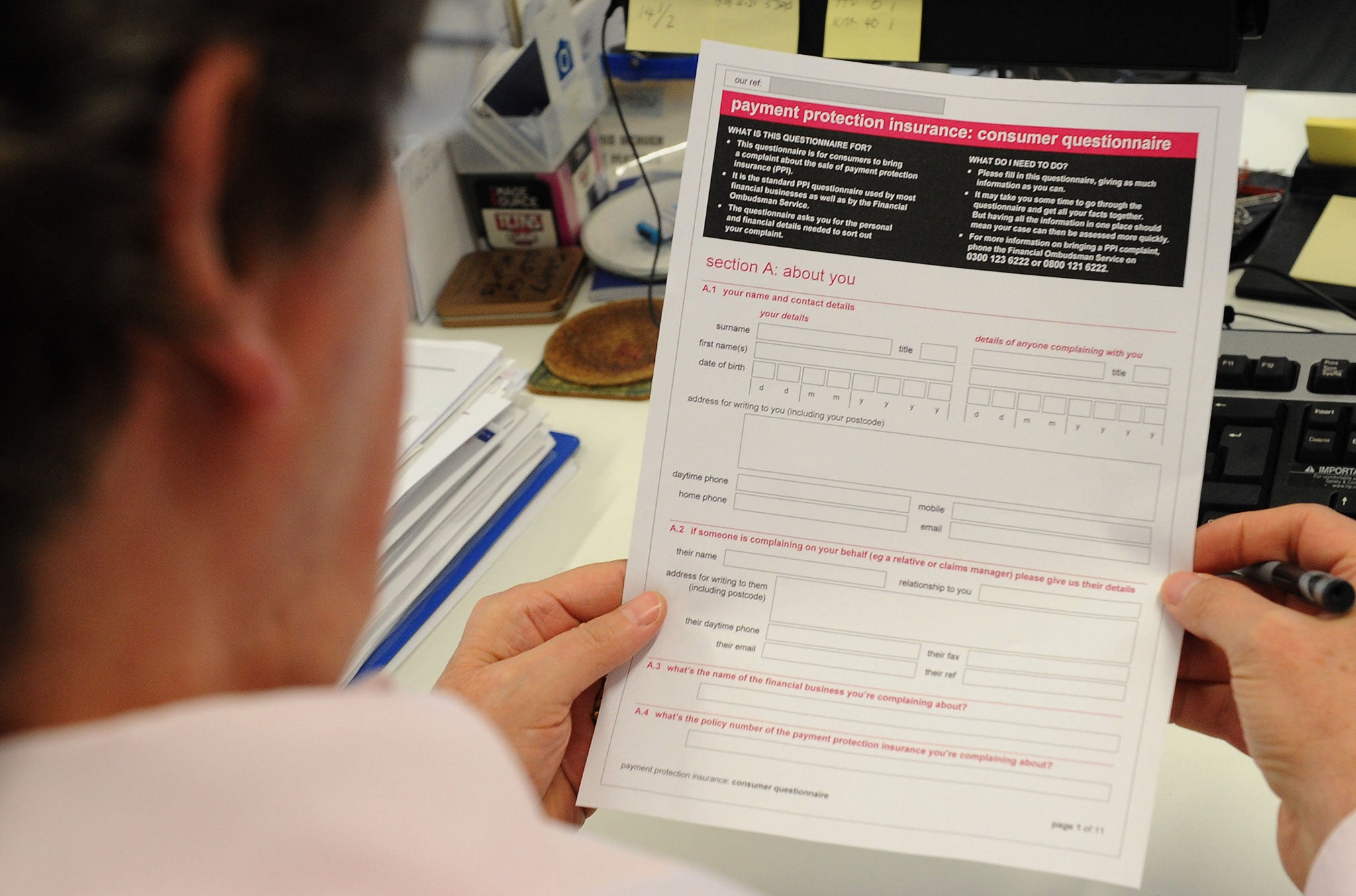

Banks may face extra £1bn hit over mis-selling of payment protection insurance

Card issuers thought they'd managed PPI compensation – will shortfalls mean recalculations?

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Will the PPI scandal ever end? It took another twist this week when an investigation suggested that people mis-sold payment protection insurance could have been short-changed by £1bn when they were paid out by their banks.

Those affected had PPI with credit cards issued by Lloyds Banking Group, Barclays, MBNA and Capital One, according to the BBC.

The estimated shortfall in compensation happened because – although the banks refunded the premiums and interest on their mis-sold PPI policies as regulators require – they failed to refund additional charges triggered by the premiums of the mis-sold PPI policies, the BBC claimed.

The failure to include fees and charges resulted in reductions to the amounts some customers have received. However, the banks involved all claim they tried to pay the correct compensation.

Lloyds said: "When a customer lets us know that they may have incurred other costs because of their PPI policy, we will investigate and make an appropriate refund".

Barclays said it is introducing a new, "enhanced" method which "will enable us to move from a monthly to a cumulative assessment of fees".

MBNA said: "We are confident that our redress is correct, we have considered our methodology carefully and in detail. Our confidence is reinforced through external independent reviews."

Capital One said: "We aim to pay redress that puts the customer back in the position they would have been in if they had not had PPI."

However, the BBC said that the Financial Ombudsman Service has told Capital One to recalculate two cases of compensation. And it has begun investigating how Capital One recalculates its offers in relation to fees and charges across all cases.

Consumer group Which? said the PPI scandal has cost Britain's banks £22.4bn, making it the UK's biggest case of widespread mis-selling.

Which? executive director, Richard Lloyd, said: "It adds insult to injury to be mis-sold PPI and then not get paid the full compensation you are due. Banks must ensure that anyone with a legitimate PPI claim gets every penny they are entitled to.

If there is new evidence of systematic mistakes by the banks then the FCA should investigate and take tough action against any bank found breaching the rules," he said.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments