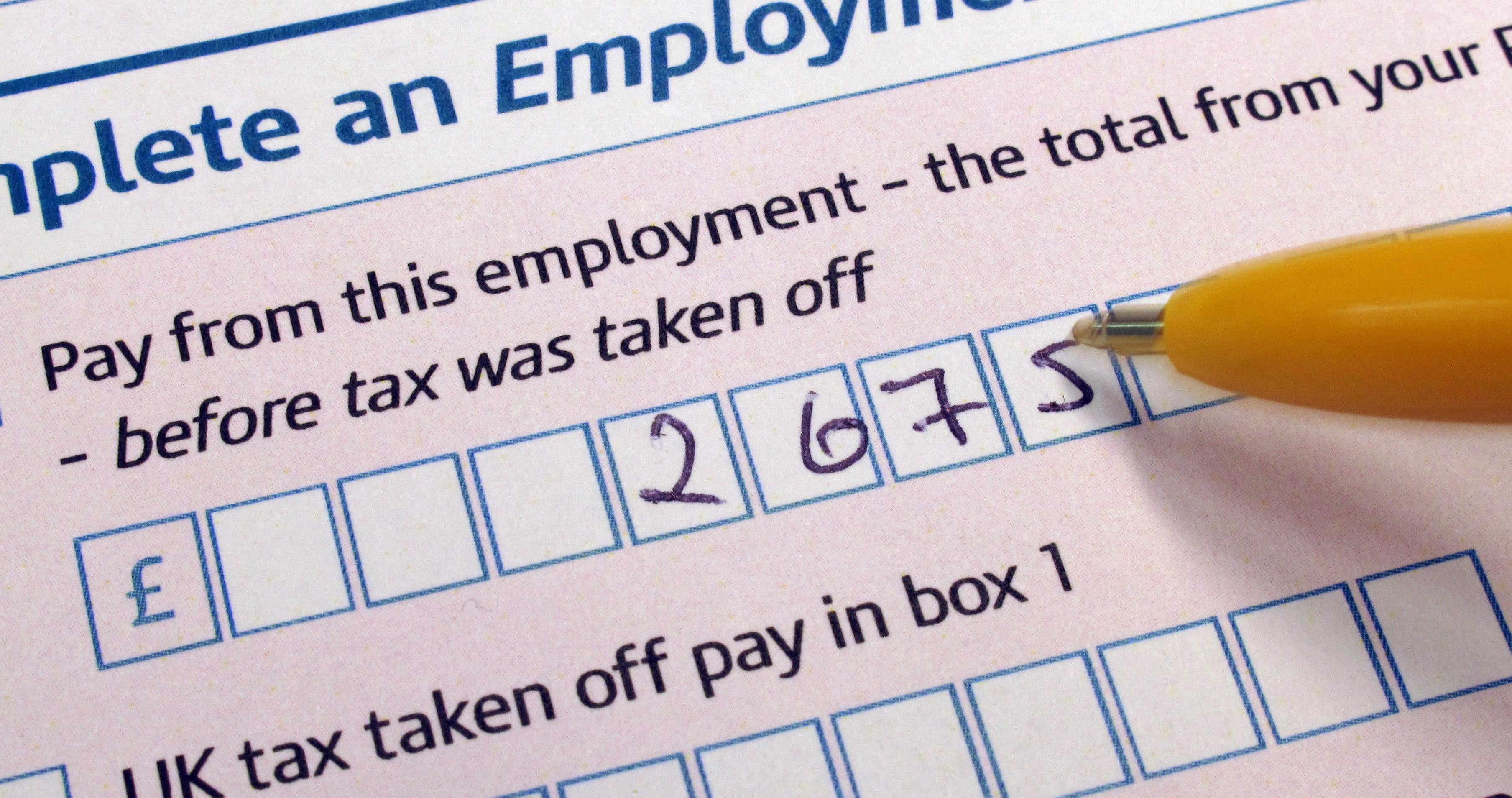

Four million taxpayers still to file returns ahead of January 31 deadline

HMRC has said it will waive penalties for one month for late returns, but interest will still be charged on money owed from February 1.

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Four million customers are yet to submit their completed self-assessment tax return and pay any tax owed – with just days to go before the January 31 deadline.

In total, more than 12.2 million customers are expected to complete a tax return for the 2020/21 tax year.

HM Revenue and Customs (HMRC) recently announced it will waive penalties for one month for late filing of tax returns and late payments. Anyone unable to file by January 31 deadline will not receive a late filing penalty if they file by February 28.

However, interest will be charged from February 1 on any amounts outstanding, as usual, so it is still better to pay on time if possible.

HMRC is urging the millions of customers still to file their tax return, pay any outstanding liabilities or set up a payment plan, to do so ahead of the deadline.

Myrtle Lloyd, HMRC’s director general for customer services, said: “We know some customers may struggle to meet the self-assessment deadline on January 31 which is why we have waived penalties for one month, giving them extra time to meet their obligations.

“And if anyone is worried about paying their tax bill, they can set up a monthly payment plan online – search ‘pay my self assessment’ on gov.uk.”